Analysis / Заголовки новостей

Crypto market incurs technical strength as altcoins begin turning parabolic

The crypto market’s firm uptrend has allowed multiple major altcoins to begin going parabolic, which to many investors is emblematic of the early stages of the massive bull run seen in late 2017. The recent series of rallies seen by both Bitcoin and other major altcoins has allowed the market to break out of a […] The post Crypto market incurs technical strength as altcoins begin turning parabolic appeared first on CryptoSlate. дальше »

2020-1-16 10:58

|

|

How top altcoins trend in coming days could set the tone for the entire crypto market in 2020

Bitcoin has been able to significantly extend its recently incurred upwards momentum, creating a strong upwards tailwind that has allowed nearly all major altcoins in the crypto market to post massive gains over the past couple of days and weeks. дальше »

2020-1-15 09:30

|

|

Binance DEX and co. accounted for only 0.01% of 2019's trading volume

TokenInsight's latest 2019 Cryptocurrency spot exchange industry annual report evaluated the overall trading performance of centralized and decentralized exchanges across the world. According to thThe post Binance DEX and co. дальше »

2020-1-15 02:30

|

|

Bitcoin SV is going parabolic, but some people in the crypto community think it may be an “exit scam”

Controversial Bitcoin Cash hard fork – Bitcoin SV (BSV) – has been caught within a massive uptrend over the past several days, which has allowed its price to go on a parabolic rally that is leading it up towards its all-time highs. дальше »

2020-1-14 10:09

|

|

The Bitcoin Lightning Network is growing, but with some scalability and security flaws

Bitcoin’s Lightning Network is expanding at an exponential rate despite a number of scalability and security flaws in its protocol. Bitcoin’s Lightning Network usage is growing The Lightning Network (LN) is a second layer solution to Bitcoin’s scalability problem. дальше »

2020-1-13 22:00

|

|

3 key fundamentals that will determine Bitcoin’s 2020 trend investors need to observe

