2024-1-26 12:59 |

In an exclusive conversation with Invezz, Sabre56 CEO Phil Harvey shared insights on how the Bitcoin ETF approval by the SEC in the US will impact the cryptocurrency industry and

How do you anticipate the recent Bitcoin ETF approval by the SEC in the US impacting the broader blockchain and cryptocurrency industry?

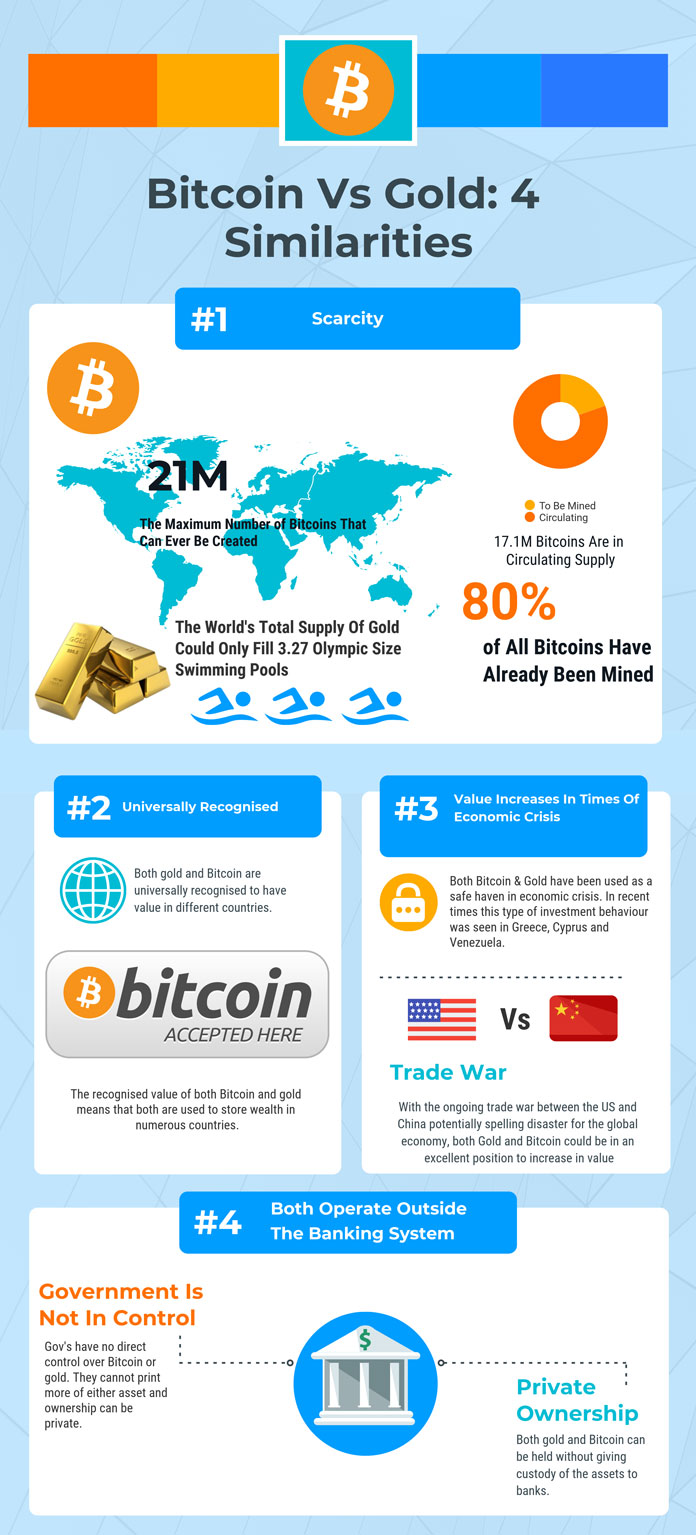

The recent approval of a Bitcoin ETF by the SEC in the US will have a positive impact on the broader blockchain and cryptocurrency industry.

The approval signals increasing legitimacy for the sector, indicating that regulatory authorities and the broader, more established financial markets are becoming more comfortable with, and open to, involvement in the cryptocurrency space.

The newfound legitimacy will attract more institutional investors, and traditional financial institutions into the market.

