2019-12-30 21:31 |

Bitcoin Long-Term Overview

Bitcoin opened 2018 with a high of $13,290 and closed the year at about $3,800. This represents a 72% loss overall. By comparison, the Dow opened the year at $24,824 and close at about $23,300. This represents a 6.2% loss overall for traditional investors.

However, 2019 is a different story as bitcoin opened it at $3,700 but climbed up by almost 60% (as of today) and is currently hovering around $5,900.

If we are honest, bitcoin is still, for the most part, a favorite toy of experienced and less experienced speculators but number of builders is burgeoning as well. The surrounding ecosystem and infrastructure is being built at blinding pace while brand presence and recognition are hitting all time highs, especially among the younger generation.

Have a look at some of the best bitcoin bots that can earn you money while you sleep.

The old establishment, comprised of mostly old white men, is still yelling at bitcoin, throwing jabs, insults and calling for a ban (best evidence of their glaring lack of understanding of how bitcoin works). Luckily, biology is on bitcoin’s side – the old ruling class and archaic technologies they cling on are dying off, making room for new ideas and technologies.

Bitcoin already owns real estate in the heads of the upcoming decision makers and wealth holders and it is only question of when, not of will, bitcoin enter the mainstream financial world.

Let’s take a look at the fundamental forces that will propel bitcoin upwards in 2019.

We can divide the fundamentals into two categories: protocol enhancements and ecosystem/infrastructure construction.

FundamentalsProtocol enhancementsFreelance journalist Ian Edwards wrote an excellent piece on bitcoin protocol improvements that you can read here. Here is the excerpt with most important developments. It is worth noting that prolific bitcoin developer Pieter Wuille unveiled two Bitcoin Improvement Proposals (BIP) on May 6th that offer plans that could prove foundational to a possible upgrade to the cryptocurrency.

Wuille’s first BIP describes a “new SegWit version 1 output type, with spending rules based on Taproot, Schnorr signatures, and Merkle branches.”

While the second describes “the semantics of the initial scripting system under bip-taproot.”

Below are most important protocol developments which are being worked on right now, with no firm deadlines when will they get implemented.

MASTMAST, short for Merkelized Abstract Syntax Trees, proposes to improve Bitcoin by changing how smart contracts are written to the blockchain. In effect, it allows smart contracts to be split into their individual parts. This has several benefits in terms of privacy, transaction size and allowing for larger smart contracts. There are excellent articles about MAST here, here and here. There is no set timeline for its implementation.

Schnorr signaturesSchnorr signatures, named after their inventor, Claus-Peter Schnorr, are a proposal to replace Bitcoin’s current digital signature algorithm (ECDSA) for a more efficient one. The first way they will improve the bitcoin protocol is that they will allow for the aggregation of multiple transaction signatures into a single signature.

This would make transaction sizes smaller in these types of transactions, and could reduce transaction’s use of storage and bandwidth of the Bitcoin network by around 25%. Second, Schnorr signatures would increase of the privacy of multisig transactions by aggregating signatures in these transactions, thereby masking the original signatures.

BulletproofsBulletproofs promise to improve the privacy of Bitcoin by concealing quantities of transactions, while still leaving the sender’s and reciever’s wallet addresses public. They are already implemented on Monero while Bitcoin implementation is still pending and according to Wuille ” “far too premature to propose for inclusion into Bitcoin.”

Confidential TransactionsConfidential Transactions (CT) would keep the amounts of Bitcoin transactions visible only to participants in the transaction.

Sidechain ProjectsSidechains are intended to allow other blockchains to connect to the Bitcoin network using a separate coin that is tied to bitcoin. This means that each sidechain is a separate blockchain that can have different rules from the Bitcoin mainnet while still remaining connected to it. There are several different sidechain proposals under development currently: Liquid Network, RSK and Drivechain.

Liquid NetworkLiquid is a private sidechain, so there is some control over who can access it. The benefits of Liquid are that it allows instant transactions, privacy (Confidential Transactions are built in) and the ability for users to hold Liquid funds outside of an exchange.

RSKRSK is a sidechain that plans to bring smart contract functionality and near instant payments to the bitcoin network. Like Liquid, it uses a federated system, with custodians tracking the movement of bitcoin between RSK’s network and Bitcoin’s mainnet. It does this by using a token called SBTC (smart bitcoin), which is pegged to BTC at a 1:1 ratio.

