2018-8-9 19:02 |

Legit CBOE Insider Continues to Be Positive After Bitcoin ETF Delay, Source Suggests There’s a “99%” Chance of VanEck SolidX Bitcoin ETF Approval

Earlier this week, the United States Securities and Exchange Commission (SEC) sent cryptocurrency markets plummeting when it delayed the decision on one of the most promising ETFs in the crypto space. Despite the delayed decision on the VanEck/SolidX bitcoin ETF, the CBOE is optimistic the ETF will be approved.

In fact, one source online claims there’s a “99% expectation” from the Cboe that the bitcoin ETF will be approved. As we reported earlier this week, the SEC’s denial of the Winklevoss denial was expected, and there’s a “near certainty” that the Cboe VanEck/SolidX bitcoin ETF will be approved.

On June 26, the SEC received an application from Cboe Futures Exchange to launch the world’s first bitcoin ETF. That bitcoin ETF is called the VanEck SolidX Bitcoin Trust.

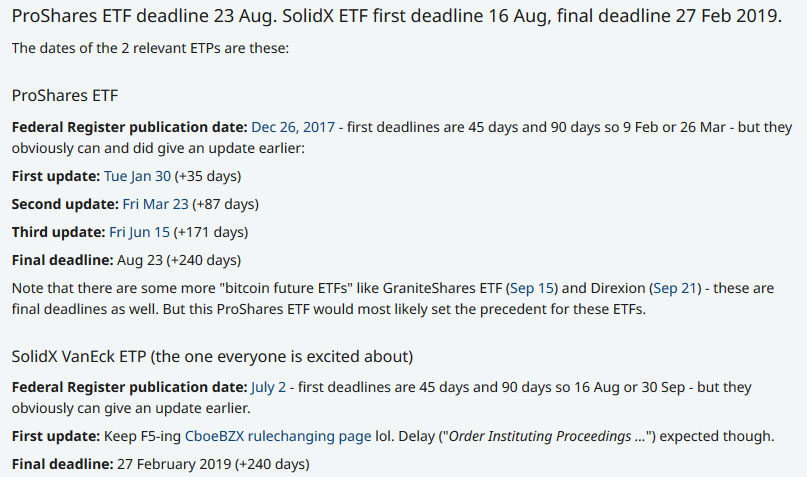

The SEC had until August 10 to approve, deny, or delay the decision on the ETF. On August 7, the SEC released a statement indicating that it was delaying the decision on the bitcoin ETF.

Optimists claimed the delay suggested future approval. Why would the SEC delay the decision on an ETF if it was just planning to deny it? Pessimists, meanwhile, claim the SEC is just doing due diligence before denying the VanEck SolidX bitcoin ETF – just like it has denied every previous bitcoin ETF application.

Last month, the SEC denied the ETF proposed by the Winklevoss twins due to fears of price manipulation in the bitcoin market. There was even speculation as to possible SEC insider trading due to the way in which they rolled out the “delayed not denied” announcement but will be hard to fetch a foundational viewpoint all things considered.

Could things really be different this time around? Will the Cboe VanEck/SolidX bitcoin ETF be the world’s first bitcoin ETF? Will the SEC really approve the investment product?

According to various sources online, the answer to all of these questions is “yes”. The VanEck/SolidX bitcoin ETF stands a very real chance of being approved. The SEC has until September 30 to approve or deny the ETF, and sources claim they’re learning towards approval.

Those sources come from The ICO Journal, which cites “CBOE contacts, Van Eck back channels, and industry vets.” Here’s what The ICO Journal had to say about one source:

“Our most consistent CBOE source responded via text this way (unedited): “Expected and the markets are acting irrationally to the announcement. Every single submission like this has gotten a delay. Again, expected. Still expect approval. 99% expectation. Print it, but as always, don’t use my name. :)””

In other words, the delay was a normal part of the approval process. It doesn’t indicate that the SEC is leaning towards denying the ETF. In fact, it suggests the opposite.

Meanwhile, The ICO media site cited a source at Van Eck who responded via email and echoed the sentiment above, saying:

“Our team expected this delay, almost to the hour, and has been an expectation in our planning process. We won’t say when we expect an approval, but there has been specific speculation that we actually agree with and have incorporated into our timeline. We are in no way surprised by this. Most importantly, we believe our submission is the strongest yet to be put in front of US regulators, and believe that strength will be rewarded.”

Both sources indicate that the VanEck/SolidX bitcoin ETF has the best chance of being approved by the SEC. The first source is particularly illuminating, claiming that the ETF has a “99% expectation” of being approved.

Finally, The crypto journal outlet reached out to a former SEC employee for comment. That employee left the regulatory agency three months, which means he had a front row seat to bitcoin ETF deliberations. He also still speaks with friends at the SEC. Here’s what that source had to say to The ICO Journal:

“The four people I still talk to on the daily at the SEC are basically telling me this ‘it is going to get approved but we are going to make the markets understand that we dug really, really deep i.e. investor protection/transparency’. And that makes sense. The vast majority of the public still has no idea what ‘digital assets’ are or what it means. So when you do an approval like this, and the successive approvals that will follow in this asset class – think of the 3-5 year return number that will be associated with this market? And maybe that is the key to the Van Eck SolidX approval? It is set up as an accredited investor vehicle. That singular element is probably what gives so many of us a firm belief in its approval. And it is a stroke of genius by the Van Eck SolidX group.”

That source illustrates one of the most important points about the VanEck/SolidX bitcoin exchange-traded fund: it’s not catered to retail investors. Instead, the ETF comes with a minimum price of $200,000 per share, which means it will cater exclusively to institutions and other accredited investors. That source describes the decision to cater to accredited investors as “a stroke of genius”. That decision could be the difference between approval and denial.

“It’s A Matter Of When Not If” The Bitcoin ETF Gets ApprovedUltimately, if you believe The ICO Journal’s anonymous sources, then a bitcoin ETF is almost certainly going to get approved in the near future. The VanEck/SolidX bitcoin ETF will be approved because it caters to accredited investors instead of retail investors, and the delay was an expected part of the approval process by everyone involved.

Of course, the markets don’t agree with The ICO Journal’s sources: crypto markets continue to slump in the wake of the SEC’s decision to delay. Bitcoin is approaching its record low for the year, currently sitting at $6287 as we go to press. The approval of the world’s first bitcoin ETF, however, could rapidly swing the market the other way as BitMex CEO says yes to 2018 approval and will send bitcoin to $50,000+.

Remember, there are 9 different Bitcoin ETFs coming down the pipeline that will await their outcome and final decision by the end of September.

While some believe it will be in Q1 of 2019 before we see the first ever SEC Approved Bitcoin ETF decision, many are remaining high on hopium with the opportunity for the barrier to come in 2018.

What are your guys thoughts on a legit, credible CBOE insider revealing there is a 99% chance of near certainty approval that we see the first-ever ground-breaking SEC decision for Bitcoin Exchange-Traded Fund? Stay tuned and know that if this gets approved, right now is the best time to buy bitcoin as the markets could react in one of the fastest growing ways imaginable.

origin »Bitcoin (BTC) на Currencies.ru

|

|