This influx of institutional capital is likely to contribute to the industry’s expansion, providing increased financial support, and fostering further structural development. In this noteworthy step towards mainstream acceptance, we will potentially see additional regulatory approvals and endorsements.

While the approval may not result in significant price fluctuations in the short term, it is likely to contribute to the overall stability of the cryptocurrency market. The market’s trajectory is likely to be steady, especially as Bitcoin approaches the next halving period.

With the SEC’s new regulations and the evolving landscape of crypt ETFs, what immediate steps are Sabre56 planning to take to align with these changes? Are there any strategic shifts that the company will undertake?

As an infrastructure specialist and facility management company serving a client base in BTC mining, we do not anticipate any immediate changes in response to the SEC’s new regulations and the evolving landscape of crypto ETFs.

The company’s focus remains on providing essential services to BTC mining operations. We do, however, believe that the introduction of ETFs may contribute to reducing overall volatility in the cryptocurrency market, leading to more stable revenue for both clients and, therefore, us.

Consequently, there are no planned strategic shifts at this time.

Can you provide an overview of the current state of the blockchain mining industry, particularly in the context of recent market fluctuations and technological advancements?

The blockchain mining industry is currently experiencing sustained growth, driven primarily by the ongoing expansion of major players such as MARA, Riot, and Peak Mining.

A key metric in this landscape is the percentage of global hash power under management, serving as a recurring benchmark for industry leaders.

Prominent miners, adopting a long-term perspective, are strategically enhancing their control over the value proposition by acquiring not only mining hardware, but also the associated facilities.

For instance, MARA has transitioned away from an ‘asset-light’ model through recent facility acquisitions. Despite the overall expansion, entry into the industry is becoming increasingly discerning, with funds entering the space predominantly backed by experienced industry players.

It is noteworthy that some less reputable entities, emerging from Chapter 11 proceedings, continue to pose challenges. The viability of their endeavours remains uncertain, contingent upon various factors that only time will reveal.

Distinguishing themselves as serious contenders, influential players are opting for technically advanced miners, particularly hydro-cooled models from manufacturers like Bitmain and MicroBT.

These miners provide heightened output stability, but demand a higher level of capital expenditure and specialised technical knowledge – which a significant portion of the industry currently lacks. This signifies a trend towards greater sophistication within the mining sector.

With the upcoming Bitcoin halving event, how do you see the economics of mining changing?

The impending Bitcoin halving event is likely to usher in a period where the cryptocurrency’s price typically experiences an upward trajectory over the course of 12 – 24 months. This surge is essential for miners to attain the revenue needed for sustenance, although with an inherent reduction in overall revenue per terahash (TH).

The economic landscape of mining, therefore, stands to witness a shift whereby miners globally may be faced with the necessity of shutting down operations due to diminishing profitability.

Some miners, having proactively upgraded their mining infrastructure, will likely navigate this landscape more successfully – while others may find themselves compelled to divest their operations, by force or by choice. In essence, mining, as an economic undertaking, remains a persistent struggle, where numerical dynamics evolve, yet the fundamental economics stay the same.

Bitcoin’s energy consumption is a frequently discussed topic. How do you conceptualize this issue within Sabre56, and what steps are you taking to address environmental concerns?

In addressing the matter of Bitcoin’s energy consumption within Sabre56, we face challenges as we function as an energy off-taker, dependent on energy providers for its creation.

Negotiating the complex landscape of the electricity grid matrix proves to be intricate – involving brokers, co-ops, and producers seeking collaborative solutions. Unfortunately, there is a lack of proactive measures within the system.

While we can adjust our load to support grids, the dialogue with grids beyond Texas and Ohio reveals a lack of clarity on how our assistance can be maximally beneficial.

The broader energy industry lacks the adeptness to handle the escalating demand across various sectors, characterised by archaic, cumbersome, and sometimes misleading practices. Whilst Sabre56 endeavours to contribute responsibly, substantive change requires top-down direction, and a more robust commitment to innovation within the industry.

The post Bitcoin ETF approval will draw more institutional investors, says Sabre56 CEO Phil Harvey appeared first on Invezz

origin »Bitcoin (BTC) на Currencies.ru

|

|