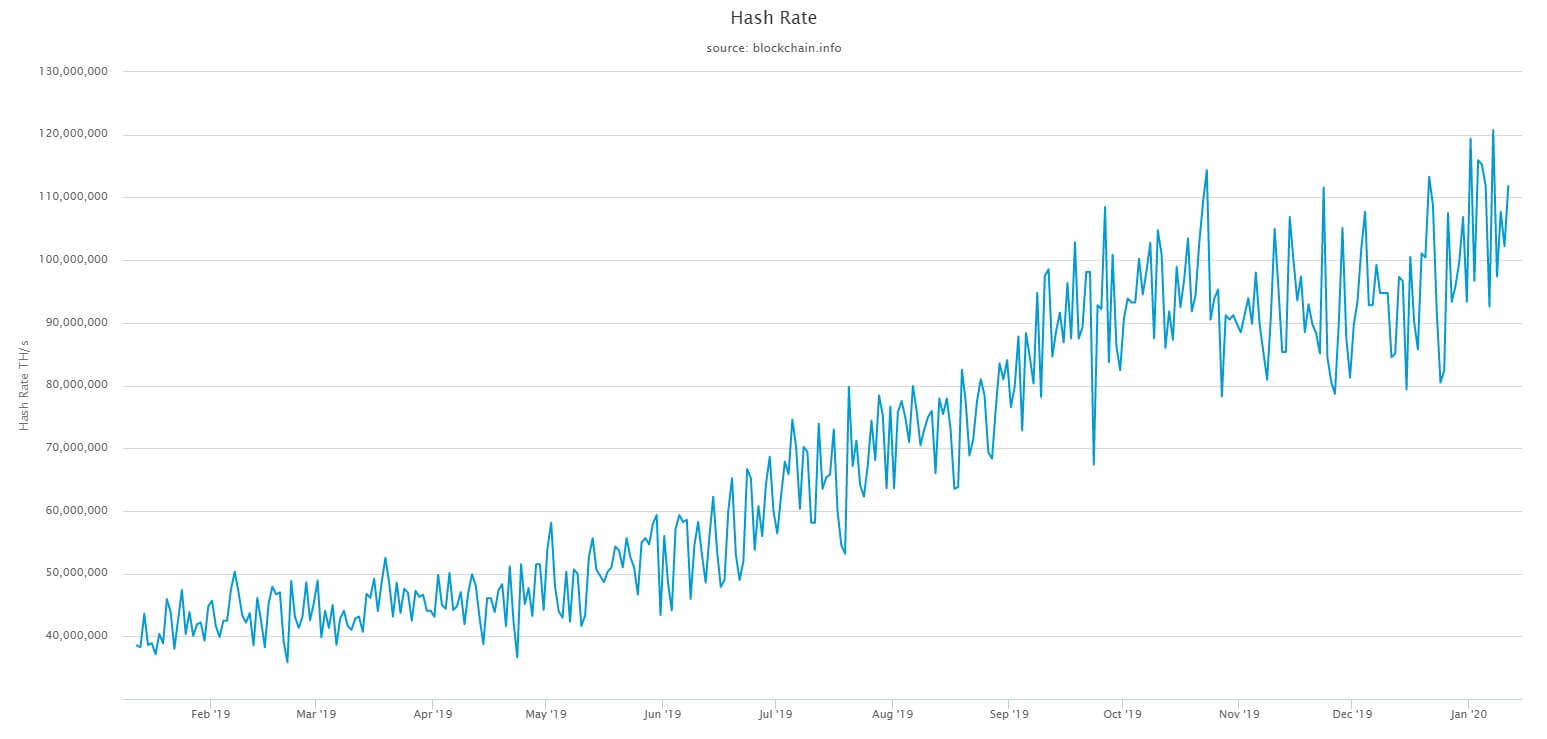

2020 is a crucial year for Bitcoin. The block reward halving, which occurs once every four years, is set to happen this May. Other than the halving, there are three important fundamental factors investors have to consider. дальше »

2020-1-13 00:36

|

|

Bitcoin options trading shows 25% probability of BTC crossing $10k by June 2020

Over the past seven days, Bitcoin's price has been revived after witnessing a lukewarm period in December 2019. Source: Coinstats Since January 4th, BTC's valuation has scaled up to 15 percent,The post Bitcoin options trading shows 25% probability of BTC crossing $10k by June 2020 appeared first on AMBCrypto. дальше »

2020-1-12 20:00

|

|

BTC Futures' high premium rates on CME highlights bullish sentiment

If the idiom 'off to a fresh start' needed an example, Bitcoin will be an ideal candidate at the moment. After starting the year at a price under $6900 on 2nd January, the largest digital asset seeThe post BTC Futures' high premium rates on CME highlights bullish sentiment appeared first on AMBCrypto. дальше »

2020-1-11 16:00

|

|

New evidence suggests that XRP could be deemed a security

A document resurfaced on the internet providing concise evidence that Ripple created XRP and that the firm is selling the token in excess of need for profit. The lawsuit against Ripple On Aug. 5, 2019, a new complaint was filed against Ripple. дальше »

2020-1-11 13:59

|

|

Crypto markets rally as Bitcoin flashes bullish signs; is altseason upon us?

Bitcoin’s uptrend throughout the first ten days of 2020 has allowed most major altcoins to put some distance between their current prices and their recent lows. Many of these altcoins have been underperforming BTC, although this may soon change as the aggregated crypto market begins incurring some major momentum. дальше »

2020-1-11 08:00

|

|

XRP sets itself up for a short-term 5% to 8% bounce

XRP, the third-largest crypto has had its downs more than ups; things have started to change for XRP, but the future looks slightly less gloomy. Especially with a tiny surge on the horizon. 4-Hour ChThe post XRP sets itself up for a short-term 5% to 8% bounce appeared first on AMBCrypto. дальше »

2020-1-10 21:00

|

|

Bitcoin's long-term prospect looks bleak but after a 5% rally

Bitcoin's recent rally was delayed but it arrived nonetheless; the price shot up by ~16% in 3 days to $8,436. However, the rally has stopped and reversed as the retracement continues. This can mean twThe post Bitcoin's long-term prospect looks bleak but after a 5% rally appeared first on AMBCrypto. дальше »

