2020-2-26 17:19 |

Although the whole crypto market has now experienced almost two weeks of downside action, altcoins have suffered a bit more than Bitcoin which was recently re-testing $9,000.

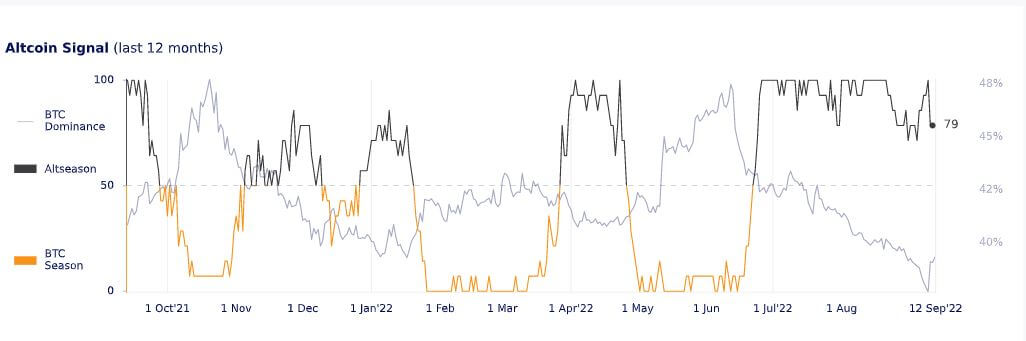

During the recent mini bull run, Bitcoin started losing a lot of market dominance dropping from a high of 69% to 60.9% in just one month. This significant decrease in market dominance was a clear indicator that altcoins were ready to take off and some of them certainly did.

Ethereum was able to outperform Bitcoin for the majority of February and has only recently lost some dominance. Similarly, XRP and many others were also able to outperform Bitcoin and see gains while BTC was trading sideways for days.

Crypto Market Outlook Data by Coin360Unfortunately, the recent crash has been way stronger on altcoins than Bitcoin. For comparison, Bitcoin has lost around 14% value since its peak of $10,500. XRP, for instance, has seen a 32% price loss while Ethereum is currently at -19%. This recent crash definitely questions the idea of a new altcoin season and reminds traders that Bitcoin is still the king and the one who dictates where the market is headed.

Are All Altcoins Dependant on Bitcoin?While Bitcoin is definitely a major factor in the price of other altcoins, it’s not entirely true that they depend on it. Historically, other altcoins have been able to outperform Bitcoin for months.

Binance Coin is a clear example and had a major bull run that started in November 2018 and lasted until April 2019, a date when Bitcoin’s own bull run started. BNB was able to perform far better than Bitcoin for months thanks to Binance, key announcements, and platform improvements.

Other smaller altcoins have also been able to see huge gains while Bitcoin remained in a downtrend but for the most part, all altcoins are influenced a lot by Bitcoin.

If you do not own any cryptocurrency right now and you want to buy a lesser-known cryptocurrency you will probably won’t have the ability to directly buy it using fiat. The process then would be to buy a cryptocurrency that actually has a pair with the desired coin you want to buy and then exchange it.

Because Bitcoin has a lot of pairs, most people will simply buy Bitcoin in order to buy another coin, this process is basically forced and it’s what makes Bitcoin so dominant.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|