2018-8-10 16:30 |

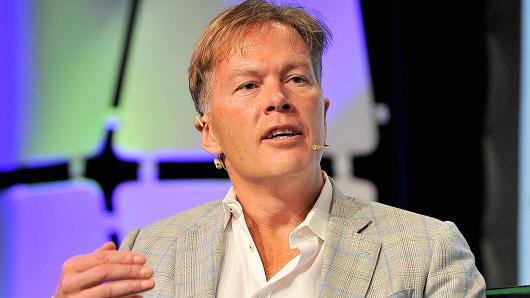

The Securities and Exchange Commission (SEC) delayed its decision that would allow bitcoin to be considered an exchange-traded fund (ETF) which prompted Dan Morehead of the hedge fund Pantera CEO to state that investors are overreacting to the news of a delay on August 8, 2018.

The Power of the ETFThe CEO stated in an interview with CNBC’s Fast Money that he believes it will be a long time before the SEC approves an ETF. He went on to compare it to copper which was the last asset class approved as an ETF. Copper has been around for a long time, and it’s ETF did not determine its worth.

According to his commentary, he sees bitcoin as an “early-stage venture,” with a real-time price feed. This price feed leads people who are holding the pioneer cryptocurrency to overreact to daily fluctuations. This means that while potential adopters can see the value of bitcoin, it also means they can see the volatility in the market. Simply put, a minor drop in a crypto wallet can make investors and adopters more than a little squeamish.

On August 8, 2018, the SEC waited on its decision to qualify bitcoin as an ETF precipitating a drop in the digital asset according to speculators. At the beginning of the summer, the financial authority stopped an attempt by Cameron and Tyler Winklevoss’ crypto exchange Gemini to list shares of their ETF. The SEC’s hesitation stems from a fear in the rise of fraudulent cases according to reports.

Slow and Steady Wins the RaceIn the cryptocurrency space, ETFs have an advantage given that investment in cryptocurrencies requires a depth of knowledge to work with the Netscape-like innovation. Thus, if the SEC accepted a Bitcoin ETF, this would make mass adoption much easier for the general public. However, if the regulator allows a crypto ETF, this also exposes the market to the risks inherent to the burgeoning asset class.

Morehead stated that it is unproductive to panic over whether Bitcoins are considered an ETF or not. Instead, they should feel positive about the adoption and utilization of significant cryptocurrency projects like Bakkt, the Intercontinental Exchange’s (NYSE: ICE) project with Microsoft and Starbucks.

Ultimately, the impact of cryptocurrencies will be felt over the next five to ten years, which should be the focus of investors rather than daily market fluctuations. Morehead cites the fact that cryptocurrency is up 82 percent year-on-year, regardless of what happens month-on-month, or day-to-day.

The post The SEC Stalls, Bitcoin Drops, but Dan Morehead Stays Optimistic appeared first on BTCMANAGER.

origin »Bitcoin (BTC) на Currencies.ru

|

|