2020-1-10 18:00

|

|

Here’s how to trade like a Bitcoin whale with ‘no less than $100 million’

Alby Ja, a cryptocurrency enthusiast, said to have spoken with a Bitcoin whale who explained how simple it is to manipulate the market with “no less than $100 million. ” Here are his insights on how to trade like a crypto whale. дальше »

2020-1-10 14:12

|

|

XRP could climb above $0.21 again if Bitcoin hikes as well

XRP closed out December 2019 on a low, with the token remaining under $0. 196 following its slumps on 16th and 17th December. It failed to breach the $0. 20 range for the next two weeks as the world's tThe post XRP could climb above $0. дальше »

2020-1-9 18:00

|

|

Why a top executive expects Bitcoin to surge 150% in 2020

Bitcoin (BTC) has had a great start to 2020, rallying 16 percent higher from the $6,800 lows put in last week. Although some say it is too early to tell if the cryptocurrency market is out of a bear phase, a top executive is convinced that Bitcoin will perform extremely well over the next 12 […] The post Why a top executive expects Bitcoin to surge 150% in 2020 appeared first on CryptoSlate. дальше »

2020-1-10 10:30

|

|

From magic internet money to digital gold: has Bitcoin become a safe-haven asset?

Advocates of Bitcoin (BTC) have long claimed that its long-term growth prospects would not necessarily stem from its utility as a currency, but rather from its status as a digital alternative to safe-haven investments like gold. дальше »

2020-1-9 07:30

|

|

Bitcoin off to slow start in 2020 as privacy coins impress

Over the past 3 days, Bitcoin has witnessed a surge of 12.3 percent, a development that took its price valuation above the $8000 mark. However, the first week of January was found to be more bullish fThe post Bitcoin off to slow start in 2020 as privacy coins impress appeared first on AMBCrypto. дальше »

2020-1-9 21:30

|

|

Monero is up 30% over the past week; what are the major factors behind its upsurge?

Monero (XMR), the biggest privacy-focused cryptocurrency by valuation, increased from $44 to $58 in the past seven days by a staggering 30 percent. Behind its abrupt increase in price are an all-time high hashrate, Coinbase CEO Brian Armstrong’s optimism towards anonymous cryptocurrencies, and Monero’s strong technology that allows for real anonymity. дальше »

2020-1-8 15:27

|

|

What Quantum Finance Means for Bitcoin

Quantum computing could allow banks to more accurately quantify their risk, opening additional opportunities to invest in Bitcoin. Some of the biggest names in banking have confirmed they’re targeting research investment into the nascent field of quantum finance. дальше »

2020-1-8 05:37

|

|

Charles Hoskinson says this will be the decade of Cardano

Charles Hoskinson, the CEO of IOHK, believes that this will be the decade of Cardano. With a successful incentivized testnet launch and over 500 stake pools already launched, Hoskinson said that Cardano was ramping up its efforts to commercialize the tech they’ve been developing for the past three years. дальше »

2020-1-7 17:00

|

|

XRP Could Retrace Before Continuing the Uptrend

XRP surged over 15 percent in the last 36 hours following a significant consolidation phase that began in mid-December 2019. Now, this cryptocurrency could be signaling a retracement before the continuation of an uptrend. дальше »

2020-1-7 14:49

|

|

Bitcoin the Answer to Monetary Debasement?

As central bankers around the world get set for a prolonged period of monetary debasement, the 99% could look to Bitcoin for protection. A Decade of Monetary Debasement Looms The European Central Bank issued guidance at the end of last year that it would keep “the key ECB interest rates to remain at their present […] The post Bitcoin the Answer to Monetary Debasement? appeared first on Crypto Briefing. дальше »

2020-1-7 09:23

|

|

Bitcoin could climb to $8500 in less than a week

Since 10 December, Bitcoin had been struggling to make gains, mostly moving between $7100 and $7500 and dipping as low as $6400 in the middle. Bitcoiners rejoiced today after the original cryptocurrenThe post Bitcoin could climb to $8500 in less than a week appeared first on AMBCrypto. дальше »