DrivechainDrivechain plans to allow for multiple blockchains to be linked up to Bitcoin’s mainnet. Like RSK, Drivechain sidechains built can be secured by Bitcoin miners using merged mining. Unlike RSK, Drivechain is flexible, and developers could create sidechains tailored to the specifications they want, such as larger block sizes or privacy features.

MimblewimbleMimblewimble is a proposal for a bitcoin-like blockchain which claims to provide higher security than the current Bitcoin protocol, improved scalability, a different kind of cryptographic security and ASIC-resistant mining algorithm to encourage mining decentralization.

Lightning NetworkOf course, there is the highly contentious Lightning Network project, the long awaited layer 2 scaling solution that bears a lot of bitcoiners’ hopes and attracts a lot of disputes and detraction from other camps, mostly from bitcoin forks like BCH and BSV.

Lightning Network, has seen significant growth last year. The first Lightning implementation developed by Lightning Labs launched in beta in March 2018.

In a little over a year since being live on mainnet, there are now nearly 4,300 nodes with active channels and about 38,000 total channels. The steeper node growth in the last three months could potentially be connected to the release of the Casa Lightning Node, which made running a node significantly easier for a regular non-technical user.

It’s also worth pointing out that the average number of channels per node has been steadily increasing throughout the last year. Also the capacity of nodes and overall network has been increasing over the last year to the current 1,079 BTC (more than $6m) locked up in nodes and channels.

source: bitcoinvisuals.comEcosystem and InfrastructureThe Big Bitmain FallBitmain, on the other hand, has suffered tremendous losses under the leadership of Jihan Wu and Micree Zhan. They had followed Roger Ver’s technological direction to fork Bitcoin into Bitcoin Cash. In August, 2017 Bitcoin Cash successfully forked from Bitcoin and Bitmain had bet big on this fork and technology adding a huge amount of hash power behind the Bitcoin Cash fork. Bitmain had been planning an IPO as well in early 2018. Bitcoin Cash forked again, the IPO was turned down and together with $400 million in losses, Jihan Wu and Micree Zhan are exiting Bitmain.

Institutional Money Is Coming Into BitcoinLast year, reports emerged that George Soros and the Rockefeller family were beginning to take positions in the emergent crypto asset class, according to Bloomberg. The family’s $26 billion Soros Fund Management was supposedly considering trading digital assets. The Rockefeller family’s VC arm, Venrock, decided to take a different approach by partnering with Coinfund to assist entrepreneurs in launching blockchain businesses. In the tail end of April, Charlie Lee, the creator of Litecoin, revealed that he spotted Bitcoin and Litecoin trading pairs appear on his TD Ameritrade Think or Swim portal. While some cast this news aside as a joke or glitch, other users confirmed that they too saw “BTC/USD” appear on their accounts on TD Ameritrade. TD Ameritrade has more than 11 million client accounts with more than $1 trillion in assets. The U.S. broker already offers Bitcoin futures trading.Circle, Coinbase, BitGo, Goldman Sachs, Citigroup, Morgan Stanley, and other major financial institutions have either already launched crypto-focused custodian solutions or plan to offer crypto custody in the short-term begin to serve an increasing number of institutional investors in the months to come.In July, Blackrock — the world’s largest exchange-traded fund (ETF) — announced that it has launched a working group to assess the potential of investing in Bitcoin.Goldman Sachs has been making inroads toward crypto adoption throughout the year. Thus, in April, cryptocurrency trader Justin Schmidt was hired by the firm in response to client interest in the space.The following month, Goldman Sachs executive Rana Yared confirmed that the company intends to buy and sell Bitcoin — after concluding the preeminent cryptocurrency was “not a fraud.”OTC MarketsAccording to cryptocurrency research group Diar, institutional cryptocurrency trading on traditional exchanges has been diminishing in volume due to BTC being welcomed into major outfit portfolios this year. There has instead been a shift to OTC trading.

During OTC market hours, there has been an increase in BTC trading volume by 20 percent, while Grayscale’s Bitcoin Investment Trust (GBTC) volumes were down 35 percent in 2017 vs. 2018 for the same period. It seems institutional traders might be shifting towards higher liquidity OTC physical BTC markets.

The approval of a Bitcoin exchange traded fund (ETF) has been chased by a number of industry players over the past few years.

Several crypto companies, such as Gemini and Bitwise, have filed for crypto ETFs, but so far, regulators have not approved any. However, the U.S. Securities and Exchange Commission might be shifting its position. The agency is now more concerned about curbing fraud on platforms that propose ETFs rather than the ETFs themselves. We believe the SEC could soon approve a crypto ETF.

