2021-2-24 17:09 |

Whether it is a presidential election, the Super Bowl or World Cup final, bitcoin (BTC) price at the end of 2021, people are largely driven by predictions and will always attempt to forecast events.

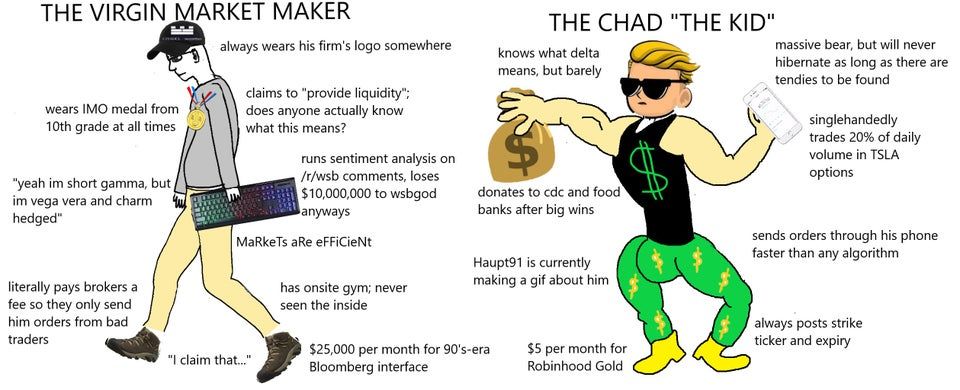

What is a prediction market?Prediction markets trade the probabilities of an event’s outcome based on factual information gathered by all the parties involved. Unlike dealing with preset odds, however, prices are determined by all participants’ activity in a prediction market.

Essentially, the price of “shares” on the prediction market reflects what participants think the outcome will be. The real-life event could be the outcome of an election, tomorrow’s weather, or some Hollywood event.

Prediction markets are oftentimes more accurate than general polls or bookmakers’ odds, because every entity trading on the market make their own research to make an informed trade. You’re more likely to be certain about your choice when there’s money on the cards.

Image source: predictit.org Crypto prediction marketsAs cryptocurrency assets continue becoming mainstream, the underlying blockchain technology provides solutions and fosters a decentralized world. Cryptocurrency prediction markets are decentralized protocols where anyone can trade the outcome of events on algorithms (smart contracts) that execute when certain conditions are met.

In this article, we’ll look at some of the top crypto prediction markets.

1. AugurAugur is a decentralized prediction market founded on Ethereum’s (ETH) ERC-20 protocol. Originally started development in 2014, Augur is one of the pioneers of crypto prediction markets with the aim to “democratize” and decentralize finance. In July 2018, the first version of Augur was released to the public.

Key features:

Fully decentralized. With traditional prediction markets, everyone participates in trading shares of a prediction. With Augur, any user can create a market for any real-world event for a small fee. The creator sets the price of the event between 0% and 50% and earns from trading fees.Trading currencies. As of the launch in 2018, Augur only allowed users to trade events in ether. However, Augur now allows MarkerDAO’s stablecoin, avoiding the volatile markets for interested users. Trading fee and limited token supply. Unlike centralized prediction markets, trading fees on Augur are very small (<1%). The reporting tokens (REP) also have a limited supply of 11 million, with 80% sold during the 2017 initial coin offering (ICO).Incentivized communal resolution system. Using the platform’s native REP token, Augur ensures accurate resolution of completed events. Holders of REP tokens can use their tokens to report events listed on the marketplace after completion. If they report an event inaccurately or fail to report an event, they lose tokens. These tokens are then redistributed to accurate reporters.After a successful ICO launch in 2018 raising over $5 million, Augur remains the leading crypto prediction market. In July 2020, Augur launched its V2 on the mainnet supporting the DAI stablecoin effectively solving issues bothering around volatility.

2. GnosisGnosis is one of the leading decentralized prediction markets based on the ERC-20 standard and is one of the earliest dApps on the Ethereum network. Like most crypto prediction markets, it uses crowdsourcing to determine the outcome of multiple real-life events, while leveraging smart contracts on a decentralized protocol.