2020-1-6 21:00

|

|

Low Bitcoin volumes and volatility signal uncertainty behind BTC’s latest rally

Despite a strong rebound in both price and sentiment, the Bitcoin market is grappling with the lowest real trade volumes seen since April last year, as reported by Forbes. Bitcoin posted a convincing bull rally Friday morning, seemingly ending a weeks-long consolidation that had taken BTC down to $6,900. дальше »

2020-1-6 14:06

|

|

The Crypto Exchange Paradigm Shift: Interest, Banking, Taxes

In their bid to source new customers, crypto exchanges will have to reinvent themselves as more than just trading venues. Hungry for Yield: Giving Users What They Want Decentralized finance (DeFi) has championed a new category of investment in the cryptocurrency industry, as the search for yield in crypto native money markets intensifies. дальше »

2020-1-6 00:06

|

|

Litecoin's bearish divergence predicts a ~4% drop soon

2020 is off to a great start, with cryptocurrencies recording largely positive gains over the last few days. Since 3 January, the total market cap of cryptocurrencies has risen by 7% from $185 billionThe post Litecoin's bearish divergence predicts a ~4% drop soon appeared first on AMBCrypto. дальше »

2020-1-5 17:30

|

|

XRP eyes 10% - 18% surge next week after 7% drop

The price of XRP has been under duress for a long time now; dipping to drastic depths by the end of 2019. However, there seems to be some hope on the horizon as the price eyes an 18% surge to $0. дальше »

2020-1-5 17:00

|

|

Report: Bitcoin and crypto adoption surging despite bear market

According to the latest Coin Metrics report, 2019 has been a record-breaking year when it comes to crypto adoption. Addresses with a balance of at least $10 increased for most of the major cryptocurrencies, as did their prices, showing that the retail market was thriving despite pessimistic predictions. дальше »

2020-1-4 15:52

|

|

Bitcoin volatility significantly dictated by BTC-ETH price in 2019

Bitcoin and Ethereum recorded a lucrative first half in 2019, with many in the crypto-community attributing the performance of the market to the performance of these cryptos. The second half of 201The post Bitcoin volatility significantly dictated by BTC-ETH price in 2019 appeared first on AMBCrypto. дальше »

2020-1-3 20:30

|

|

Bitcoin's pump, millions in liquidations; what is BTC's destination now?

Bitcoin's pump on 3 January came as a surprise; the pump contributed to BTC shooting from $6,853 to $7,369 in a span of 8 hours. During times like these, there are bound to be many liquidations, many The post Bitcoin's pump, millions in liquidations; what is BTC's destination now? appeared first on AMBCrypto. дальше »

2020-1-3 19:30

|

|

XRP could pump to $0.209 in the short-term; long-term less rosy

Since 16 December, XRP has been hovering around the $0. 19 mark, with intermittent dips under $0. 185 and rises around $0. 198. With a value of around $0. 191 at the time of writing, XRP could be in for aThe post XRP could pump to $0. дальше »

2020-1-2 17:30

|

|

Bitcoin was the world’s top-performing commodity in 2019 after a year of healthy growth

Bitcoin has wound up as 2019’s top-performing commodity despite its exclusion from the majority of commodities market wrap-up reports. With an annual increase of 90 percent, the number one cryptocurrency by market capitalization beat by a significant margin Palladium (+57 percent), U. дальше »