Universities Dipping Their ToesIn addition to big individual investors and backers, universities like Harvard, Yale and Stanford have all invested in cryptocurrency funds. An undisclosed source has revealed that endowments of the respective universities have invested tens of millions of USD into at least one crypto fund.

It’s no secret that one of the impediments to institutional investors entering the crypto space is the need for a suitable regulatory framework; hedge funds can’t simply invest their clients’ funds in the same free-and-easy manner as a retail investor.

Regulation is not a crypto killer. Regulation will provide much-needed clarity to investors big and small, as well as the entities issuing the coins themselves. People can start to focus on how these assets can best be leveraged to diversify portfolios, transfer money overseas, and improve business models, instead of looking over their shoulders in fear of running afoul of the SEC. With increased regulation, increased adoption will follow, particularly among those for whom due diligence is paramount. Financial institutions will be able to confidently bring these investment options to their clients, pension funds can incorporate cryptocurrencies into their long-term holdings — the applications are endless.

This article of ours covers bitcoin regulations and current legal frameworks around it, worldwide.

Famous BackersJack Dorsey is the CEO of Twitter and has been showing its support for Bitcoin (BTC) and the Lightning Network .

Steve Wozniak is known for co-founding Apple, one of the largest companies in the world. Wozniak said that Bitcoin will become the world’s currency.

There is another Bitcoin bull in the market, Peter Thiel. The venture capitalist has already bet on Bitcoin and the possibility for it to become a gold-like safe haven. During a conversation with CNBC, he said that he would be long Bitcoin and neutral of everything else.

Tim Draper, a recognized venture capital investor, has been participating in the crypto market for a very long time. He invested in Bitcoin when it was traded under $1,000 and it has also made very bullish predictions for the future of this digital asset.

Ashton Kutcher has been an outspoken advocate for Bitcoin and he invested in a sports betting blockchain, UnikoinGold, along with billionaire, Mark Cuban.

Cryptohopper is by far one of the best automated trading bots in the market. Read our review here.

Joe Rogan said that he is fascinated by the idea, but haven’t given bitcoin his full attention, but he thinks it could really shake up the global economy.

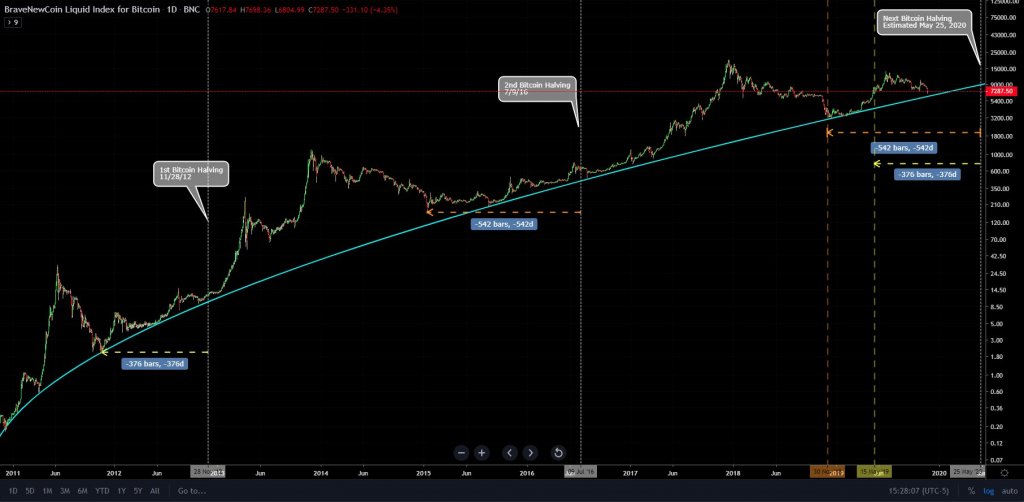

Price Action and Market ShiftsQuick historic overviewHere is a brief history of highs and lows of bitcoin prices, as compiled by colleagues at U.today:

At the beginning of its journey, Bitcoin was worth less than $1.The first peak was a mark of $30 in July 2011, followed by a fall to $4.In mid-2013, Bitcoin broke through the price of $200 but rolled back to $120.An important point was the end of 2013 when the price raised to $1,100. However, the next 2 years were a solid drop for Bitcoin. The bottom was a mark of $240.The turn happened at the end of 2015, then the stable growth of the coin began. It lasted until the end of 2017 when the price reached a historic high of $20,000.The entire 2018 was marked by a tremendous fall. Any analysis and forecast turned out to be wrong. Bitcoin reached the bottom of $3,200.In 2019, new cycle of growth began, and the price exceeded $5,000 again.Since the start of 2019, bitcoin is clearly most profitable asset class, as indicated by Binance Research.

