2020-9-17 00:00 |

Ethereum has been seeing some intense selling pressure over the past few days, which has likely come about due to the trend reversal seen amongst DeFi tokens.

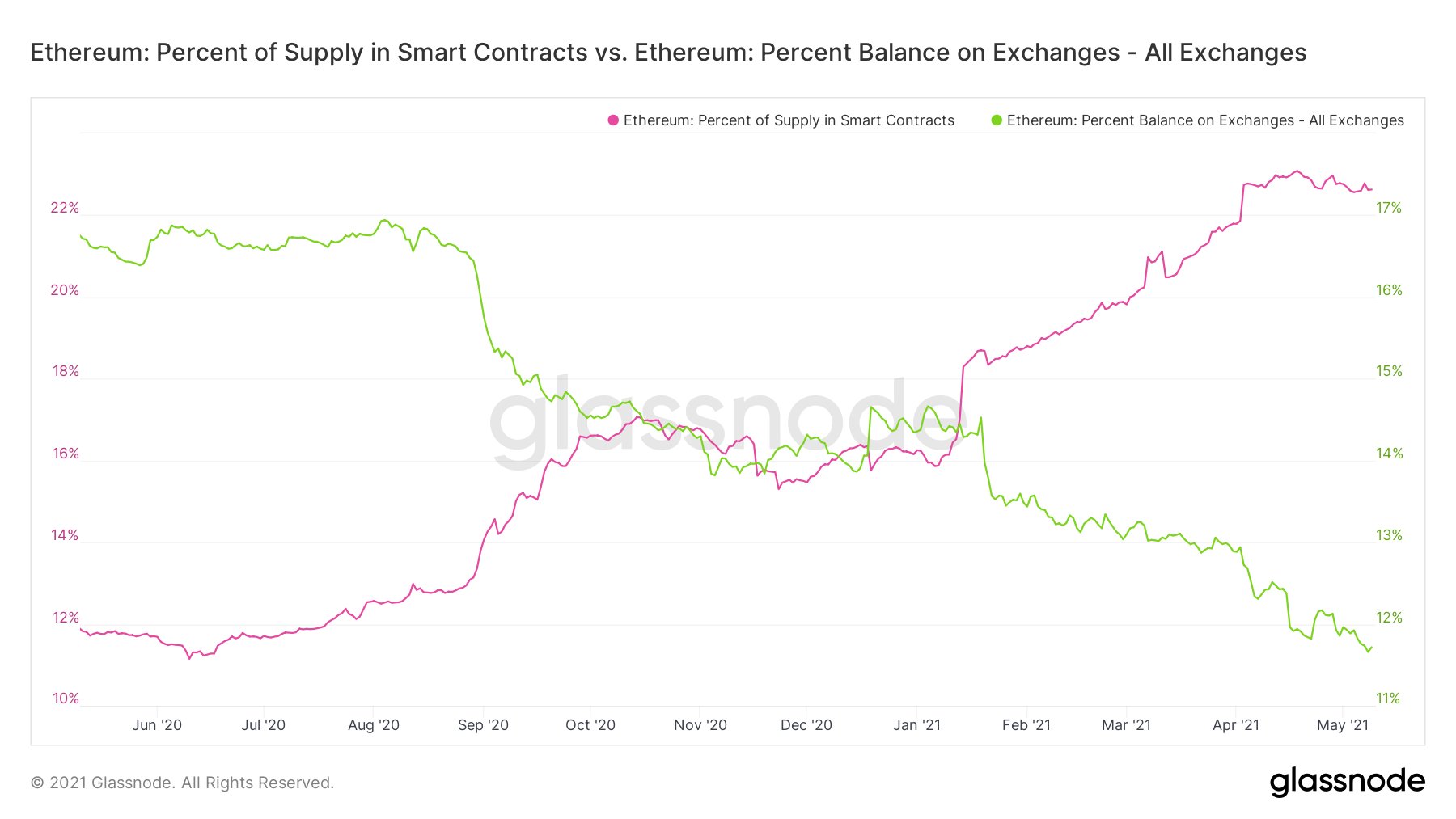

Because the DeFi market is essentially built on top of Ethereum, the ETH token has been heavily influenced by the expansion of this sector.

That being said, as yields across platforms begin waning and as token prices plunge, some investors appear to be offloading their Ethereum holdings in favor of Bitcoin – which has been able to rally higher over the past couple of days.

This trend has hurt ETH’s short-term outlook, which is hampering that of the entire altcoin market.

One analyst claims that until Ethereum surmounts its near-term resistance and bucks this slight downtrend, “altseason” is postponed.

In some ways, ETH has become an index bet of DeFi, which means that whether or not it can break its downtrend will depend largely – or entirely – on how this emerging sector of tokens trends.

Ethereum Struggles to Gain Momentum as Investors Flock to BitcoinAt the time of writing, Ethereum is trading up marginally at its current price of $366. This is around the price at which it has been trading throughout the morning, with bulls and bears largely reaching an impasse.

It is important to note that ETH plummeted to lows of $355 earlier today, widely seen as its “last-ditch” support level that must continue being ardently defended.

A break below this level would be dire for the crypto’s near-term outlook, but the strong reaction bulls posted to it signals there is strong buying pressure here.

So long as Bitcoin remains stable or continues climbing higher – as it has over the past few days – it is unlikely that Ethereum will see any dire technical breakdowns.

Analyst: ETH’s Price Action Likely to Guide That of the Entire Altcoin MarketOne popular analyst explained that so long as Ethereum remains below its key resistance region between $380 and $400, altcoins will likely struggle to garner significant momentum.

He spoke about the similarities seen between altcoins while referencing an Ethereum chart:

“Grand vast majority of altcoins looks the same: 1. Mega dump 2. Scam pump 3. Retest of previous support as resistance 4. Rejection. Altseason postponed till further notice.”

Image Courtesy of Teddy. Chart via TradingView.Whether or not Ethereum can catch up to Bitcoin and plow higher in the near-term may hold heavy influence over both DeFi tokens and the crypto market.

Featured image from Unsplash. Charts from TradingView. origin »Ethereum (ETH) на Currencies.ru

|

|