2020-1-2 07:07

|

|

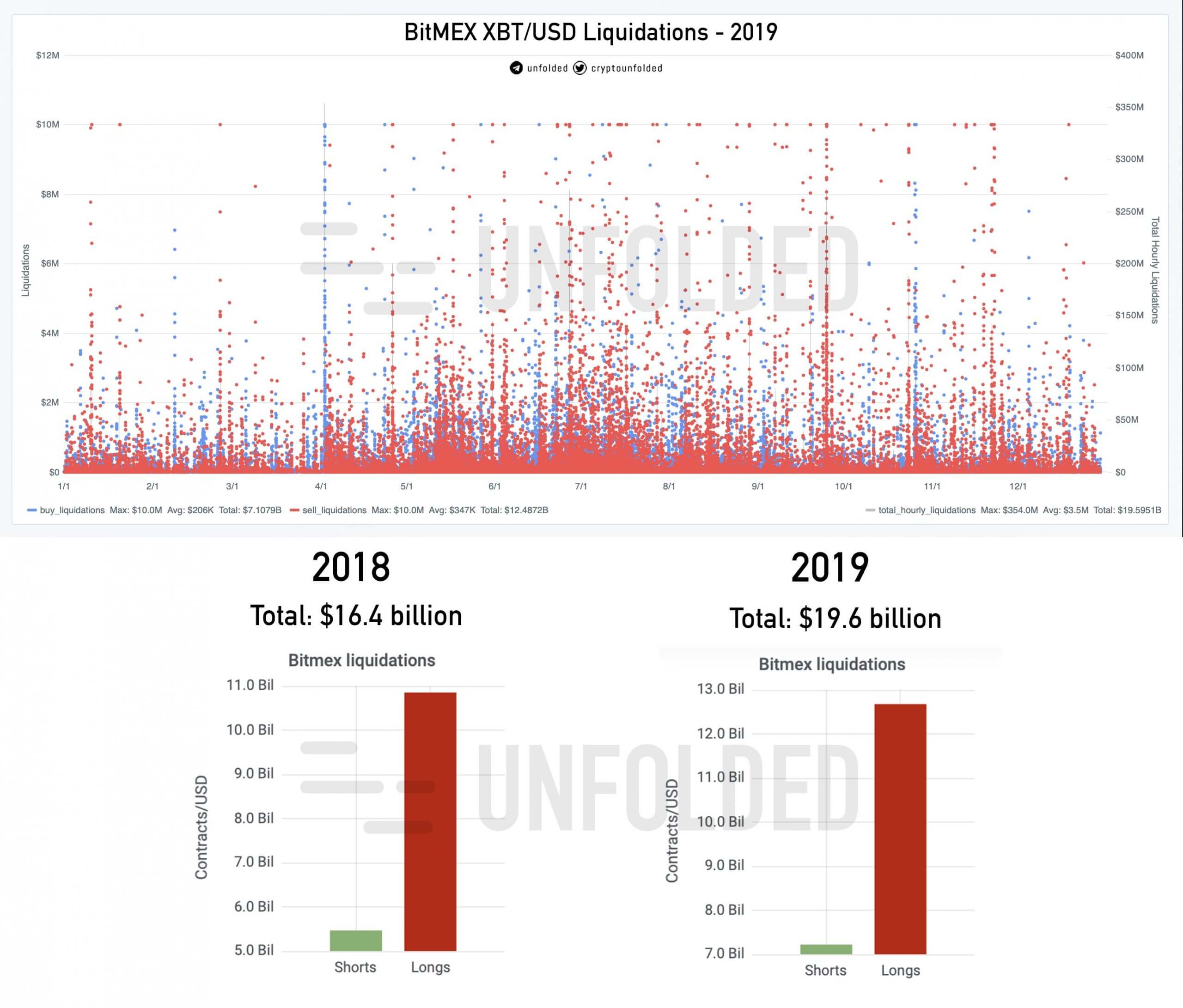

$13 billion in Bitcoin longs were liquidated in 2019; what does it mean for 2020?

For a second consecutive year, long liquidations dwarfed that of shorts by more than two-fold. In 2018, long liquidations reached $11 billion by the year’s end while short liquidations hovered at $5 billion. дальше »

2020-1-2 05:25

|

|

Bitcoin's double bottom close to failing; sub-$6,000 levels on the horizon

Bitcoin's price has been under the $7,600 range for over a month now. Even with 3 major retests of the resistance at $7,660, Bitcoin's price hasn't managed to breach it. With the formation of a doubleThe post Bitcoin's double bottom close to failing; sub-$6,000 levels on the horizon appeared first on AMBCrypto. дальше »

2020-1-1 09:30

|

|

Bitcoin’s $132bn market cap puts it above Turkey in terms of M1 money supply

Bitcoin’s $132 billion market cap might be a far cry from its 2017 all-time high, but it doesn’t mean it’s not playing in the big leagues. According to data from the CIA, Bitcoin’s current market cap makes it the 34th largest economy in terms of M1 money supply, just below the United Arab Emirates (UAE) […] The post Bitcoin’s $132bn market cap puts it above Turkey in terms of M1 money supply appeared first on CryptoSlate. дальше »

