2020-2-25 17:10 |

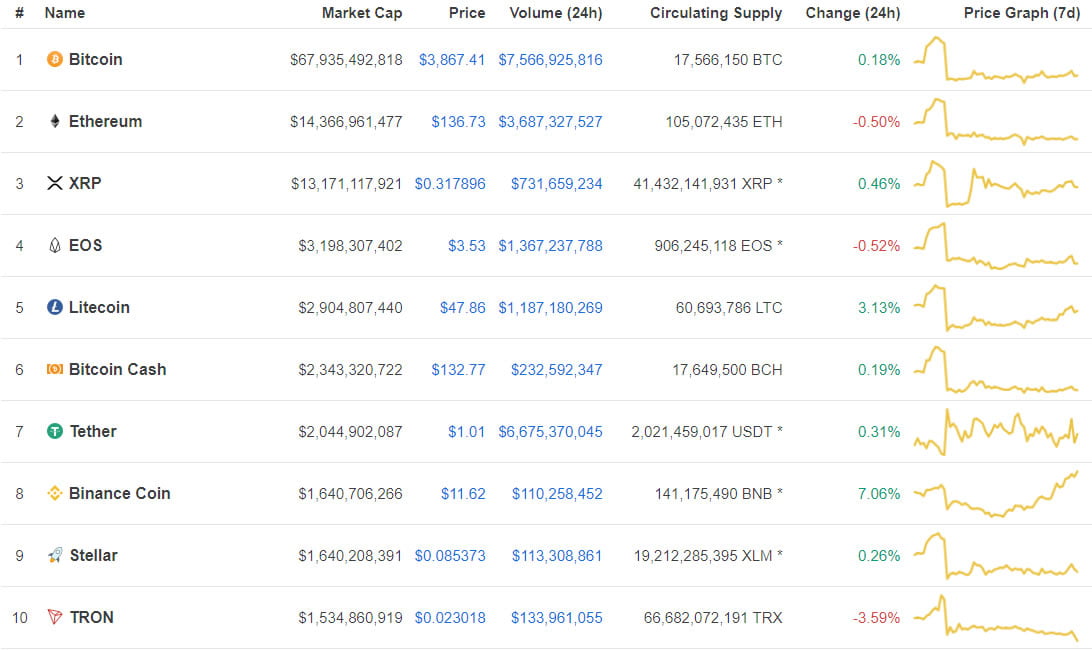

The low volatility in the market pushed the top three altcoins by market capitalization, Ether, XRP, and Litecoin, into a stagnant phase. The following technical analysis evaluates whether these cryptocurrencies could soon resume their bullish trends.

Ethereum Stagnant, Consolidates in Narrow RangeEthereum has enjoyed a bull rally that has seen its price skyrocket nearly 130% so far this year. The significant uptrend, however, appears to have reached exhaustion on Feb. 15. Since then, Ether entered a consolidation phase without a clear indication of where it is heading next.

The low levels of volatility seen over the past week allowed the Bollinger bands on ETH’s 12-hour chart to squeeze. Squeezes are usually followed by periods of high volatility. The longer the squeeze, the higher the probability of a strong breakout.

ETH/USD by TradingViewDue to the inability to determine in which direction ETH’s trend will result, the area between the lower and upper Bollinger band is a reasonable no-trade zone. This trading range is defined by the $249 support level and the $285 resistance level.

Breaking below or above this zone could be key to determine whether Ether is bound for a steeper decline or the continuation of the bullish trend.

ETH/USD by TradingViewAn increase in the selling pressure behind Ethereum that allows it to move below the $249 support level, could trigger a sell-off among investors. ETH could then plummet to the next support levels that are given by the 61.8%, 50%, and 38.2% Fibonacci retracement levels.

These support barriers sit at $222, $202, and $182, respectively.

ETH/USD by TradingViewNevertheless, if the bulls are able to push the price of Ether above the $285 resistance level, investors would likely enter into a FOMO (fear-of-missing-out) stage sending it to new yearly highs.

