2020-10-4 20:00 |

Now that BitMEX has a target on its back, there is a cloud of uncertainty surrounding one of the leading cryptocurrency exchanges.

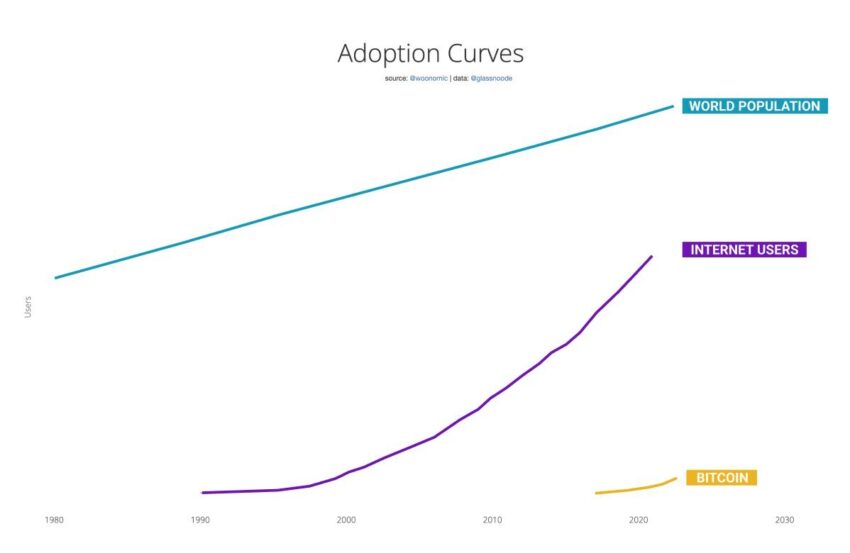

According to widely cited on-chain market analyst Willy Woo, however, the latest regulatory and criminal crackdown could pave the way for the herd to finally arrive in the cryptocurrency space.

BitMEX, which gives users the ability to trade crypto derivatives, is known for its lax rules, such as letting traders take on exorbitant amounts of risk by piling on the leverage. There are some hefty charges against the exchange, not the least of which involve KYC, AML and sanctions violations. BitMEX is still open, even if users are pulling their money off the trading platform fast and furiously.

Popular cryptocurrency analyst Willy Woo suggests that the CFTC’s wrecking ball hit BitMEX for “wrecking bitcoiners,” calling it a “necessary cleanup” for a bitcoin ETF to see the light of day. Woo believes it is a defining moment in the cryptocurrency space, calling it “one of those herd is coming events.”

CFTC is wrecking BitMEX for wrecking Bitcoiners. It's a necessary clean up step before an ETF can be approved. This is one of those "the herd is coming" events.

— Willy Woo (@woonomic) October 2, 2020

He also observed when the BitMEX news first came out that the pullback in the bitcoin price paled in comparison to that of a “proper liquidation event on BitMEX.” He predicts that the regulatory sweep is bullish for both bitcoin adoption as well as the medium and long-term BTC price.

The bitcoin price has held up well in the face of the headwinds that have hit the market in the last day or so.

In a 24 hour period…

Leading derivatives exchange gets charged by CFTC and DoJ, Co-Founder gets arrested.

Leader of the free world, who also has co-morbidities, tests positive for Covid.

Price is down…*checks chart*….3%

And you're BEARISH #Bitcoin?? pic.twitter.com/IQ7lIeeJQ5

— Travis Kling (@Travis_Kling) October 2, 2020

Does Bitcoin Really Need an ETF?Not all crypto market participants are fixated on having a bitcoin ETF. They argue that the industry has made it this far without one, and question whether it is really necessary given the flood of demand for decentralized finance (DeFi). In response, Woo tweeted,

Regulated exchanges will be for doxxed institutions, DEXes will be for everyone else. The latest developments in DeFi are super interesting, traders are playing ponzi-chicken for sure but it's a proving ground for the underlying tech.

Anonymity of DEX developers may important. https://t.co/pERQmnjy3r

— Willy Woo (@woonomic) October 3, 2020

Second That EmotionMeanwhile, Woo isn’t the only one who sees the stage being set for the herd to finally come off the sidelines and into crypto. Galaxy Digital chief Mike Novogratz said the same thing days before for, only for different reasons.

Novogratz turned to anecdotal evidence, such as the fact that his phone is ringing daily, which has left him “very bullish on the overall space.” Once the institutional investors do enter crypto, chances are they are here to stay because as Novogratz explained, they are “stickier money” vs. retail — though it is far from a zero-sum game.

And as Willy Woo pointed out, the CFTC in its announcement about the BitMEX charges touted digital assets for their “promise” while warning that the bad actors needed to be removed.

The post Willy Woo on Regulatory Sweep: This Is One of Those ‘Herd Is Coming’ Events appeared first on BeInCrypto.

origin »Miner One token (MIO) íà Currencies.ru

|

|