2024-10-29 22:52 |

Ethereum (ETH) co-founder Vitalik Buterin has slammed critics who call out the Ethereum Foundation for selling ETH. In an X post, Buterin noted that the funds raised from ETH sales went towards supporting the Ethereum blockchain.

Buterin says the organization uses the funds to pay researchers and developers. Part of the funds are also used to ensure that the blockchain operates smoothly and achieves important upgrades.

“The ETH foundation is paying researchers and devs that are responsible for Ethereum not bleeding 5M ETH/year to proof of work, your fees being low today… Show some respect,” he stated.

bro the ETH foundation is paying researchers and devs that are responsible for

(i) ethereum not bleeding 5M ETH/year to proof of work

(ii) your fees being low today

(iii) your txs getting included in < 30s instead of like 1-30 min (eip 1559)

show some respect

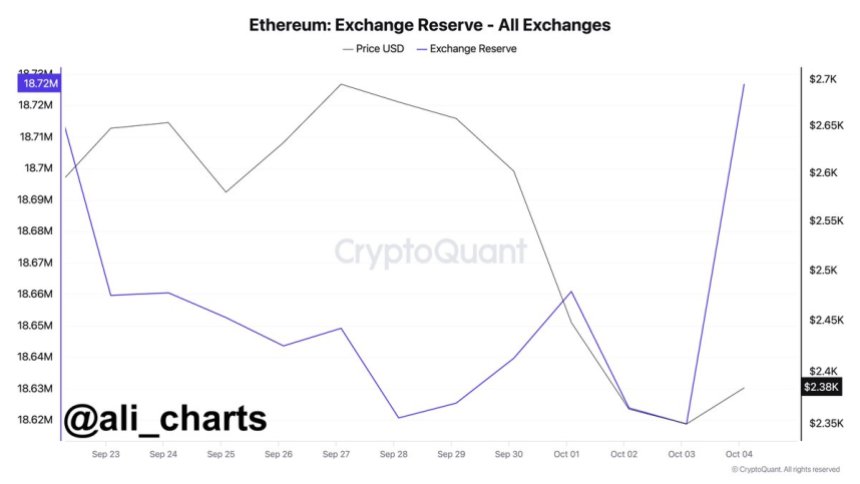

His remarks come amid intense selling by the Ethereum Foundation in recent months. As ZyCrypto reported, the organization’s sales have been among the factors attributed to ETH’s poor price performance.

Buterin added that part of the funds raised from the sale would support multiple events globally. Furthermore, developers who worked on improving Ethereum’s security and mitigating threats such as distributed denial of service (DDoS) attacks were also paid from these funds.

Staking will create governance issuesButerin further responded to a user who questioned why the Ethereum Foundation could not stake the ETH tokens it owns and generate yield. By doing so, the organization could be less inclined to sell tokens to cover the costs of maintaining the blockchain’s security and meeting developer needs.

However according to Buterin, if the foundation engaged in staking, it would be required to participate in governance. As such, given the many developments and upgrades surrounding Ethereum including hard forks, Buterin stated that the organization did not want to be ‘forced to make an official choice.”

He also noted deliberations on how the organization could stake Ether by lending it to others. Those who were given the grants would have to ensure that they did so ethically.

“Another way to get around this problem would be to spread the legitimacy and resources around more, so there’s multiple organizations viewed in people’s eyes as credibly representing Ethereum. We’re already in a much better position in this regard than we were even 2 years ago,” he added.

Despite this reassurance, Ethereum’s price has yet to recover strongly. ETH traded at $2,502 at press time after a slight 2% gain in 24 hours. ETH has dropped by around 6% in the last seven days and steadily lost its market dominance to Bitcoin (BTC).

Similar to Notcoin - Blum - Airdrops In 2024

Ethereum (ETH) на Currencies.ru

|

|