2024-10-12 07:30 |

The Bitcoin ongoing rebound, reclaiming the $62,000 price mark once again today, has sparked renewed optimism in the cryptocurrency community.

According to a recent analysis by CryptoQuant analyst Crypto Dan, the current market is still amid a bull cycle, with promising long-term prospects for Bitcoin holders.

While the market has faced some short-term turbulence, key indicators suggest that more gains may be on the horizon.

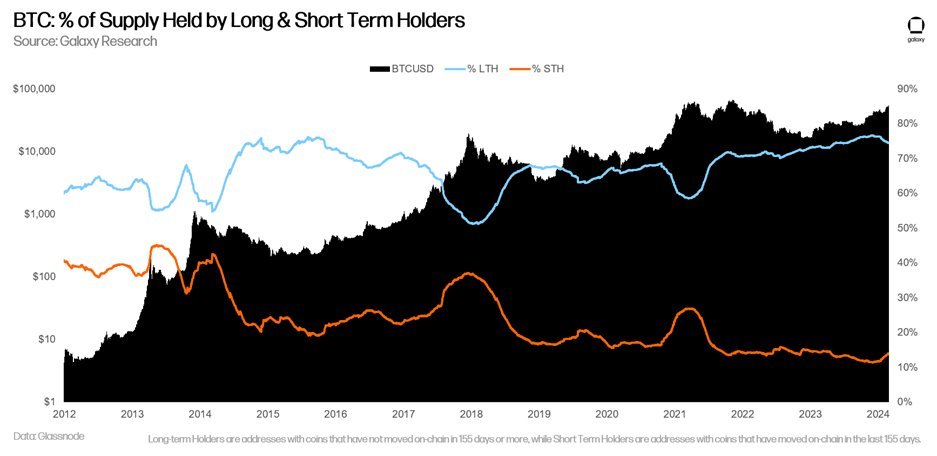

Bull Run Is Still In ProgressCrypto Dan’s insights, shared on the CryptoQuant QuickTake platform, highlight how Bitcoin’s current movement mirrors patterns seen in previous bull cycles. Specifically, Dan noted that long-term investors realized profits twice during the 2013 and 2020 bull markets.

He further pointed out that 2017’s market peak differed, lacking the same period adjustments in other cycles. Dan suggested that if we follow the patterns of 2013 and 2020, the current market could be poised for another significant upswing.

In addition to the cycle comparison, Dan emphasized the global macroeconomic situation, specifically the recent trend of interest rate cuts by central banks worldwide.

He explained that while liquidity may take several months to return to markets fully, prices typically move ahead of these developments based on investor expectations.

This anticipatory movement could set the stage for significant price increases by 2025, offering long-term investors the potential for substantial gains. The analyst advised:

If you “invest” through a big frame rather than a short-term picture, you are more likely to get a much better result.

Bitcoin Bounces Back, Coinbase Premium Points to AccumulationMeanwhile, Bitcoin has shown signs of recovery after dipping to $58,000 earlier in the week. At the time of writing, the asset is trading at $62,080, marking a 2.4% increase in the past 24 hours.

This recovery has been met with positive sentiment from the crypto community, especially as other indicators point to the continued accumulation of Bitcoin.

Another CryptoQuant analyst, Avocado Onchain, provided further insights into Bitcoin’s price movements, particularly focusing on the Coinbase Premium, an indicator that measures the difference between Bitcoin prices on Coinbase and other exchanges.

Avocado explained that the Coinbase Premium dropped to -100 points, typically a bearish signal. However, Bitcoin’s price has since rebounded, suggesting a positive outlook.

According to the analyst, historically, during bull markets, Bitcoin’s price tends to bounce back after the Coinbase Premium falls below -50. This pattern has held true over the past year, with Bitcoin consolidating within a broad price range for the past eight months.

Avocado noted that, in a bear market, such negative premiums would typically lead to panic selling, yet that has not been the case now. Instead, the data indicates that larger players may be accumulating Bitcoin at lower prices, signalling that the bull market “may not be over.”

Featured image created with DALL-E, Chart from TradingView

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) íà Currencies.ru

|

|