2025-12-16 20:00 |

XRP has spent the past several weeks moving sideways around the $2.00 level, even as headlines around Ripple and the broader XRP ecosystem continue to stack up.

Related Reading: Dogecoin Holds Demand Zone Above $0.13, What A Bounce Would Do

From a $300 million venture fund expansion into South Korea to nearly $1 billion in spot ETF inflows and fresh regulatory approvals, the backdrop appears supportive on paper.

However, price action tells a different story. Instead of responding to institutional traction and regional growth, XRP remains locked in a tight range, reflecting a disconnect between developments and market behavior.

Institutional Growth Isn’t Translating Into Token DemandRipple’s expansion into South Korea through a $300 million venture fund has drawn attention due to the involvement of well-established, Seoul-based asset managers.

However, market participants are increasingly viewing this move as tied to Ripple’s corporate strategy and potential IPO positioning, rather than direct demand for XRP. Institutional investors tend to prioritize predictable cash-flow or equity-style exposure, limiting the immediate impact such initiatives have on the token’s market dynamics.

A similar pattern is visible in the ETF market. Spot XRP ETFs have recorded roughly $990 million in inflows over 30 consecutive days, making them one of the fastest-growing crypto fund segments.

Despite this, XRP has fallen more than 12% over the past month. Analysts note that ETF inflows do not always translate into spot market pressure, especially when liquidity is fragmented or offset by broader risk-off sentiment across crypto assets.

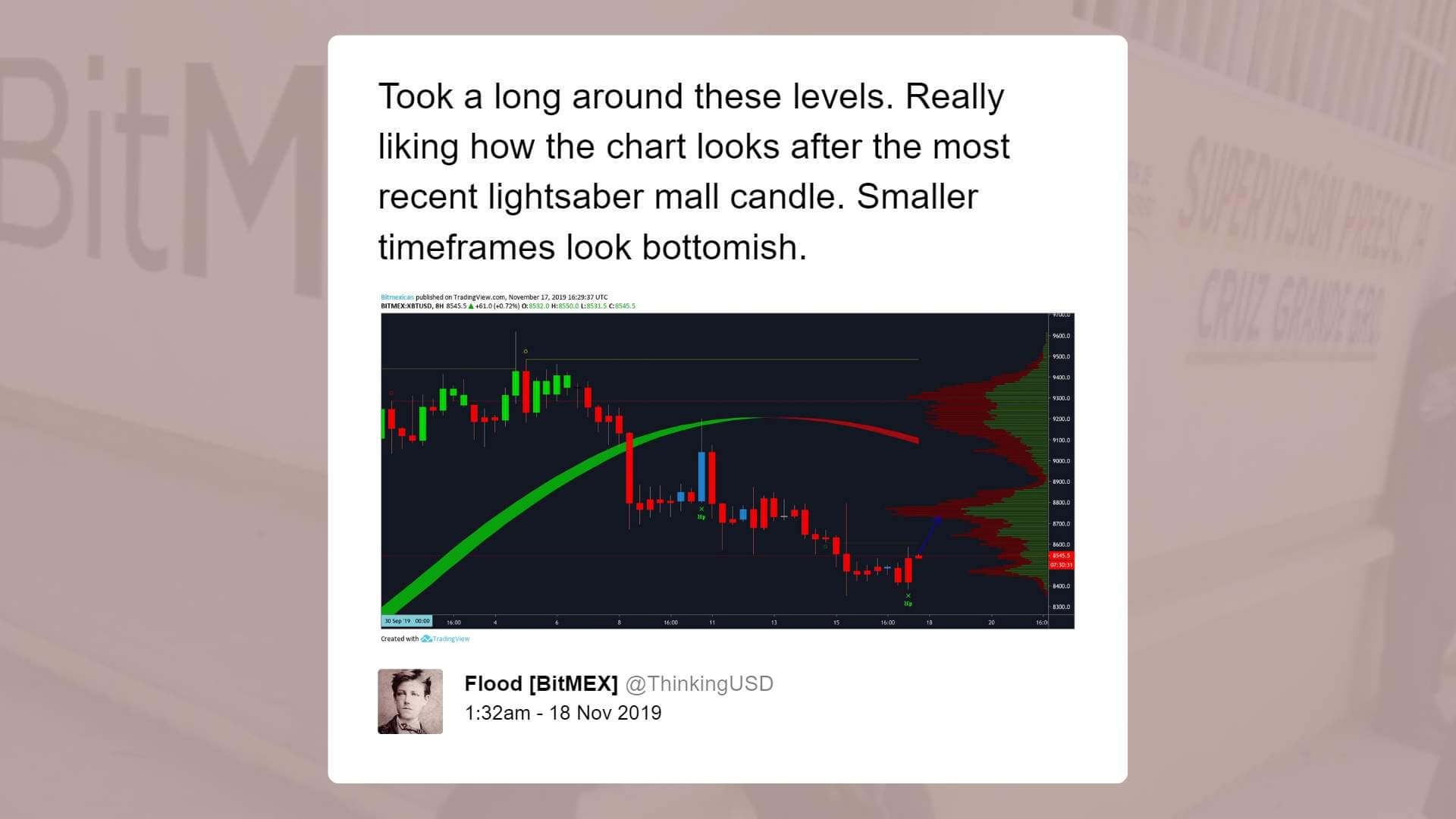

Technical Pressure and Broader Market HeadwindsFrom a technical standpoint, XRP remains under pressure. The price has retraced to key Fibonacci levels after falling from its yearly high near $3.65.

Chart patterns such as a developing death cross and a double-top formation point to downside risk, with support levels around $1.63 and $1.50 in focus if selling continues. Traders describe the current phase as bearish consolidation, with strong resistance clustered between $2.00 and $2.20.

These conditions mirror weakness across the wider crypto market. Bitcoin’s decline from earlier highs and drawdowns in major altcoins have reduced risk appetite, often pulling XRP lower regardless of asset-specific news.

Liquidity, Bots, and Muted Price ResponseMarket structure may also be playing a role. Analysts point to low trading volumes and heavy arbitrage activity as factors keeping XRP pinned near psychological levels.

In thin markets, automated strategies tend to fade moves quickly, preventing follow-through. While some data suggests tokens are gradually moving off exchanges, signaling longer-term holding, short-term price discovery remains dominated by macro flows and Bitcoin-led volatility.

Related Reading: Dogecoin (DOGE) Slides Deeper Into Red—Is a Bottom in Sight?

Currently, XRP’s lack of movement reflects market mechanics more than a judgment on progress within its ecosystem. Until volume and liquidity shift decisively, headlines alone may not be enough to move the price.

Cover image from ChatGPT, XRPUSD chart from Tradingview

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|