2024-7-12 21:00 |

The delays in the approval process for Spot Ethereum ETFs have raised questions among traders and investors about the cause of the holdup and when a final decision will be made. A look into the approval process for Spot Bitcoin ETFs may provide some clues.

Meanwhile, ETFSwap (ETFS) is refining its platform’s features and tools to equip traders and investors to gain maximum profits trading Spot Ethereum ETFs when they pass the SEC’s final review process.

The Blueprint As Laid By Spot Bitcoin ETFsThe US SEC’s approval of Spot Bitcoin ETFs on January 10th marked a historic milestone for the cryptocurrency community. Bitcoin (BTC) was no longer a specialized asset, reserved only for deviants of the traditional finance system, but an investment option for all and sundry. It also served as a precedent for mainstream approval of other cryptocurrencies.

Integrating cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) into traditional financial markets as tokenized ETFs allows investors to include them as real assets in their portfolios. However, Spot Bitcoin ETFs and Spot Ethereum ETFs have had very different paths to approval.

ETFSwap (ETFS) Becomes The Future For Trading Spot ETFsETFSwap (ETFS) is the premier marketplace for trading and investing in tokenized real-world assets, including funds, bonds, spot ETFs, etc., from diverse sectors ranging from healthcare to agriculture. The platform seamlessly merges these institutional investment vehicles with blockchain technology for seamless, transparent, and secure ETF trading.

ETFSwap (ETFS) has AI-powered tools that analyze vast amounts of market data, helping traders make efficient decisions without cramping their trading strategy. Hence, they are always ahead of the competition.

With attractive leverage options, traders can increase their exposure to the market with a smaller capital investment. ETFSwap (ETFS) offers up to 10x leverage on all trades and 50x leverage to trade perpetual futures and options. Taking advantage of these features can increase traders’ equity on capital by up to 100x.

ETFSwap (ETFS) understands the risks associated with leveraged trading and provides tools to manage them. Traders and investors can use the risk assessment tools, such as stop-loss orders and margin calls, to safeguard their investments.

