2019-1-10 10:43 |

XRP army is one livid crew, they get easily triggered by XRP critical articles. This one is not XRP hate, rather a highlight of little discussed velocity problem that XRP token will face in hypothetical mass adoption scenario.

As Kyle Samani of Multicoin Capital explains it in this seminal piece, token velocity is often overlooked in crypto sector. Basically, all token pitches include a line that goes something like this: “There is a fixed supply of tokens. As demand for the token increases, so must the price.”

This logic fails to take into account the velocity problem.

XRP will be used to pay network fees in the xRapid Ripple Protocol implementation, and can also be used as a bridge currency between institutions. As such, XRP will change hands very fast. Buyers won’t hold the tokens for more than a few minutes at a time. There’s simply no incentive to hold them and incur price risk relative to the dollar.

Here is how token velocity will work in XRP case.

The velocity of a token is a measure of the turn around time between successive uses of the coin/token. If a payment takes 3 seconds, then the daily velocity of the token can reach 24*60*60/3 = 28800 – this in turn means that ‘in principle’ each XRP can be reused 28800 times per day.

In practice we believe that an xRapid transaction is actually holding xrp for 1-2 minutes (lets say 60s for simplicity). That makes the velocity 1440.

The lower velocity should lead to a higher price. When demand on the market (xRapid traffic flow) is high, there will not be enough xrp available if many are locked up or on the wrong exchange. High velocity = lower price. Lower velocity = high price (for xRapid transactions). Lack of availability on an exchange will lead to higher prices (liquidity curves). Source

At 60 secs each XRP is used 1,440 times per day ( 60 minutes X 24 hours ). Lets assume that XRP is at the price of $1….

So to use up 1 billion XRPs on a permanent rolling basis, you would need a throughput of $1.44 trillion per day on any given exchange/corridor. (1,440 X 1 billion)

At a price of XRP = $10, the volume exchanged would need to be $14.4 trillion. The whole SWIFT network only has a daily volume of $5 trillion per day.

Lets assume that in 5 years time all the escrow has been released and investors/speculators hold half of all XRP, that leaves 50 billion XRP to be used as transfer of exchange. This means a huge volume of XRP usage would be needed to use up all the XRP and therefore drive up the price of XRP. Source

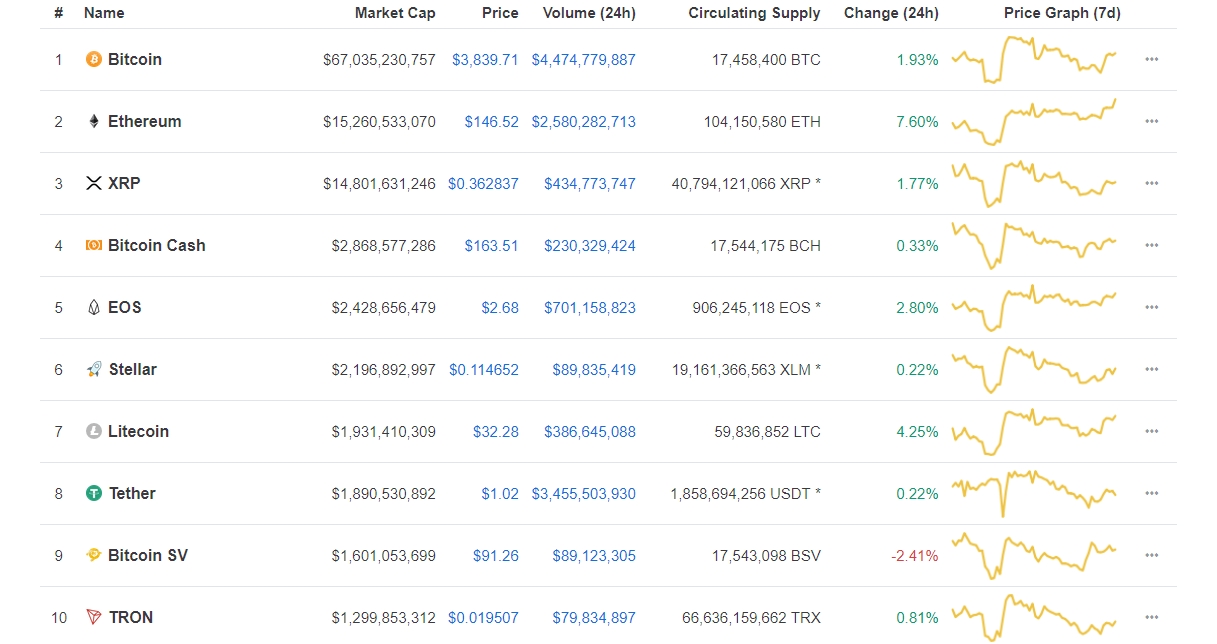

The above calculations are quite disheartening for the delusional XRP believers who think XRP can reach some unrealistic heights like $5, $10 or even $589 as one popular, unhinged XRP holder predicted on Twitter. XRP token can’t accrue value even if Ripple protocol indeed becomes what the most enthusiastic supporters hope it become – world’s main network for financial transfers.

Since Ripple holds 55 billion of XRP tokens, most of the new entrants into the RippleNet will purchase their XRP from Ripple in OTC markets that do not influence the market price of XRP. What is even worse for XRP holders is that the token might even lose value as those institutions will offload their XRP once they stop needing it for their short-term use.

The post XRP’s token velocity problem: Who will benefit from the potential increased network usage, holders or Ripple? appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|