2023-5-30 21:00 |

If the historical pattern in this on-chain indicator is anything to go by, hopes for the continuation of the Bitcoin rally may still be alive.

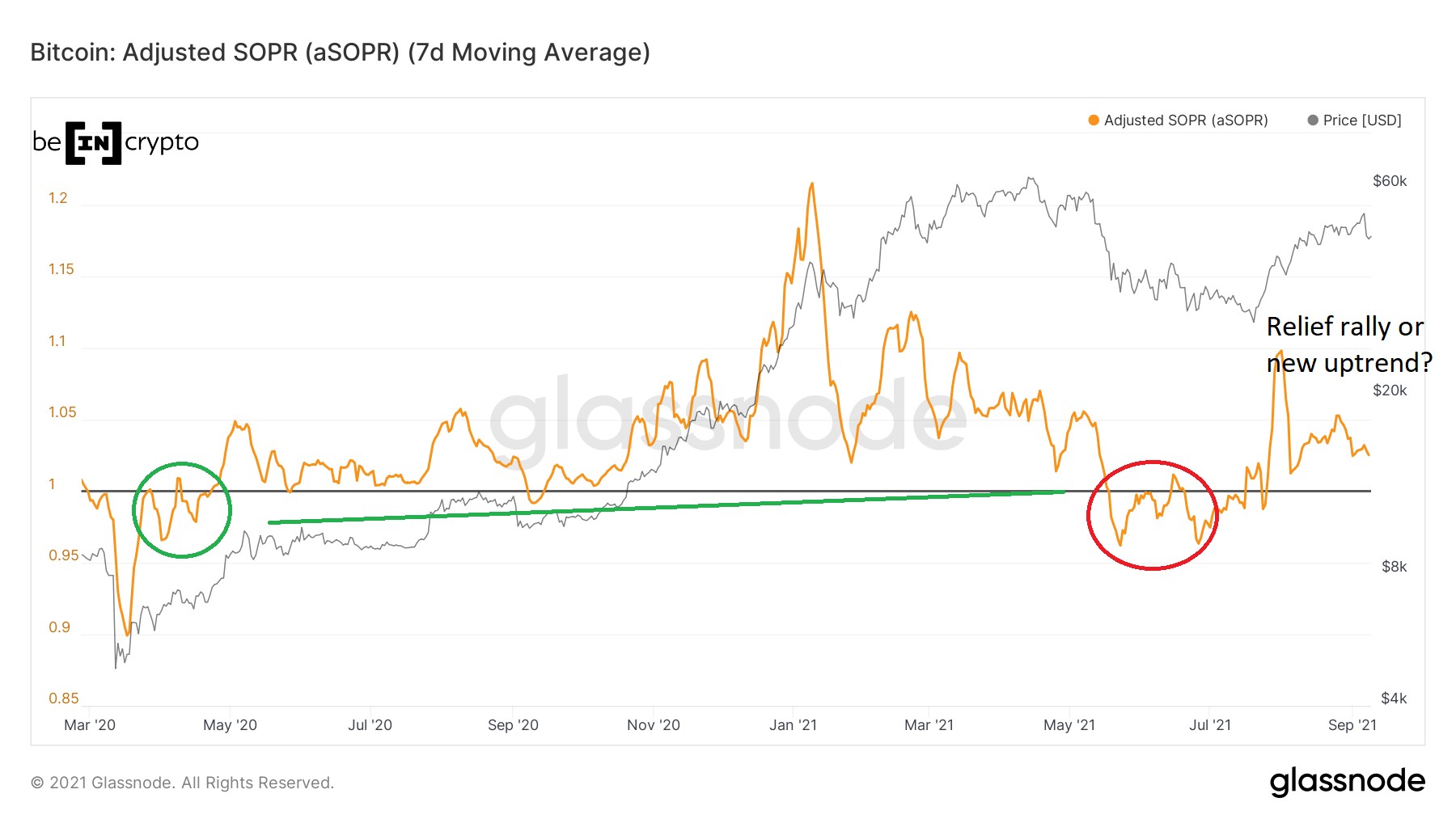

Bitcoin SOPR Ratio Has Been Going Up In Recent WeeksAs an analyst in a CryptoQuant post pointed out, the SOPR ratio has been above 1 recently. The “Spent Output Profit Ratio” (SOPR) indicates whether the investors in the Bitcoin market are selling their coins at a profit or a loss right now.

When the value of this metric is above 1, it means the average holder in the sector is currently moving their coins at a loss. On the other hand, values below this threshold imply the market is realizing a net profit at the moment.

The BTC sector is generally divided into two main holder groups: the “short-term holders” (STHs) and the “long-term holders” (LTHs). The former cohort includes all investors that acquired their coins within the last 155 days, while the latter group includes those who bought before this cutoff.