Key features:

Open market creation. Gnosis allows any user to create a market based on a real-life prediction by locking up a specified token in the smart contract.Two-token system. Gnosis uses two tokens, GNO and OWL. The Gnosis smart contract requires a GNO holder to lock some of their tokens for a specified period. In turn, users can generate OWL tokens that are used to fund transaction fees. Largely centralized token distribution. However, unlike Augur, the token system is mostly centralized, and the Gnosis founding team holds more than 90% of the tokens.During the 2017 ICO boom, the Gnosis team sold about 5% of its total supply raising over $12.5 million in hard cap under ten minutes. The controversial ICO remains one of the fastest ever ICOs.

The Gnosis prediction market is regularly compared to Augur, and both are largely considered the largest prediction markets in crypto.

3. StoxStox is another open-source blockchain prediction market founded on Ethereum’s ERC-20 protocol. The aim of Stox, like many other crypto prediction markets, is decentralization.

It is essentially a decentralized practical framework for mainstream prediction markets. Launched in the third quarter of 2018, Stox has grown significantly in the past few years. The platform’s native token, STX, has a market cap of $1.18 million, at the time of writing.

Key features:

Open market creation. Like Augur, Stox is a fully decentralized prediction market where anyone can create a market prediction based on real-life events.Trading currency. Stox uses its native token STX for trading predictions of real-life events. Syndicate payments and oracle payments are also made in STX.Bancor token and liquidity reserve. For any peer-to-peer protocol utilizing a single currency, there is always the concern for volatility and a potential liquidity problem as the network grows. To solve this, Stox uses bancor (BNT), an ERC-20-backed token template, to offer continuous liquidity for Stox. Essentially, there is a pre-determined exchange rate between STX and BNT that ensures that BNT reserve remains 4%.Oracle and dispute resolution. Stox uses a centralized method of dispute resolution where the operator (creator of the event) is required to specify the address of the oracle and their private key necessary to sign the oracle.Stox has come under fire for being a controversial token even in crypto news rounds in the past. In 2018, the United States Securities and Exchange Commission (SEC) charged celebrities Floyd Mayweather and DJ Khaled for unlawfully promoting the ICO in 2018.

4. DelphyDelphy is a distributed social mobile prediction market built on the Ethereum network. Located in Asia, Delphy’s initial launch was focused on predicting cryptocurrency markets, but it has now expanded to relevant real-life events.

Key features:

Faster transaction speed. Delphy has a straightforward user interface, website, and transactions are processed faster than on the Augur or Gnosis platforms.Trading currency. Delphy uses the Delphy token, DPY, to trade the outcome of events, and the event’s virtual price reflects the probability.Centralized oracle. Delphy uses a centralized, as well as multi-centralized, oracle depending on the type of event. Overall, the aim is to close predictions as quickly as possible.Delphy primarily targets the Chinese and Asian markets and its vision to accurately predict and create the future through the crowd’s wisdom.

5. PolymarketPolymarket is a decentralized market where users can trade the most debated events globally. Polymarket was launched in 2020 on Ethereum’s ERC-20 protocol. With the ultimate aim of preventing the spread of misinformation, Polymarket’s predictions are largely restricted to trendy real-world events.

Key features:

Trading currency. Polymarket uses the US dollar-backed stablecoin, USDC, to trade the outcome of events.Simple user interface. The Polymarket website is simplistic and offers a wide range of users an opportunity to predict events. The website includes a step-by-step guide to funding and trading worldwide events on the platform.Centralized resolution. Results of events on the Polymarket platform are automatically resolved and do not require a consensus mechanism.Polymarket is still very much in the early stages of development, but it has been very promising raising over $4 million.

Over the years, we have witnessed a steady evolution of decentralized prediction markets. Prediction markets apparently have enormous potentials locked in them and can produce more accurate predictions than general polls.

The post 5 Crypto Prediction Markets to Pay Attention to in 2021 appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

pxUSD Synthetic USD Expiring 1 April 2021 (PXUSD_MAR2021) на Currencies.ru

|

|