2019-7-6 23:49 |

On July 4, 2019, Willy Woo, a cryptoanalyst and Bitcoin proponent while speaking on an episode of the Coinist Podcast said that the current cycle will spike Bitcoin’s market capitalization to $1 trillion. Also, the next cycle will take it one step further by making Bitcoin’s market value to exceed that of Gold, according to a media outlet’s report on July 5, 2019.

Willy Woo Stands by the Same Prediction from 2013Per the report, Willy Woo while speaking in a podcast reaffirmed the prediction he had made in 2013. At the time, the Bitcoin proponent opined that Bitcoin’s market cap will surge to $1 trillion by 2025. It may be worthy to note that his prediction was made at a time when the virtual asset had dumped to $200 before spiking to $20,000 in 2017.

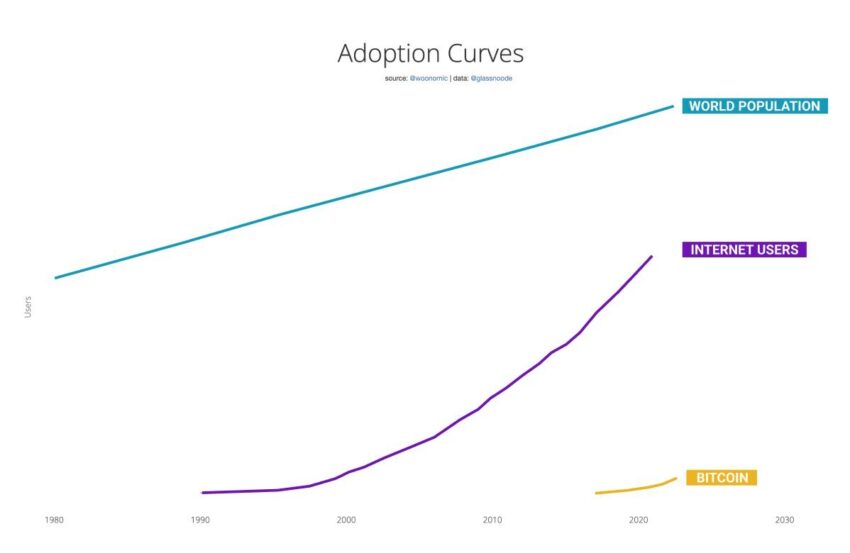

Woo further outlined that Bitcoin will not only stop where he has prognosticated, but it will overtake Gold’s $7.5 trillion market cap in the near-term future. According to him, Gold only forms a hurdle that will set as a stepping stone for Bitcoin’s development. The digital currency, on the other hand, is the world’s first “internet-native digital currency.”

Woo also said:

“Bankers say it’s a bubble, technologists call it a disruption; students of history would call it the dawn of the digital age.”

Chris Burniske Predicts Bitcoin’s Market Cap of $1 TrillionLike Woo, Chris Burniske, a partner at Placeholder VC on April 20, 2019, also affirmed that Bitcoin on its own can get to a market cap of $1 trillion in the next bull market. According to Burniske, he came to the conclusion after taking a look at the ten top cryptocurrencies by market cap at the end of each year.

Looking at the top 10 cryptoassets at the end of each year makes me think #bitcoin (blue) gets to $1 trillion on its own in the next bull market. pic.twitter.com/75YaGesYxR

— Chris Burniske (@cburniske) April 20, 2019

There’s also a similar prediction by PlanB, a professional cryptocurrency trader who stated on March 26, 2019, that Bitcoin’s market cap will hit $1 trillion after its halving in May 2020. He also said the virtual asset has the potential of trading around $55,000 by that time.

Bitcoin, on the other hand, is currently trading around $11,300 and its market capitalization is $202 billion. The price and market value are significant improvements when one compares it to the $3,700 price level and $67 billion market cap it opened on January 1, 2019.

Facebook’s Libra Cryptocurrency is Bad News for BitcoinDespite these predictions and the positive turnout of events in the crypto market, there are still Bitcoin bears that are skeptic about the asset. For instance, Peter Schiff, the veteran gold bug stated on June 14, 2019, that Libra, Facebook’s cryptocurrency is bad news for Bitcoin. In his opinion, Libra is targeting the same market Bitcoin is counting on for growth and the coin is easier and cheaper to use.

The post Willy Woo Predicts Bitcoin Market Cap of $1 Trillion By 2025 appeared first on ZyCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|