2025-3-3 01:00 |

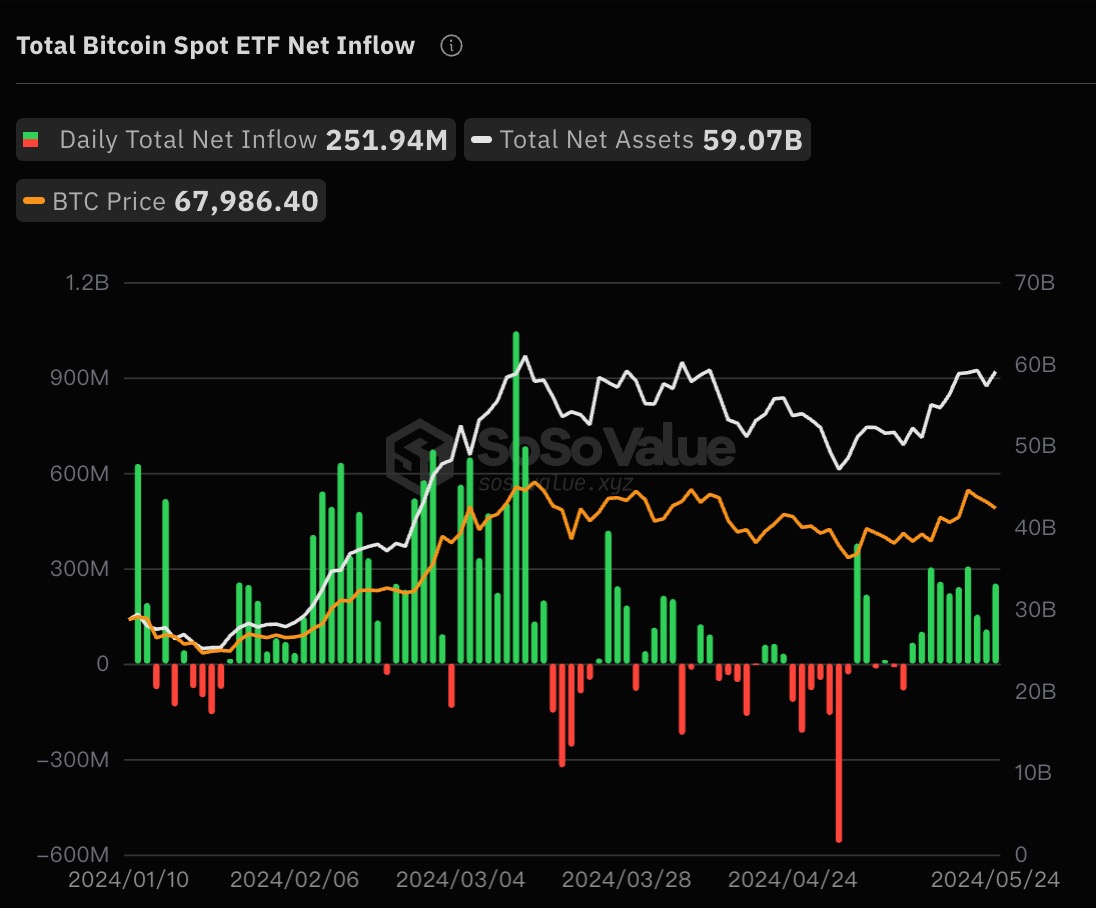

In the past few days, the price of Bitcoin has been under significant bearish pressure, falling by more than 10% in the past week. The US-based spot Bitcoin ETFs (exchange-traded funds) registered significant withdrawals in the same period, begging the question of whether the funds are responsible for the market downturn.

The spot Bitcoin exchange-traded funds ended the run of significant daily outflows on Friday, February 28, with nearly $100 million added in value to close the week. However, it might be too early to tell whether this latest capital influx to these crypto-based products represents a shift in investor sentiment.

Bitcoin ETFs Lose $3.2 Billion In Eight DaysAccording to the latest market data, the US-based spot Bitcoin ETFs recorded a total daily net inflow of $94.34 million on Friday. This latest capital inflow put an end to the funds’ eight-day streak of consecutive net outflows.

The ARK 21Shares Bitcoin ETF (with the ticker ARKB) was responsible for a substantial portion of the day’s total inflow, posting $193.7 million in capital influx. ARKB was followed by Fidelity Wise Bitcoin Fund (FBTC) on Friday, adding more than $176 million to its net assets to close the week.

Bitwise Bitcoin ETF (BITB) and Grayscale Mini Trust (BTC) were the only other exchange-traded funds that saw net inflows ($4.57 and $5.59 million, respectively) on Friday. BlackRock’s IBIT (the largest Bitcoin ETF by net asset) accounted for most of the total withdrawals ($244.5 million), continuing its recent trend of outflows.

The $94.34 million single-day net influx did little to alleviate the US-based Bitcoin ETFs’ weekly performance, which stood at a record negative outflows of over $2.61 billion. Up until the past Friday, the last time the US Bitcoin ETF market saw a daily net positive inflow was on Friday, February 14.

More than $3.265 billion was withdrawn from the spot Bitcoin exchange-traded funds within these eight days. Most notably, the Bitcoin ETFs registered over $1.1 billion in its daily net outflow on Tuesday, February 25 — the first time withdrawals have ever crossed the billion-dollar mark since launch.

Bitcoin Price And The Spot ETFsThere is undeniably a relationship between the performance of the spot Bitcoin ETFs and the BTC price. According to CryptoQuant’s Head of Research Julio Moreno, exchange-traded funds have disappeared as a source of demand growth for Bitcoin so far in 2025 relative to 2024.

The net cumulative inflows into Bitcoin ETFs on day 58 of 2025 stand at 12,100 Bitcoin ($1.7 billion), which pales in comparison to 128,700 Bitcoin ($6.3 billion) in 2024. This trend somewhat explains the Bitcoin price struggles since the start of this year.

As of this writing, BTC is valued at around $85,400, reflecting a 1.5% price increase in the past 24 hours.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|