2024-7-24 10:00 |

Leading crypto analyst Willy Woo recently weighed in on the state of Bitcoin, providing commentary on five macro signals influencing how he views the top digital asset.

His analysis, noted for its depth and precision, provides a balanced view with three bullish and bearish indicators that could influence Bitcoin’s trajectory shortly.

What are The Bullish Bitcoin Signals?Willy Woo pointed out one of the most significant bullish indicators is the end of miners’ capitulation. This is a classic indication of an imminent bullish scenario that has worked well in the past.

According to Woo, the Bitcoin hash rate (the computational power used in mining and processing transactions) is surging back.

This resurgence occurred concurrent with new mining hardware, such as M66s and S21 Pros, beginning their operations. These developments allow miners to do more with less, positively impacting BTC price and profit. Woo added:

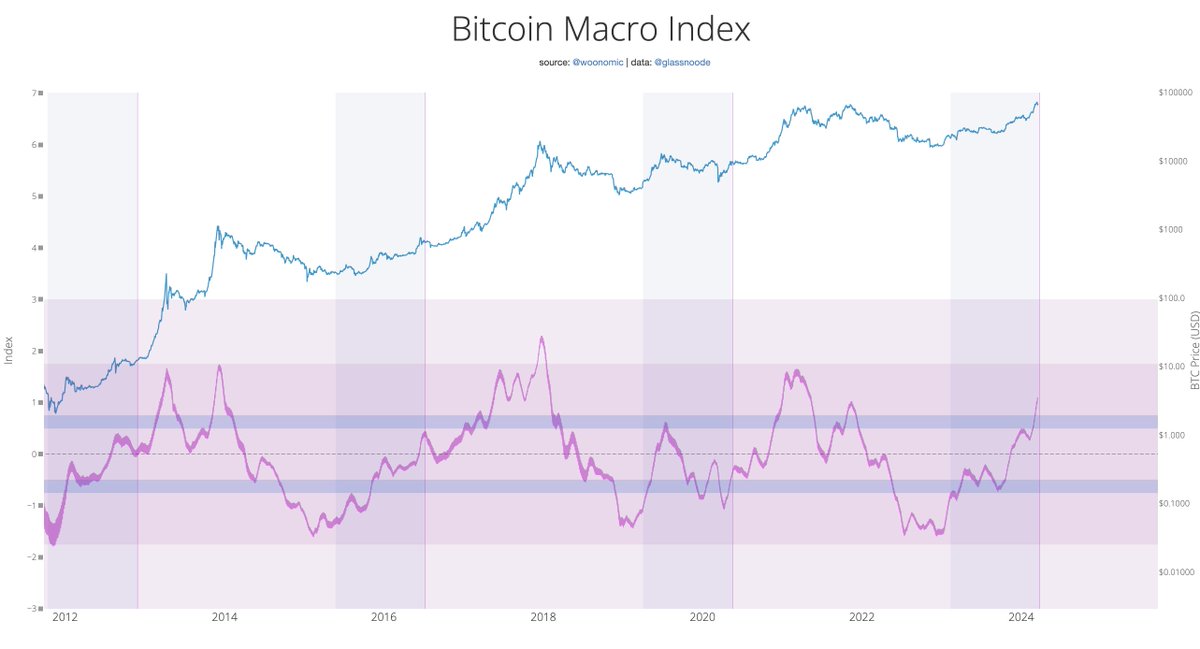

Puell Multiple measures miners relative profit to past revenues. It’s a 1-2 punch macro signal. 1) Macro bottoms happen when profitability is at a minimum 2) A signal bottom happens when BTC halving cuts miner earnings by 50%, leading to the proper bull run. We are at (2). Miners will be making good money from here. Publicly listed miner stocks should breakout. Now is a good time to buy into mining.

Accompanying these trends is the rise in global liquidity, which further underpins market optimism. In times of increased money supply, sectors like Traditional Finance (TradFi) will allocate to risk-on assets such as Bitcoin.

Preliminary signs suggest a breakout in this department, paving the way for larger investment inflows into Bitcoin and other cryptocurrencies. This setup can offer plenty of space for any value appreciation within Bitcoin while attracting investors from more traditional markets to the crypto sphere.

The Bearish SignalsHowever, it’s not all clear skies ahead. Willy Woo also pointed out some pretty chilling bearish signals in his analysis. Of particular note has been a large increase in Bitcoin flowing into spot exchanges – a phenomenon commonly seen before sell-offs.

A particular point of interest is the 50,000 BTC recently transferred to the Kraken exchange from Mt. Gox, which may be part of an imminent dump. Moreover, there is also the launch issue for an Ethereum spot Exchange Traded Fund (ETF).

According to Woo, this event is a potentially bearish development for Bitcoin, as it could temporarily siphon away some of the capital from various Bitcoin spot ETFs into Ethereum.

Regardless, Willy Woo concludes his analysis on an optimistic note. Woo stated:

In summary we have a tug-o-war happening on demand and supply. IMO the bullish factors overpower the bearish factors. In the short term BTC only needs to break 73k in order to light the fuse to short squeeze to 77k, above that it’s nothing holding it down for price discovery.

Featured image created with DALL-E, Chart from TradingView

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|