2024-9-17 21:17 |

Ethereum (ETH) has underperformed against Bitcoin, with the ETH/BTC trading pair dropping to the lowest level since mid-2021. The decline comes as ETH price continues to struggle amid a decline in demand and a lack of interest from whales.

The ETH/BTC trading pair plunged to 0.039 at the time of writing, its lowest level since 2021. This suggests that in the last three years, Bitcoin’s price has strengthened while the price of ETH has traded lower and underperformed.

Technical indicators show that ETH might have bottomed against Bitcoin, setting the stage for a possible reversal. The Relative Strength Index (RSI) is at 30, signaling that ETH is oversold, and traders could take advantage of the dip to accumulate more.

Furthermore, a falling wedge pattern has emerged. This pattern usually hints at a possible exhaustion of the downtrend.

(Source: TradingView)However, traders should remain cautious of the bearish momentum seen on the Moving Average Convergence Divergence (MACD). The MACD line is below the signal line while the histogram bars are red, showing that bears are in control of the price action.

Moreover, selling momentum is still dominating Ethereum price, with whales dumping the altcoin at a high rate, dampening market sentiment.

Ethereum whales’ selling spree continuesWhales appear to be cashing out at the bottom, with on-chain data showing that some of the largest Ethereum holders are now selling.

According to SpotOnChain, one of the largest Ethereum whales with a record-making profit streak has sold ETH after holding the token for eight years.

This whale bought ETH in 2016 when the price was around $5. On September 16th, the whale sold $1M worth of ETH and still holds 16,199 Wrapped ETH (WETH), worth around $37M.

A diamond-hand whale with a $38M (x436) profit is selling $ETH after 8 years of dormancy!

Between Jan 19 and Feb 23, 2016, when the price was only ~$5.24, whale "0x996" withdrew 16,636 $ETH (est. cost: $87,136) from ShapeShift and held all tokens until today.

6 hours ago, the… pic.twitter.com/sxniRoaRYt

This diamond whale is not the only large ETH investor selling the altcoin. The Ethereum Foundation, which is well-known for selling at the top, has also been on a selling spree.

On September 16th, this organization sold another 100 ETH. In the last three weeks, the address has dumped 650 ETH tokens into the market.

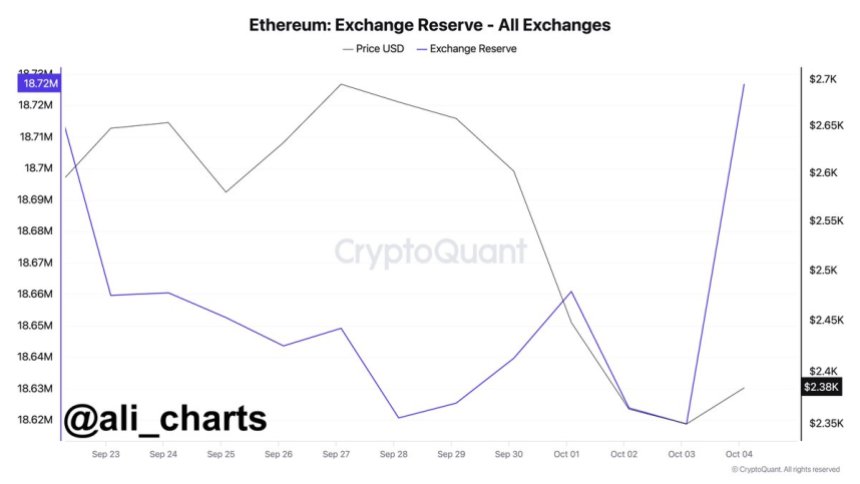

This selling activity is increasing ETH supply in the market at a time when the demand is notably low. A recent report by Coinshares noted that outflows from Ethereum investment products have reached $117M over the past month.

These outflows signal a lack of interest in ETH, given that within the same month, Ethereum rival Solana saw $6.9M in inflows.

Similar to Notcoin - Blum - Airdrops In 2024

Ethereum (ETH) на Currencies.ru

|

|