2024-10-9 15:16 |

Fears of a $4.38 billion Bitcoin sale by the US government have arisen following a Supreme Court decision related to a case involving ceased assets from the dark web marketplace Silk Road.

On October 7, the United States Supreme Court declined to hear a case involving ownership of 69,370 Bitcoin seized from the dark web marketplace, Silk Road.

With this decision the US government can now proceed with selling ceased Bitcoin, which is valued at $4.38 billion, and closing the legal road for Battle Born Investments, a company that had claimed rights to the seized Bitcoin.

Battle Born Investments argued in court that it had purchased rights to the Bitcoin from a bankruptcy estate linked to Raymond Ngan, who they claimed was “Individual X”—the person who stole billions of dollars worth of Bitcoin from Silk Road.

However, a federal court in California ruled that Ngan was not “Individual X” and denied the claim.

A federal appeals court in San Francisco upheld this ruling, and now the Supreme Court’s refusal to hear the case puts an end to the legal battle.

With the Supreme Court’s decision, the US government is now expected to move forward with the sale of the assets.

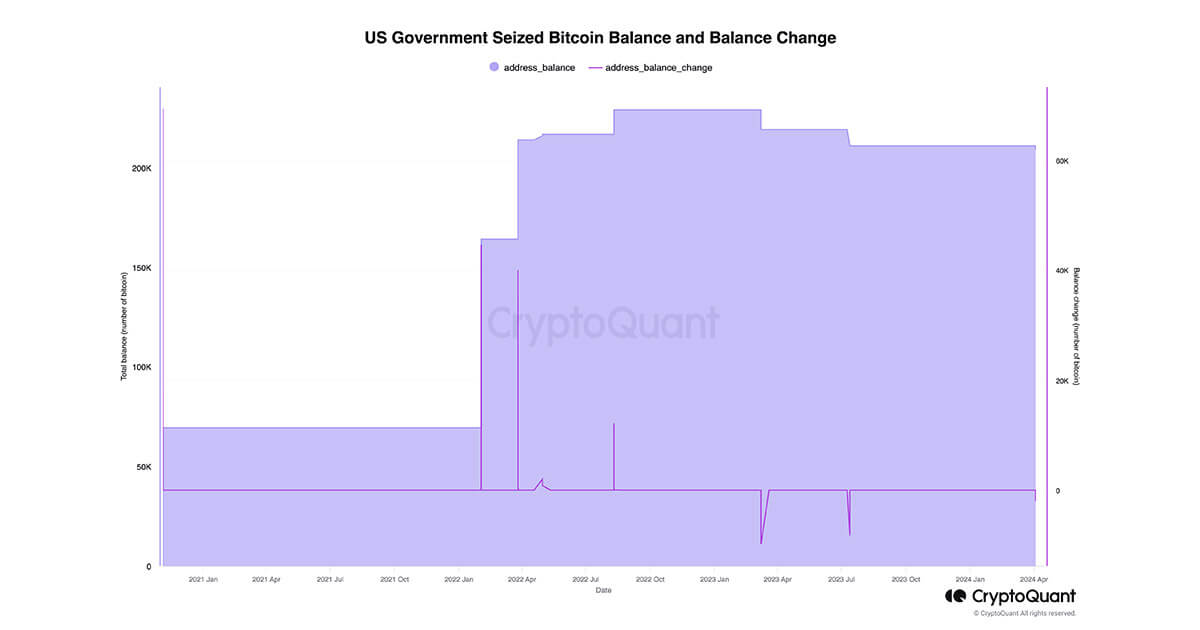

In recent months, the government has transferred large amounts of the cryptocurrency to new wallets, a common move in preparation for asset liquidation.

Notably, the US Marshals Service has a custody agreement with Coinbase Prime, suggesting the assets may be under Coinbase’s management until the sale.

In August, financial lawyer Scott Johnsson predicted that the US government would soon sell the Silk Road Bitcoin, after data from Tokenview revealed that over 19,000 BTC had been moved into a Coinbase account.

Scott Johnsson@SGJohnsson·FollowYes, US Marshal Service (USMS) is almost certainly selling silk road bitcoin. Joey is right (at least in the present). USMS has been sending BTC to a custodial address required by the terms of the servicing agreement that USMS entered into with Coinbase in June. Given the…

8:53 am · 16 Aug 2024923ReplyCopy linkRead 53 replies Fears of a crashThe anticipated sale has sparked concerns about potential market volatility.

