2021-2-8 09:40 |

On Feb. 5, one of decentralized finance’s largest and most prominent platforms suffered a flash loan attack and the loss of millions of dollars from one of its liquidity pools. The incident shows that not even the big players are safe, and Yearn is now advising users to get insured.

Yearn Finance was the latest to be exploited by a flash loan arbitrage attack which effectively gamed the system as no code was hacked. The incident was the latest in a long line of similar exploits that plagued the DeFi sector in 2020.

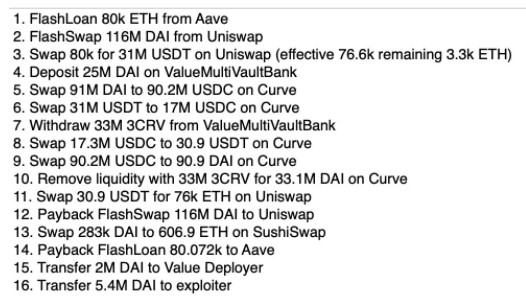

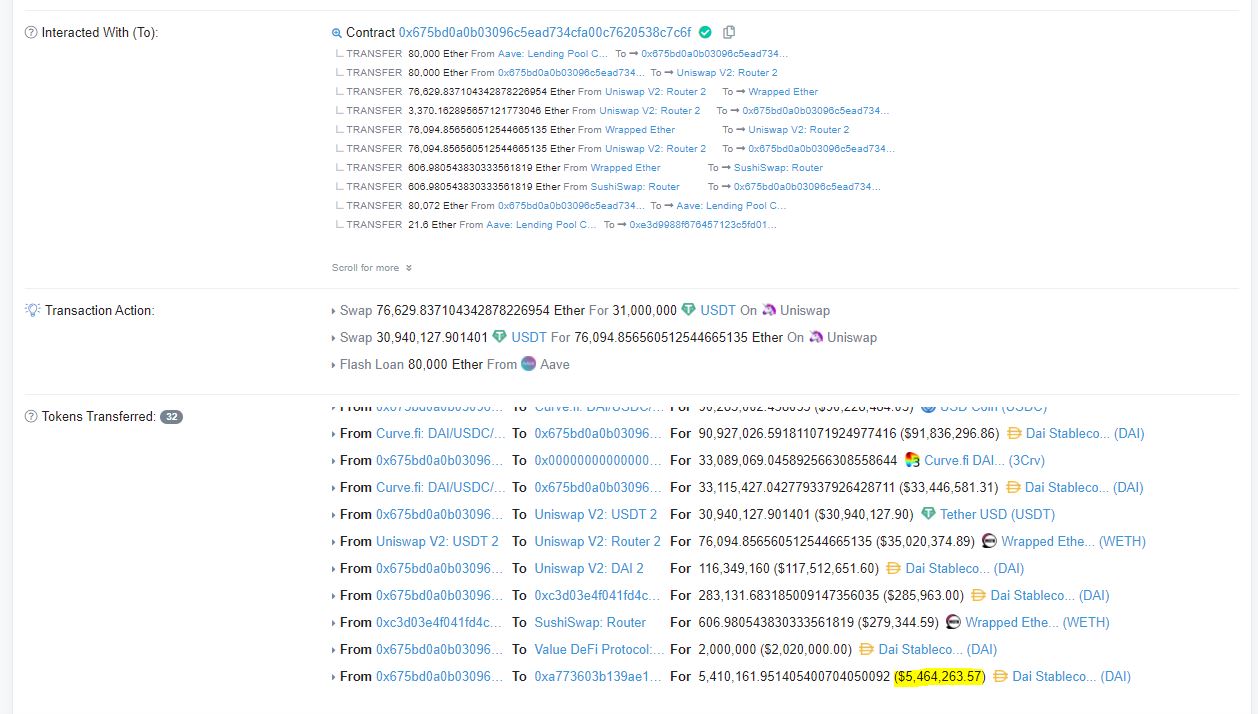

The Rekt Blog broke down the incident in its usual post mortem fashion confirming that the vault was attacked using nine flash loans.

In total, $11 million was lost from the vault — $2.7 million of which went to the attacker, $3.5 million went to Curve liquidity providers, $3.5 million went to Curve stakers, and $1.4 million was paid in Aave v2 fees.

It pointed out that even the largest platforms in the industry are not too big to fall victim, adding;

“Falling victim to an arbitrageur must be humiliating for the team who were once seen as unbeatable. […] This attack went straight to the heart of one of the biggest DeFi conglomerates, shaking the foundations of what was once seen as an impenetrable fortress.”

Get Insured!Tether has frozen 1.7 million USDT that was stolen in the attack and could burn them, minting more to reimburse losses. This would then make it the same as a central bank, the blog post pointed out.

The response from Yearn Finance was a little less constructive for those that lost funds. It stated that it was evaluating options to make the exploited yDAI vault whole by creating a Maker CDP (collateralized debt position) with YFI.

However, it asserted that buying insurance from one of its partners would be a better option;

“In general, investing in Yearn is at your own risk. If you wish to protect yourself from exploits of external protocols in the future, please consider purchasing insurance for your deposits from Cover or Nexus mutual.”

Yearn is evaluating options to make the exploited yDAI vault whole. The current path involves creating a Maker CDP with YFI and drawing the deficit, which will be repaid with protocol fees. To prevent realized loss, please refrain from withdrawing until the remedy is in place.

— yearn.finance (@iearnfinance) February 7, 2021Protocol founder Andre Cronje reinforced this with a tweet stating that those with insurance would be able to claim reimbursement, however, this is of little consolation to those that were not covered.

https://t.co/f4iX58JDGj

With the reimbursement plan; if you had @NexusMutual insurance & @COVERProtocol cover, you would be reimbursed, and able to claim Nexus and Cover payouts

New version of Cover will be opt-out as part of all vaults, paid for out of yield. No upfront costs https://t.co/uUj7nf4YGA

At the time of press, YFI was trading at $31,300. It has gained 37% since the beginning of 2021 but has not been able to close in on its 2020 all-time high of $44,000.

Meanwhile, tokens from other DeFi protocols such as Aave and Uniswap have been on fire. Both have reached new all-time highs over the past week.

The post Yearn Finance Pushes DeFi Insurance Following Flash Loan Attack appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Flash (FLASH) на Currencies.ru

|

|