2020-1-1 00:33

|

|

XRP could rise to $0.216 or drop to $0.181 by mid-January

Having maintained its value above $0. 25 for most of 2019, XRP’s dip below the mark gave birth to alarm bells throughout the community, a community that had already been in a frenzy before the ~17. дальше »

2019-12-31 17:30

|

|

Ethereum to suffer more before it spikes to $170 - $180

Ethereum has been free-falling for quite a while now and yet, the bottom doesn't seem to be in yet. However, a largely bullish pattern has formed, with ETH bouncing in it and starting its mini-rally oThe post Ethereum to suffer more before it spikes to $170 - $180 appeared first on AMBCrypto. дальше »

2019-12-31 01:30

|

|

Bitcoin's LN may require higher transaction fees for economic viability

Bitcoin's Lightning Network has received a lot of flak over the years, but a majority of its criticism is due to lack of clarity. Although the scaling solution recently received support from major The post Bitcoin's LN may require higher transaction fees for economic viability appeared first on AMBCrypto. дальше »

2019-12-29 21:35

|

|

USDT-margined futures limits volatility risk to a certain degree: OKEx exec

The growth of digital assets' derivatives market underlined one of the key developments in 2019. Institutional involvement soared significantly as the likes of Fidelity and ICE's Bakkt announced thThe post USDT-margined futures limits volatility risk to a certain degree: OKEx exec appeared first on AMBCrypto. дальше »

2019-12-28 20:30

|

|

Bitcoin sideways movement could breakout to $8500 in January

Since November 20, Bitcoin has been consolidating between the $7000 and $7500 levels, with intermittent pumps to $7800 and dips under $6500. Despite relatively poor performance over the last month, thThe post Bitcoin sideways movement could breakout to $8500 in January appeared first on AMBCrypto. дальше »

2019-12-28 19:30

|

|

Bitcoin's Howey Test result refined SEC's ICO regulation protocols

Cryptocurrencies introduced a whole new financial industry but a string of debates trailed immediately behind it. A major discussion that is hotly contested across various assets is whether an asseThe post Bitcoin's Howey Test result refined SEC's ICO regulation protocols appeared first on AMBCrypto. дальше »

2019-12-28 01:30

|

|

Ethereum's low network-value-to-token-value ratio 'indicates lack of growth'

Ethereum's network registered high levels of activity on its blockchain in 2019 and a majority of it was down to the increasing interest of Decentralized Finance ["DeFi"]. The application of DeFi haThe post Ethereum's low network-value-to-token-value ratio 'indicates lack of growth' appeared first on AMBCrypto. дальше »

