2018-11-16 23:06 |

The world of cryptocurrencies talks about Ripple all the time, which is easily noticed even by newcomers. However, it takes quite a bit of knowledge about Ripple in order to determine if the topic of discussion revolves around the coin XRP, the company Ripple Labs, or the Ripple Protocol itself.

Those familiar with all three can usually understand what others are talking about from context alone, which is why it is important to make a clear difference between these three things. Each of them has a role in the Ripple ecosystem, and in order to understand this, we need to discuss what that role is.

What Is The Ripple Protocol?Ripple Protocol is an inter-bank settlement protocol that was created for providing faster international payments than what traditional systems can offer. It includes different currencies and asset classes, which has made it popular with banks and financial institutions around the world.

So far, banking systems required one of two things in order to send money between different banks. The first one was a so-called “IOU”, which one bank sends to another. Both banks will make a record of a transaction in their own books, and recipients can immediately access the money. Another solution is for the first bank to have its own account with the second one, and to make a deposit to that other bank.

The IOU system allows almost instant transfer of money between the banks, but in order for it to exist, there needs to be a certain level of trust between the banks. This is usually not the case when it comes to banks that exist in different countries, and so settling each transaction needs to be done before the money becomes available. This is why cross-border payments often take days to be completed.

This is where Ripple Protocol comes in to act as a middleman. By using a decentralized public ledger, it allows inter-bank transfers to go through, and complete transactions in an instant. It is no longer a problem if banks operate in different countries, and by using Ripple, they can easily send money to one another.

There are several ways to do this. One bank can either exchange one fiat currency to XRP, send it to another country, and exchange it to another preferred fiat currency, or the two parties can agree on another digital currency, such as Bitcoin. Finally, there is also a possibility of XRP ledger routing transactions through one or more different parties so that a swap between two different fiat currencies can be done and delivered to the receiving bank.

All transactions are approved by Ripple consensus protocol, which is run by various servers that act as validator nodes.

What Is Ripple Labs?Ripple Labs is a software company headquartered in California. They are the ones who created previously discussed Ripple Protocol. The company was founded back in 2012 by Jedd McCaleb and Chris Larsen, and it was called Opencoin at the time.

Three years later, in 2015, it changed the name to Ripple Labs, which is the name it uses to this day. In 2018, it managed to raise over $96 million in funding, and it is known that multiple large investors such as Andreeson Horowitz, Standard Chartered, Google Ventures, and Accenture have supported it.

The company was often criticized in the past for being an operator of a large number of validator nodes within the Ripple network. Many believe that this allows them a significant amount of control over Ripple Protocol and that this prevents the coin, XRP, from being truly decentralized.

What Is XRP?Finally, there is XRP, which is Ripple network's native cryptocurrency. While it is used for charging transaction fees, it should be noted that this is not the only coin that can be used for international payments. As mentioned earlier, other currencies, such as Bitcoin, can be used as well, but this also includes fiat currencies.

XRP is a coin that has a total supply of 100 billion units, half of which are currently held by Ripple Labs. The company's own tokens are held in escrow, and they release one billion tokens per month for their own use. Since this is the only way for XRP to enter the circulation, there is no mining involved.

The coins leave circulation by being used for network fees, which leads to their burning. In other words, the more the Ripple network is used, the more coins are being burned, and less of them remains in circulation.

The coin has reached its highest price to date on January 4th, 2018. Only four days later, on January 8th, XRP also reached its highest market cap, at $130.3 billion.

Until April 2017, XRP's value was less than a cent, which suddenly changed at this point, when the coin surged to reach the price of $0.35 in May 2017.

Its next surge came in December 2017, when the coin's value skyrocketed again, all the way up to $3.84. After the market crash in January 2018, XRP lost a lot of its value, and its next big spike came in September 2018, when the price doubled, and the coin managed to overtake Ethereum as the second largest coin by market cap multiple times.

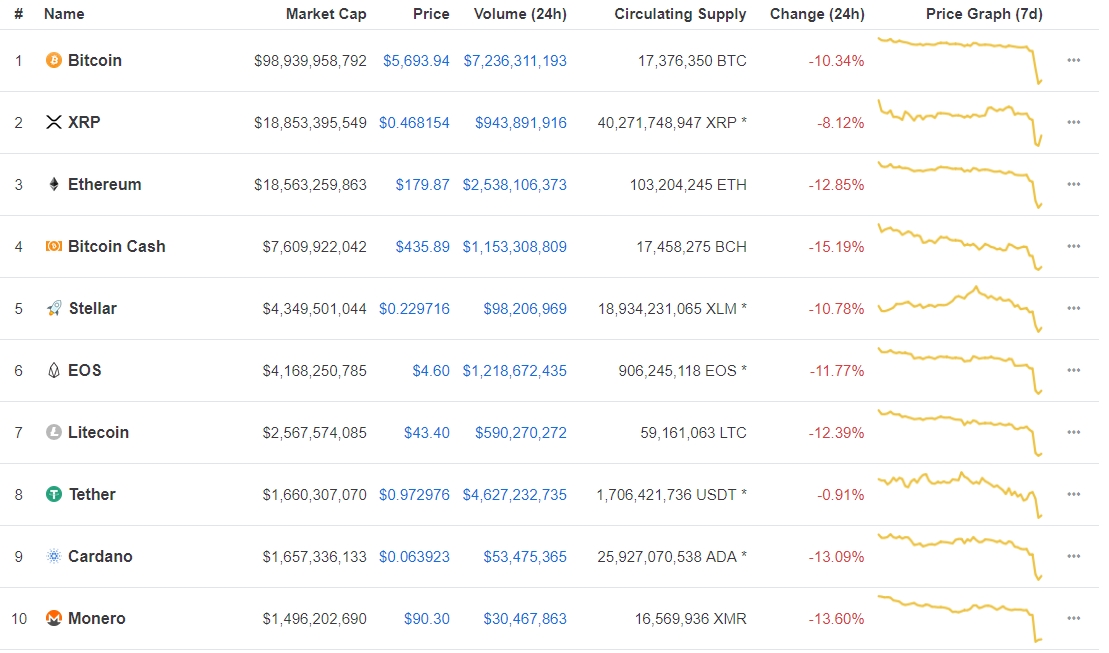

In fact, XRP is the second largest coin even now, due to another recent price drop. Its current value $0.472758 per coin, and it has experienced a 4.27% increase in the last 24 hours. Its current market cap is a bit over $19 billion, which makes it exactly $600 million higher than that of Ethereum.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|