2020-11-7 10:00 |

On Wednesday and Thursday, there was a clear sense of capitulation amongst investors in top Ethereum DeFi tokens.

CryptoSlate market data shows that then, top coins pertaining to this space were plunging lower by dozens of percent without any relief. Yearn.finance (YFI) fell over 20 percent in the span of a day while many investors on Twitter announced that they were shifting to Bitcoin and other “safer” investments.

But in a weird turn of events, the DeFi market has begun to pump.

This coincides with Bitcoin topping just $20 shy of the key $16,000 technical level. In bull markets, when BTC tops, profits are often distributed into altcoins temporarily as investors try to accumulate more Bitcoin.

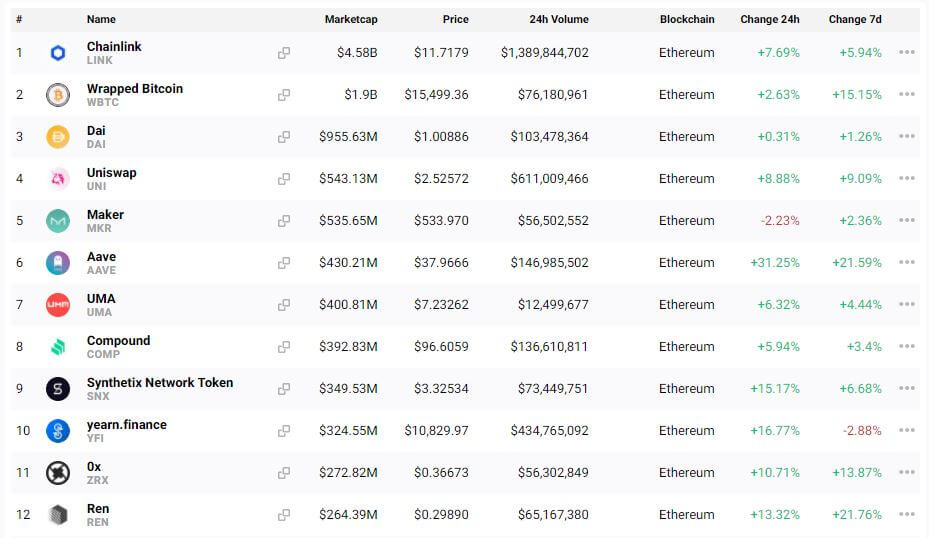

DeFi coins explode higherMarket sector data from CryptoSlate shows that the past 24 hours for the DeFi market has been a positive one.

Key coins pertaining to the space such as Uniswap (UNI), Aave (AAVE), Compound (COMP), Synthetix Network Token (SNX), Yearn.finance (YFI) have printed 10-30 percent rallies over the past day after yesterday’s capitulation.

Arthur Cheong, the founder of DeFiance Capital, says that this reversal is a result of “high volume” forming in the DeFi markets. He shared a chart showing that he had personally accumulated some AAVE at $28. The coin now trades for around $38.

High volume reversal across DeFi market over the night.

Someone creating the bottom.

— Arthur (@Arthur_0x) November 6, 2020

On-chain data indicates that there are institutional players like Choeng accumulating DeFi coins en-masse.

As reported by CryptoSlate, Nansen data shows that prominent Wall Street trading firm Jump Trading holds at least $75 million worth of cryptocurrency, including millions worth of Compound’s COMP, Keep Network’s KEEP, HXRO, Numeraire (NMR), Orchid Protocol (OXT), and MakerDAO’s MKR. The firm has also spent $5 million accumulating COMP over the past week alone.

Similarly, blockchain analytics firm Santiment reported that “whales of many respective $ETH-based #altcoins have added to their non-exchange bags. $ETH, $LINK, $REN, $ELF, $KNC, & $ZRX are among those recently hitting one-year highs.”

Is this the actual bottom?While a strong bounce to be sure, not everyone is convinced this is the actual bottom.

Ari Paul, CIO and CEO of BlockTower Capital, recently shared his thoughts on the DeFi market.

Referencing a tweet he shared in September, which predicted the majority of this move lower, he said that buying an asset at 85 percent down from its all-time high is still not a reliable way to buy a bottom:

“Defi down 85% yet? That’s a point to *start* looking for value, but remember that the fall from 85% to 95% down is another 65% loss.”

The post Ethereum DeFi prints massive recovery 10-30% after capitulation amongst investors appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) íà Currencies.ru

|

|