On its way up, Ethereum could face significant resistance around $334, $358, and $393.

XRP on the Verge of a Major MoveThe price of Ripple’s XRP has been stagnant within an ascending parallel channel since early December 2019.

Since then, each time this cryptocurrency plunges to the lower boundary of the channel, it goes up to hit the upper boundary, and from this point, it drops again. These are the primary characteristics of a channel.

Now that XRP appears to have moved below the middle line of the channel, it could be heading to the lower boundary. If this technical pattern continues to hold, a bounce back to the middle or the upper boundary of the channel can be expected. This move has been repeated for the past three months.

XRP/USD by TradingViewNevertheless, Peter Brandt, a 45-years trading veteran, argues that a head-and-shoulders pattern could be developing on XRP’s 1-day chart. Brandt believes that a spike in the selling pressure behind this crypto could trigger a breakout very soon.

If validated, a daily candlestick close below the neckline at $0.268 could trigger a 23% correction.

“If this H&S top plays out,” said Brandt, “[then the] target would be .2071.”

XRP/USD by Peter BrandtThe ambiguity that XRP is currently presenting suggests that in the event of a sell-off, the lower boundary of the ascending parallel channel could be key to its trend.

Moving past this support level would likely validate Brandt’s bearish outlook while bouncing off from it could set the stage for higher highs.

Litecoin Continues Trending UpOn Jan. 5, Litecoin was able to move above its 200-four-hour exponential moving average (EMA) turning it into support. Since then, this EMA has contained the price of LTC from a further correction on the 4-hour chart serving as a rebound zone and catapulting this crypto to higher highs on several occasions.

Following the recent peak around $84, Litecoin plunged over 22% and its 200-four-hour EMA was able to reject the bearish momentum once again. If this support level continues to work as it has done in the past, then LTC could be about to reach a new yearly high.

LTC/USD by TradingViewAdding credence to the bullish outlook, an inverse head-and-shoulders pattern appears to be developing within the same time frame. This technical formation is considered to be one of the most reliable trend reversal patterns by some of the most prominent analysts in the space.

Litecoin seems to be creating the right shoulder of the pattern. To do so, LTC needs to drop to the support area between $68 and $71 and surge back to the neckline at $80.5 with enough volume behind it. Breaking above this important resistance cluster could trigger an increase in demand that pushes the price of this cryptocurrency up over 18% to $95.5.

This target is determined by measuring the distance between the head and the neckline and adding that distance down from the breakout point.

LTC/USD by TradingViewIt is worth noting that the 200-four-hour EMA poses a lot of significance to Litecoin’s uptrend. Thus, a candlestick close below this support level could jeopardize the bullish outlook previously mentioned.

A sudden increase in the amount of sell order behind LTC that pushes its price below its 200-four-hour EMA and the 38.2% Fibonnaci retracement level would likely have the strength to trigger a significant correction.

If this happens, Litecoin could find support on its way down around the 50%, 61.8%, or 78.6% Fibonacci retracement level. These support zones sit at $60, $54, and $46, respectively.

LTC/USD by TradingViewStagnant Markets and Moving ForwardOver $127 billion has flooded the cryptocurrency market since the beginning of 2020. The massive inflow of capital allowed many digital assets including Ether, XRP, and Litecoin to post significant gains.

Due to the exponential upswing, it seems like now investors are worried about the threat of a steep correction.

In fact, the Crypto Fear and Greed Index (CFGI) is currently sensing high levels of fear among market participants. This fundamental indicator reached a value of 46, which represents fear.

Fear, however, is usually perceived as a positive sign. The last time the CFGI was this low the total crypto market cap surged 37%. Now, traders will simply have to wait out this stagnant period before determining if a similar scenario could be taking place.

The post Ethereum, XRP, and Litecoin Stagnant, Investors Fear Steeper Decline appeared first on Crypto Briefing.

Similar to Notcoin - Blum - Airdrops In 2024

Ripple (XRP) на Currencies.ru

|

|