2018-11-23 15:24 |

Bitcoin has experienced perhaps one of the worst few weeks in a long time, with its price declining over 30 percent from its steady $6,000 to a low of nearly $4,000. Some believe that hash power had to do with the decline, especially because it was delegated to the BCH chain. The chain has seen Bitmain try to dominate over Bitcoin ABC. The fork does create several issues, ones that Bitcoin maximalists have been trying to avoid for some time now.

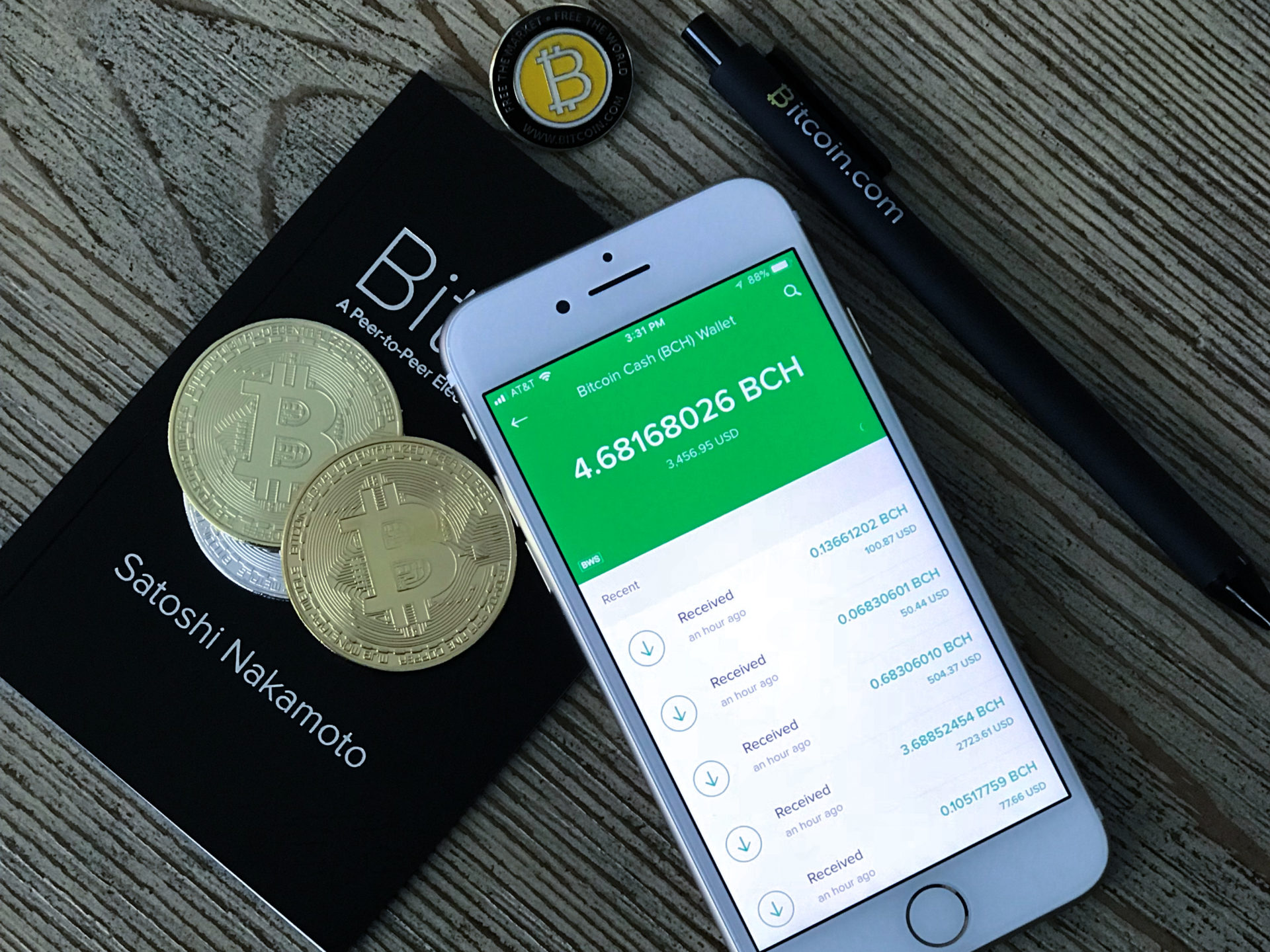

First and foremost, BTC was developed as a “peer-to-peer electronic cash system” and its functionality was meant to be permission-less and trustless. The former quality seems to have eroded, especially in light of centralized exchanges, and the trustless aspect seems to have declined as well. The decentralized aspect comes in handy because of BTC’s peer-to-peer nature.

However, it seems that BTC may not continue being as decentralized as it was meant to be. The network has evolved from using CPUs for mining and it also uses centralized cartels. Essentially, this has led to the potential centralization of bitcoin, which may be its biggest enemy.

Centralization And BitcoinBitcoin’s mining power is centralized and it is mainly concentrated in China and Russia due to low electricity costs. Further, mass adoption of Application Specific Integrated Circuits has also made it more difficult to mine BTC where CPU and GPUS are unable to be utilized effectively. At the end of the day, the more power one has, the greater chance for success.

Right now, it is undisputed that Bitmain is dominating the market when it comes to ASIC space. It has a 70 percent market share and has sent a great amount of hash power on the chain. On the downside, the platform has also been accused of operating unknown mining facilities without the ability to find blocks quickly. It may have also lied concerning hash power. Bitmain also operates a massive mining pool called AntPool and another called ViaBTC.

ConsequencesThe impact that Bitmain has over the chain is noticeable, especially when delegating hash power. The delegation has led to a decrease and it has decrease any challenges as well.

According to Bitmain CEO Jihan Wu:

“I have no intention to start a hashwar with CSW, because if I do (by relocating hash power from btc mining to bch mining), btc price will dump below yearly support; it may even breach $5000. But since CSW is relentless, I am all in to fight till death.”

The result of this strategy is a decrease in BTC’s market cap.

In light of these changes, it seems that XRP has been able to resist the impact and to develop a position as a hedge method for those who are looking to avoid BTC losses. XRP has also been able to avoid the impact of centralization better than other coins on the market and it has fared well throughout the week.

Ripple, the platform that is designed to use XRP, has over 50 billion of its tokens in an escrow account that cannot be altered until the end of the time frame. The platform also does not use the same BTC proof-of-work algorithm, which has been called wasteful and not environmentally friendly. Rather, XRP functions on consensus algorithms that do not provide validators with incentives for mining. There has also been an influx of funds into XRP, which may be behind its performance lately.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|