In the context of the current discussion, the relevant indicator is not the SOPR itself but the “SOPR ratio.” This indicator measures the ratio between the SOPR, specifically for the LTHs and the STHs.

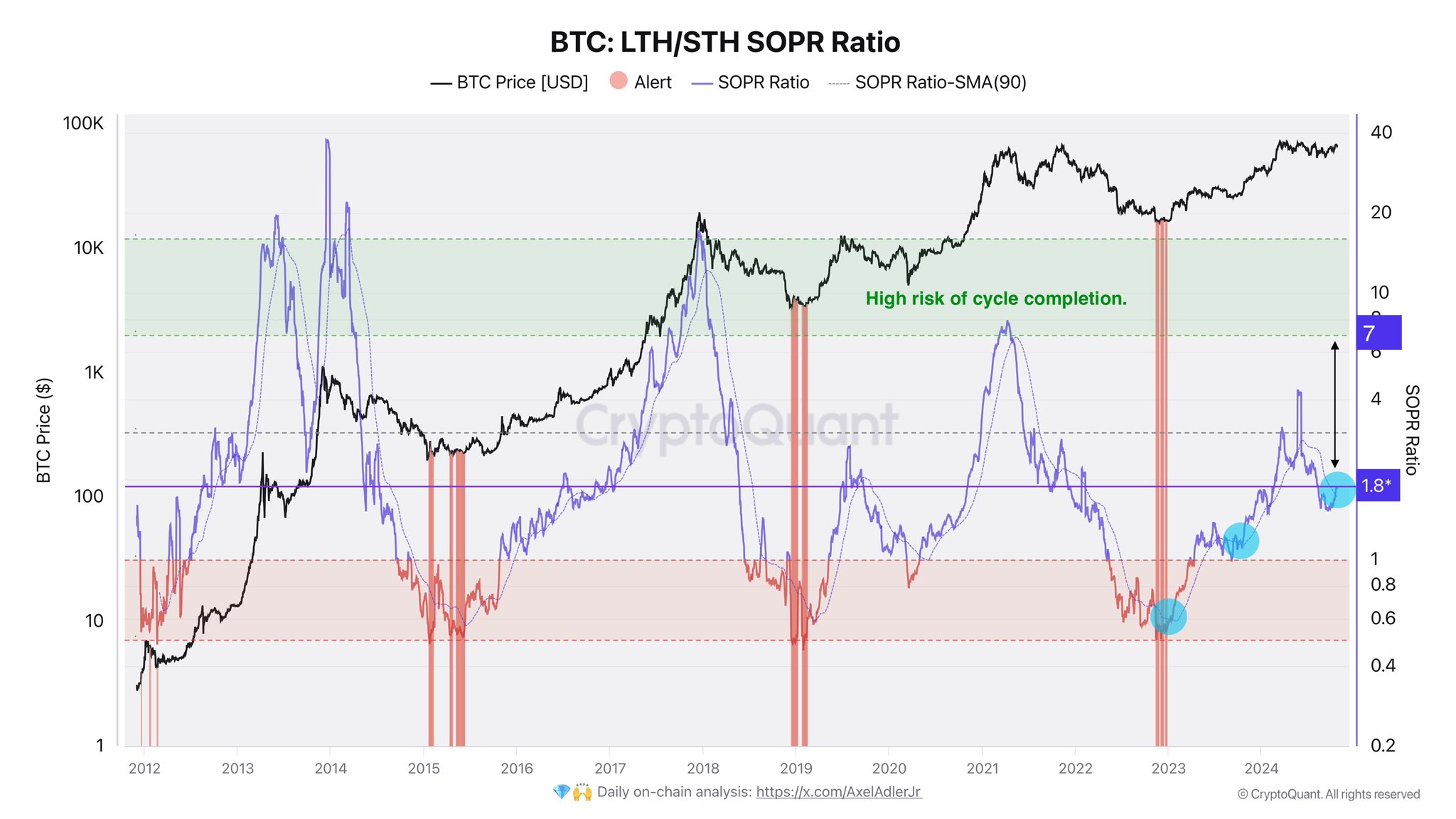

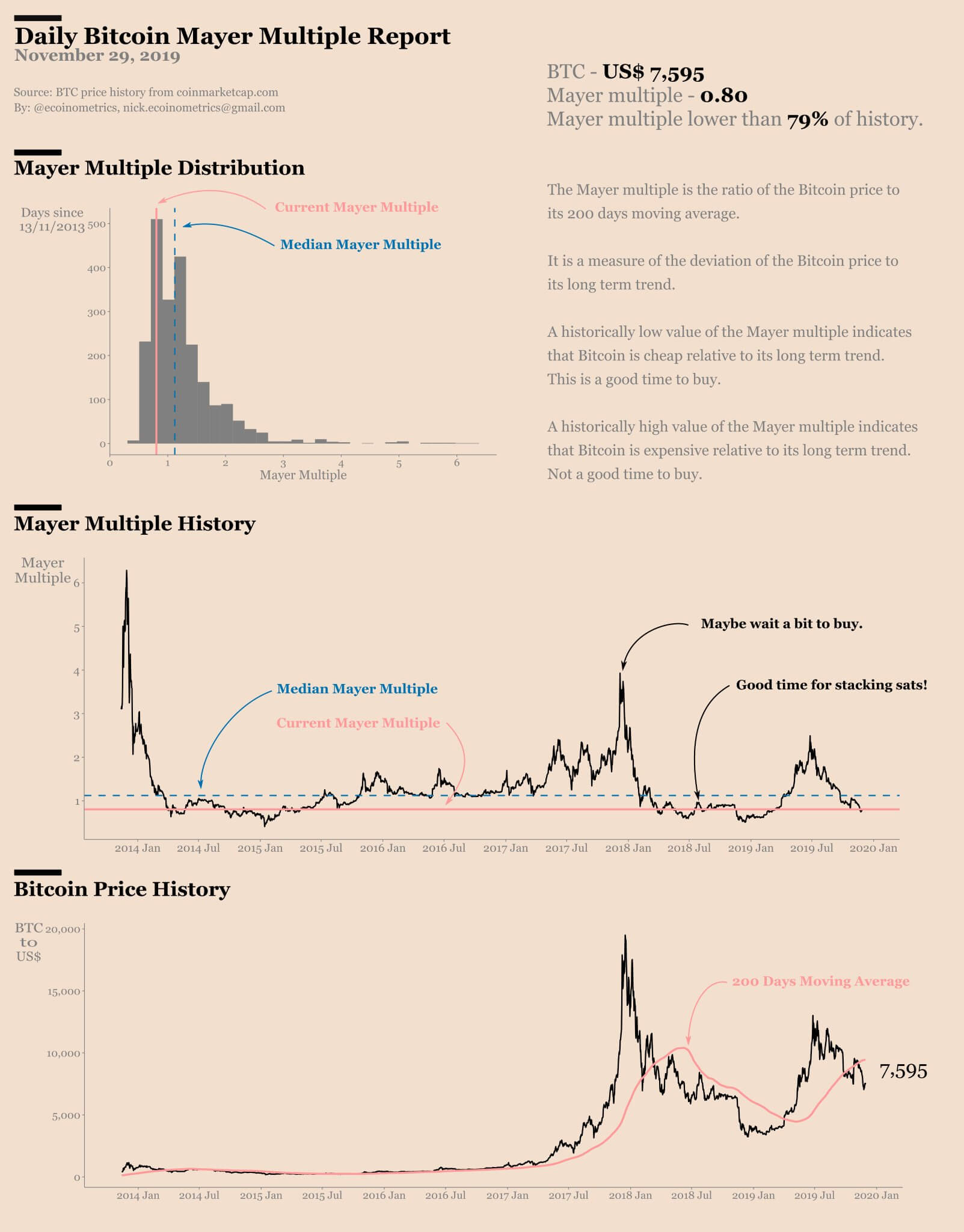

Now, here is a chart that shows the trend in the 30-day simple moving average (SMA) Bitcoin SOPR ratio throughout the history of the asset:

As you can see in the above graph, the quant has marked the pattern that the 30-day SMA Bitcoin SOPR ratio seems to have followed during the past cycles of the cryptocurrency.

Whenever the SOPR ratio is below 1, the LTHs realize lower profits relative to the STHs. Historically, this has usually been observed inside bear markets.

The bear market bottom formations in the asset price have always occurred when the indicator has plunged deep below this mark and hit a value of about 0.5.

Bullish periods followed with a surge in the metric back above the 1 level. Such a breakout implies a shift in the market dynamics, as the LTHs are harvesting a higher profit than the STHs during periods like these.

During the rally in the last few months, the 30-day SMA Bitcoin SOPR ratio has again managed to break above the 1 mark, suggesting that the shift towards a bull market may have occurred.

The metric is still firmly above this level, despite the recent struggle that the coin has seen. The analyst believes this is a sign that the bulls continue to dominate the market.

From the chart, it’s also visible that the present values of the SOPR ratio are nowhere near as high as what was observed during past rallies, including the April 2019 rally, which may hint that the rally has some potential to go before the top.

BTC PriceAt the time of writing, Bitcoin is trading around $27,900, up 4% in the last week.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|