2019-12-23 13:30

|

|

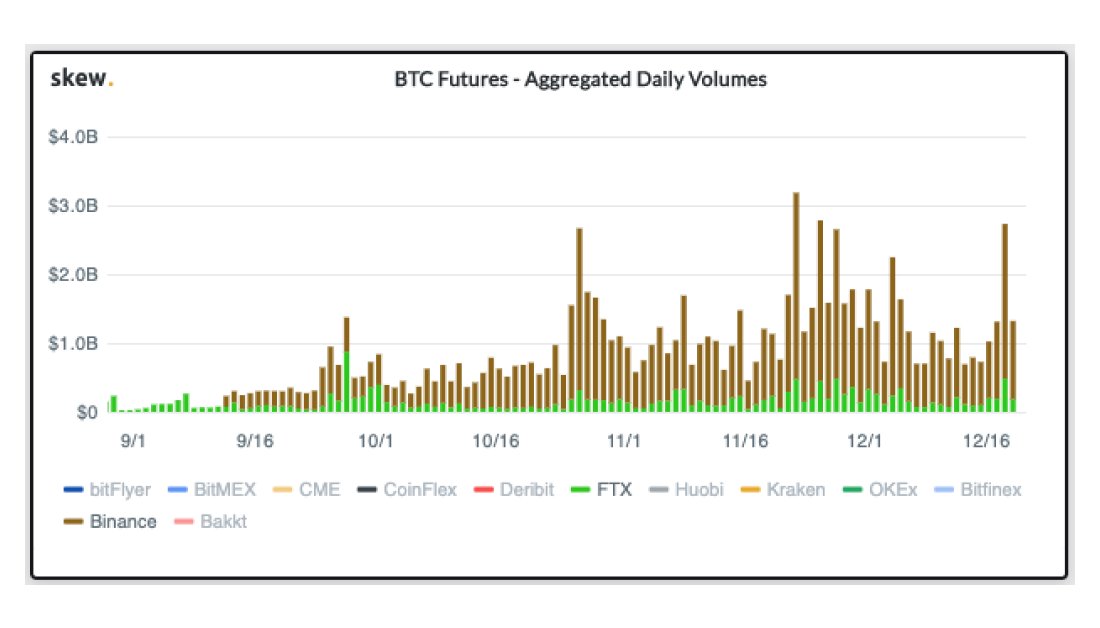

Data shows $1 billion of trading volume in Binance and FTX combined

Binance, one of the largest cryptocurrency exchanges in the world, made a strategic investment in the crypto derivatives trading platform FTX. The firms have combined trading volumes in their Bitcoin futures markets that surpass $1 billion on a regular basis, according to Skew. дальше »

2019-12-21 23:59

|

|

Bitcoin may reach $250k by 2023: Tim Draper

Optimism is currently a word forgotten from Bitcoin's dictionary! Since November, the largest digital asset has faced substantial volatility in the market, and it is fair to say, the altcoin marketThe post Bitcoin may reach $250k by 2023: Tim Draper appeared first on AMBCrypto. дальше »

2019-12-21 20:30

|

|

Bitcoin 'to scale between $10k-$100k in 2020'; but jury split on halving effect

As 2019 nears its end, crypto proponents in the digital asset industry are already vocal about their speculation on Bitcoin's price in 2020. Over the past twelve months, Bitcoin registered a year-tThe post Bitcoin 'to scale between $10k-$100k in 2020'; but jury split on halving effect appeared first on AMBCrypto. дальше »

2019-12-21 19:00

|

|

Futures data suggests latest Bitcoin rally is just short-covering, most Bakkt contracts aren’t being settled

A massive drop in open interest on the CME and Bakkt Bitcoin futures contracts indicates short-covering has fueled BTC’s latest rally, likely egged on by the expiry of Bakkt’s December contract. On Tuesday, open interest rocketed more than 1,000 percent on the cash-settled CME contract for December, the day after Bakkt hit an all-time-high for […] The post Futures data suggests latest Bitcoin rally is just short-covering, most Bakkt contracts aren’t being settled appeared first on CryptoSlate. дальше »

2019-12-19 15:00

|

|

Why Bitcoin: Federal Reserve to print billions to keep economy afloat

While Bitcoin is an asset independent of central banks, of banks, and of Wall Street, the cryptocurrency’s strength and underlying value proposition have become increasingly dependent on events in the traditional financial world as this fledgling industry has grown. дальше »

2019-12-16 07:02

|

|

Bitcoin longs hit record high on Bitfinex, long squeeze incoming?

The number of Bitcoin long contracts on margin trading platform Bitfinex has exploded in December to reach the highest level in years, far exceeding the levels of BTC’s late 2017 bull market. дальше »

2019-12-14 23:07

|

|

Cardano will be joining Microsoft, LinkedIn, and Norwegian Airlines as McCann’s client

The Cardano Foundation announced that it has appointed McCann Dublin, the Ireland-based hand of the global advertising agency, as its brand strategy and design agency. According to the company’s announcement, McCann will be tasked with realigning the Cardano brand with the company’s mission. дальше »

2019-12-14 21:45

|

|

The European Central Bank is evaluating the development of a stablecoin

The president of the European Central Bank (ECB), Christine Lagarde, pledged to meet the growing demand for stablecoins by getting “ahead of the curve” in the rapidly evolving economic environment. дальше »

2019-12-14 16:10

|

|