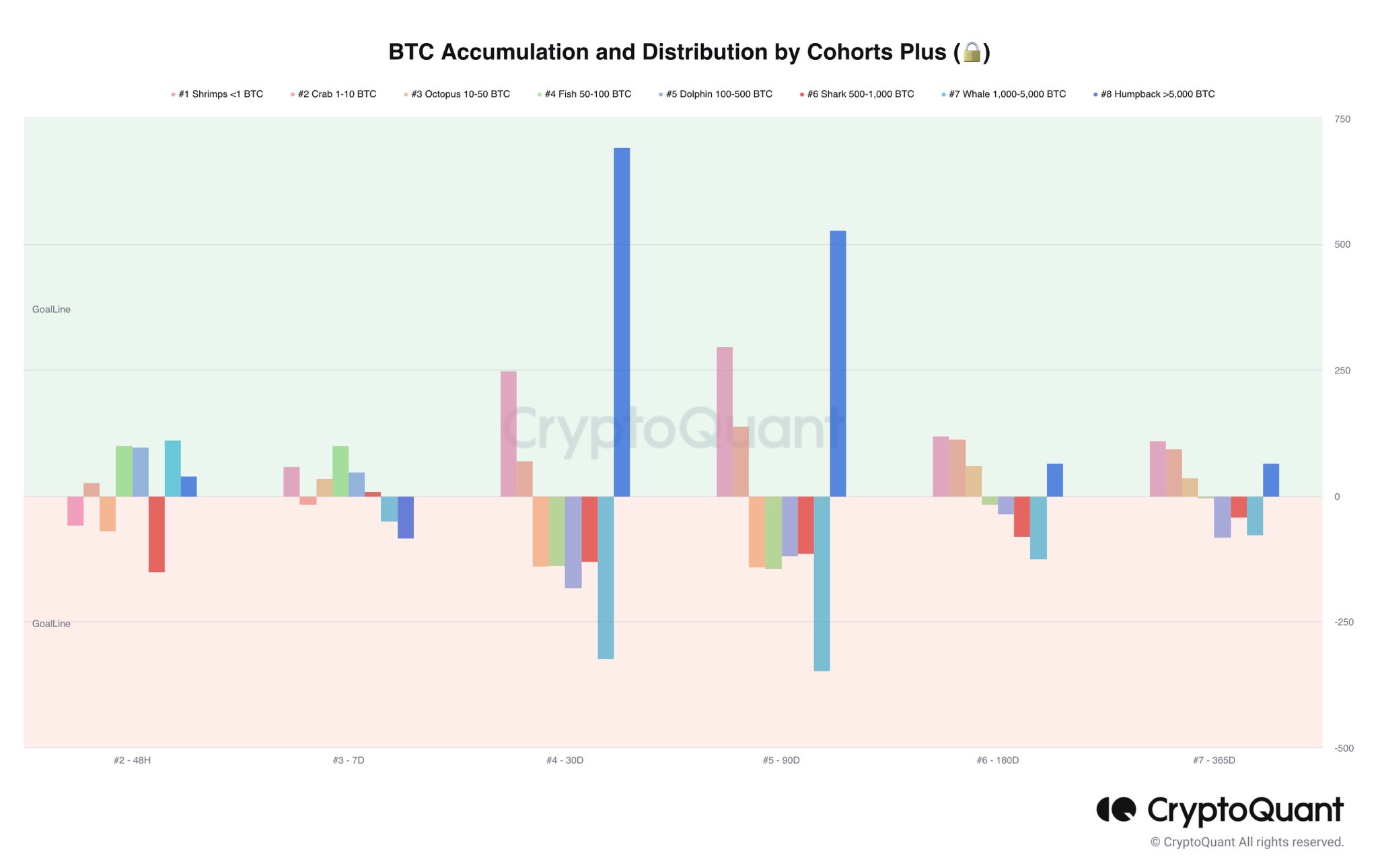

Some fear that selling such a large amount of Bitcoin could disrupt the market, as seen earlier this year when the German government offloaded nearly 50,000 Bitcoin.

That sale, worth over $3 billion, followed the government’s seizure of Bitcoin from the illegal streaming site Movie2k.to.

In June and July, Germany sold the cryptocurrency over several weeks.

Despite these concerns, some in the crypto community believe the market will absorb the sale.

It is yet to be seen how the US government proceeds, as the crypto community awaits an official update.

Previously, former president Donald Trump pledged to create a “strategic Bitcoin stockpile” if re-elected.

Subsequently, Senator Cynthia Lummis introduced the Bitcoin Strategic Reserve bill in August.

This bill, if passed, would establish secure cold storage for government-owned Bitcoin, overseen by the Secretary of the Treasury.

The bill also mandates a Bitcoin Purchase Program, allowing the government to acquire up to 1 million Bitcoin.

The assets stored in the reserve cannot be sold for five years unless new legislation allows it.

Bitcoin printed an intraday low of $62,099 after the news emerged, but was back up at $62,495 when writing.

The post Bitcoin market braces for volatility as US prepares $4.38B Silk Road asset sale appeared first on Invezz

Similar to Notcoin - Blum - Airdrops In 2024

ROAD (ROAD) на Currencies.ru

|

|