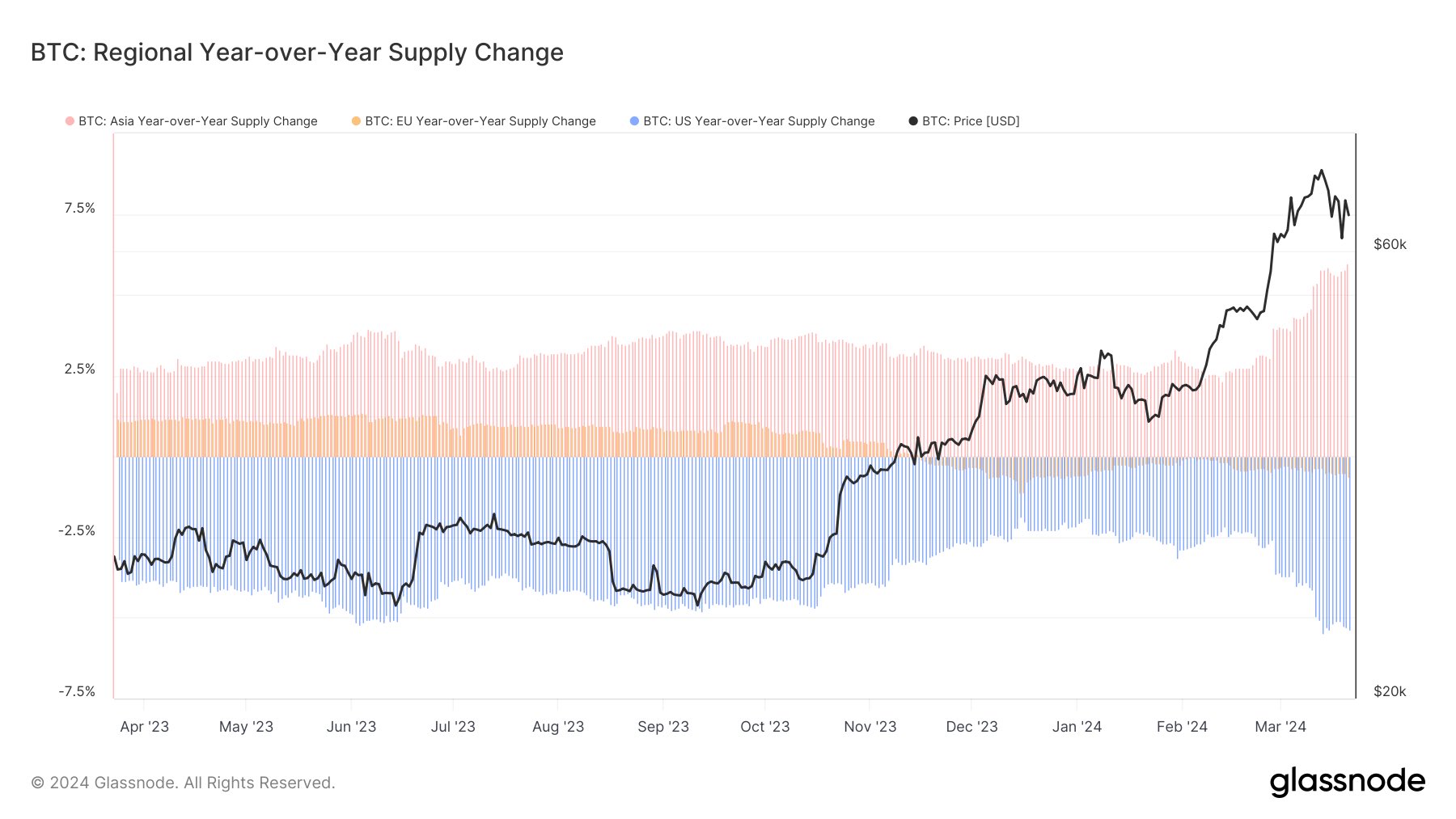

The Parallels Between Spot Ethereum ETFs And Spot Bitcoin ETFsThe approval of Spot Bitcoin ETFs generated immense excitement from the public, causing the cryptocurrency to see increased activity. Bitcoin’s (BTC) trading volumes increased dramatically, sending its price from $42,000 to $75,000.

Ethereum’s (ETH) trading volume also increased after Spot Ethereum ETFs received initial approval. The price hit a 12-month peak before dipping back down, thanks to a bearish crypto market.

Bitcoin ETFs did not exactly have it easy. The SEC thoroughly investigated the cryptocurrency to prevent market manipulations and protect investors. However, Bitcoin’s (BTC) strong market presence ($1.11 trillion in market worth) and growing interest from institutional investors shifted the odds in its favor.

Conversely, Spot Ethereum ETFs have had a more complex process due to regulatory debates regarding whether the altcoin should be classified as a security or an asset. The complications in classifying Ethereum (ETH) stem from its wider application, which includes NFTs and decentralized finance (DeFi), thus necessitating an advanced regulatory approach.

Top analysts and crypto experts maintain confidence that Spot Ethereum ETFs will eventually receive full SEC backing. When that happens, Ethereum’s (ETH) broad range of applications will fuel more innovation and inclusivity in the traditional finance scene. Additionally, the crypto ETFs will find a home on the world’s best platform for profitable ETF trading, ETFSwap (ETFS).

ConclusionThe approval process of Spot Bitcoin ETFs and Spot Ethereum ETFs has far-reaching implications for the cryptocurrency market, signaling an evolving regulatory landscape and increasing mainstream acceptance.

In the meantime, ETFSwap (ETFS) is holding a presale for its native token, ETFS, at the discounted price of $0.01831. Do the smart thing and use the ongoing 40% bonus promo to accumulate more tokens today to position yourself for potentially massive gains.

For more information about the ETFS Presale:

Visit ETFSwap Presale

Join The ETFSwap Community

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Will Spot Ethereum ETFs Follow The Same Process As Spot Bitcoin ETFs? appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cryptospot Token (SPOT) на Currencies.ru

|

|