2021-1-19 21:00 |

Bitcoin has seen some wild chop as of late, with the crypto’s price ranging between the lower and upper-$30,000 region It has found some strong support within the lower part of this range, with sellers attempting on multiple occasions to break it to no avail. The cryptocurrency has also been seeing large bouts of buying activity to counter selling pressure that appears to be coming from large whales on Coinbase and Binance As soon as these bears lift their sell walls or run out of coins to sell, BTC could begin flying higher One trader is now noting that although the crypto appears to be positioned for further upside, high funding rates remain a potential catalyst for a long-squeeze

Bitcoin has seen some positive price action this morning, with the crypto rallying higher following a sharp overnight selloff that sent the cryptocurrency down to lows of $34,800.

The buying pressure here proved to be significant and helped spark a rebound that is still unfolding at this moment.

BTC’s price ran as high as $37,500 before facing an influx of buying pressure that slowed its ascent.

It still is looking strong, and there’s a large possibility that it sees further near-term upside once $37,000 is flipped to support.

One analyst is cautioning against getting too excited, as he notes that high funding rates seem to indicate that there could be a long-squeeze in Bitcoin’s future.

Bitcoin Rebounds Following Sharp Overnight SelloffAt the time of writing, Bitcoin is trading up just under 3% at its current price of $36,900. This marks a notable rally from its overnight lows of under $35,000 set just several hours ago.

Where the crypto trends in the mid-term will likely depend on its continued reaction to $37,000. This is a resistance level for BTC, which would make flipping it into support technically significant.

Analyst: BTC’s High Funding Poses a Risk to Upside PotentialOne analyst explained in a recent tweet that Bitcoin’s short-term upside potential is currently being hampered by the high funding rates for leveraged positions.

This could indicate that being long is an incredibly crowded trade and that a Bitcoin long-squeeze is imminent.

“TWAPs & daily opens seem to be really important these days. Funding is getting pretty high again though, so I don’t think there’s a whole lot of room for further upside.”

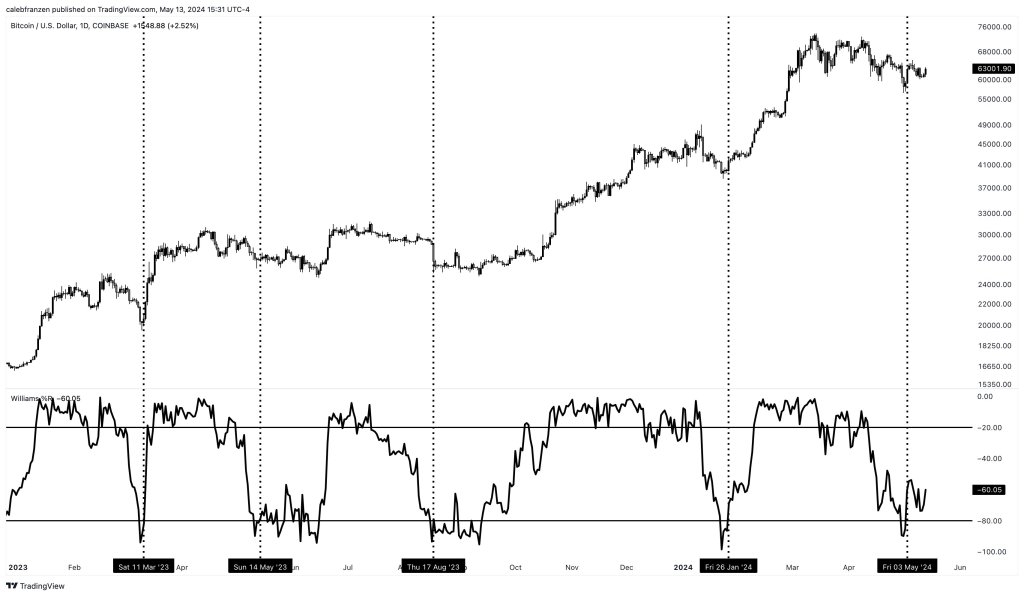

Image Courtesy of Byzantine General. Source: BTCUSD on TradingView.The coming few days should shed some light on Bitcoin’s outlook, with its reaction to $37,000 and ultimately to $40,000 setting the tone for where it trends in the mid-term.

Featured image from Unsplash. Charts from TradingView.Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|