2019-8-6 14:00 |

CNBC has continued its seemingly non-stop coverage of Bitcoin and other crypto markets. On Monday, the outlet brought on Thomas Lee of Fundstrat Global Advisors to divulge his latest thoughts on the cryptocurrency market.

Unsurprisingly, Lee’s comments centered around the impact that tumult in traditional markets and the geopolitical stage, like the U.S.-China trade war, could have on the price of Bitcoin and the broader industry.

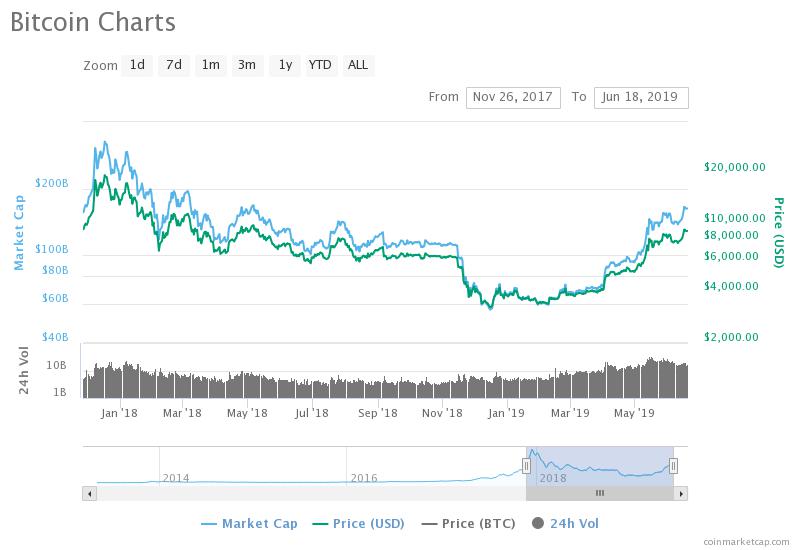

Related Reading: Bitcoin Could Hit a New High This Week, Factors And Trends The Sky is Falling! The Sky is Falling!Ever since mid-December 2018, Bitcoin has been on an absolute tear. The cryptocurrency, which some cynics expected to wither away earlier this year, has rallied from a bottom of $3,150 to $12,200, where it stands as of the time of writing this.

Per Lee, a prominent cryptocurrency analyst and commentator, some, if not most of this rally was catalyzed by a growing number of investors looking to hedge their bets against traditional financial risk. You see, over the past few months, years even, there have been growing storms in the macroeconomic landscape.

Bitcoin will rally to new highs as market mayhem continues, says @fundstrat's Tom Lee. Here's why. pic.twitter.com/SYDmaEcjIj

— CNBC's Fast Money (@CNBCFastMoney) August 5, 2019

Here’s a brief list of some of the many issues (most of which deserve their own articles in and of themselves): over $14 trillion worth of negative-yielding bonds (debt), most of which is high-grade; a dovish Federal Reserve that recently cut rates for the first time since the Great Recession; a raging trade war between the U.S. and China; Brexit and other turmoil in the European Union; and currency crises in places like Venezuela, where Bitcoin has already taken grip of the economy.

Bitcoin, the Go-To HedgeAnd according to a growing number of economists and investors, Bitcoin is one of the ways that those with fiat holdings can hedge their risk against the aforementioned issues.

As Chamath Palihapitiya, a former Facebook executive and a current venture capitalist, told CNBC earlier this year, Bitcoin is the single best insurance against the “traditional finance system” that the world has ever seen. Palihapitiya has been under the belief for a while now that the cryptocurrency will eventually hit $1 million, with one price driver being it being used as a safe haven, much like gold.

Palihapitiya isn’t the only one with this thought process. As detailed by this outlet on an earlier date, former Bitcoin skeptic Tyler Cowen, who is a columnist at Bloomberg, wrote in an op-ed regarding his thoughts on the development of the cryptosphere, one of the four reasons why BTC is here to stay for the long term is its potential to be used as a hedge against uncertainty.

And even the Financial Times, a legendary business news publication, earlier this year hinted that Bitcoin is joining the exclusive class of go-to safe-haven assets — gold, Swiss Francs, and Japanese Yen, to name a few in that class.

This assertion regarding Bitcoin and the economy is very similar to that made by Jeremy Allaire, the chief executive of the Goldman Sachs-backed Circle. Per previous reports from NewsBTC, the industry executive told CNBC’s “Squawk Box” panel on Monday that there is a growing correlation between macroeconomic turmoil and movements in the Bitcoin price, implying its use as a hedge.

Indeed, Bitcoin began its latest rally around two days ago in direct correlation with a tweet that Donald Trump published in regards to fresh tariffs, which also coincided with a drop in the value of the Chinese Yuan against the U.S. Dollar. This is the seeming second time that tariff-related messages from the Trump administration have resulted in a drop in the CNY/USD and a rally in BTC. This move supports the hearsay that Chinese investors who have managed to skirt regulations are buying Bitcoin to get money out of an increasingly threatened economy.

Bitcoin to See Fresh All-Time HighsAccording to Lee, all this is preparing Bitcoin to experience new all-time highs in the near future. He explains that the fact that Bitcoin has been rallying amid all the aforementioned turmoil and a strong U.S. dollar will push institutions, many of which are underperforming their benchmarks and are looking for alternative opportunities to produce outsized returns, to invest in digital assets. Per the analyst, this newfound influx of investment help BTC hit $20,000 in the near future.

Featured Image from ShutterstockThe post Bitcoin Price to See Fresh All-Time Highs Amid “Market Mayhem”, Fundstrat Asserts appeared first on NewsBTC.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|