Market Prediction For Bitcoin Price:Everybody and their mother made a bitcoin prediction for this and upcoming years. Not everyone’s opinion should concern us, but some forecasts are more valuable than others so we will pick out the most relevant ones below.

Let’s take a look at some of these Bitcoin predictions.

John McAfee Bitcoin Price Prediction – $1 million by 2020John McAfee, the eccentric founder of the popular security software and a controversial Bitcoin follower predicted that Bitcoin will hit $1 million by 2020. He also added his own flair to the whole prediction betting to eat his male parts should he fail to be true. He subsequently relativized his bet and you can read more about it here.

Willy WooThe founder of Woobull.com predicted a bearish momentum in Bitcoin’s price as we head into Q2 2019. Willy expected the price of Bitcoin to bottom in the months of the second part of the year (sort of happened) before entering an accumulation period for the rest of the year.

“All our blockchain indicators remain bearish. NVT, NVTS, MVRV, BNM, NVM. They are experimental but have served to make very correct calls to date, even when traditional on-exchange indicators were reading to the contrary.” – Willy Woo

Mike NovogratzThe billionaire made his predictions on the price of Bitcoin late last year stating the coin could reach highs of $10,000 by the end of March (missed on this one) and cross its ATH price of $20,000 by the end of the year. The Galaxy Digital founder believes institutional investment from firms such as Fidelity and Bakkt will be key to the surge in BTC’s price.

Tom Lee, co-founder and head of research of Fundstrat, believes that the break-even point of mining 1 BTC directly correlates with the price of the cryptocurrency.

Tom Lee stated that the BTC fair value is much higher than the current price. The current fair value is somewhere between $13,800 and $14,800 which he believes might increase and reach $150,000 per coin as soon as bitcoin wallets account for seven percent of 4.5 billion Visa’s holders.

Zhao Dong, one of the biggest Bitcoin OTC traders in China and an influencer recently predicted that Bitcoin might reach $50,000 by 2021. He reiterated that now is the best time to invest in BTC and said that you might get a yield of 100 to 200% over 3 years if you invest now.

Anthony Pompliano Bitcoin Price PredictionIn a recent tweet, Anthony Pompliano, founder of Morgan Creek said that Bitcoin isn’t going anywhere. He stated that BTC might go as low as $3000, after which it will continue being bullish starting from 2019. He enunciated that there is no reason to freak out on the declining price as Bitcoin’s fundamentals are becoming stronger.

Murad MahmudovMurad Mahmudov, host of ‘On The Record’, believes that Bitcoin will hit a new all time high sometime in late 2020. Prominent crypto personality and analyst Tone Vays generally agreed in an interview with this statement, adding that there is a 40% chance of seeing a new all time high in 2020. This percentage increases to 45% for 2021.

Wheatley model: $2,352.03According to a Forbes article, the Wheatley model predicts Bitcoin will be trading at a rather bearish $2,352.03 in 2020. The article explains that the Wheatley model focuses solely on Bitcoin’s demand and also notes that Wheatly and researchers gave a far lower total market cap to bitcoin than the actual cap is ($20 billion is the figure used in their estimation model). Bitcoin’s slow demand growth is why its 2020 price prediction is so low.

Hayes model: $55,931.60The Hayes model on the other hand predicts a much more bullish trading price for BTC in 2020. This is because that while the Wheatley model focuses on Bitcoin’s demand, the Hayes model focuses on its supply. Bitcoin’s supply is expected to slow as it approaches its supply cap, which should drive up prices.

ConclusionThe current sentiment in the Bitcoin community is positive and technical improvements along with overall ecosystem growth are foretelling a bright future going forward. The technical indicators are signaling an upcoming bullish run and with more people understanding the unique features and advantages of bitcoin over traditional system. While past performance is not a great indicator for future price, the fundamentals underlying Bitcoin may well see it soar in the near future to $20,000 USD crossing its all-time high price.

The post Bitcoin Price Prediction 2020 | 2025 | 2030 – Future Forecast For BTC Price appeared first on CaptainAltcoin.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|