2021-1-10 18:58 |

The price of Bitcoin abruptly fell by over 5% in just three hours on January 10. Analysts generally attributed the volatility to an overheated derivatives market and the new upcoming weekly candle.

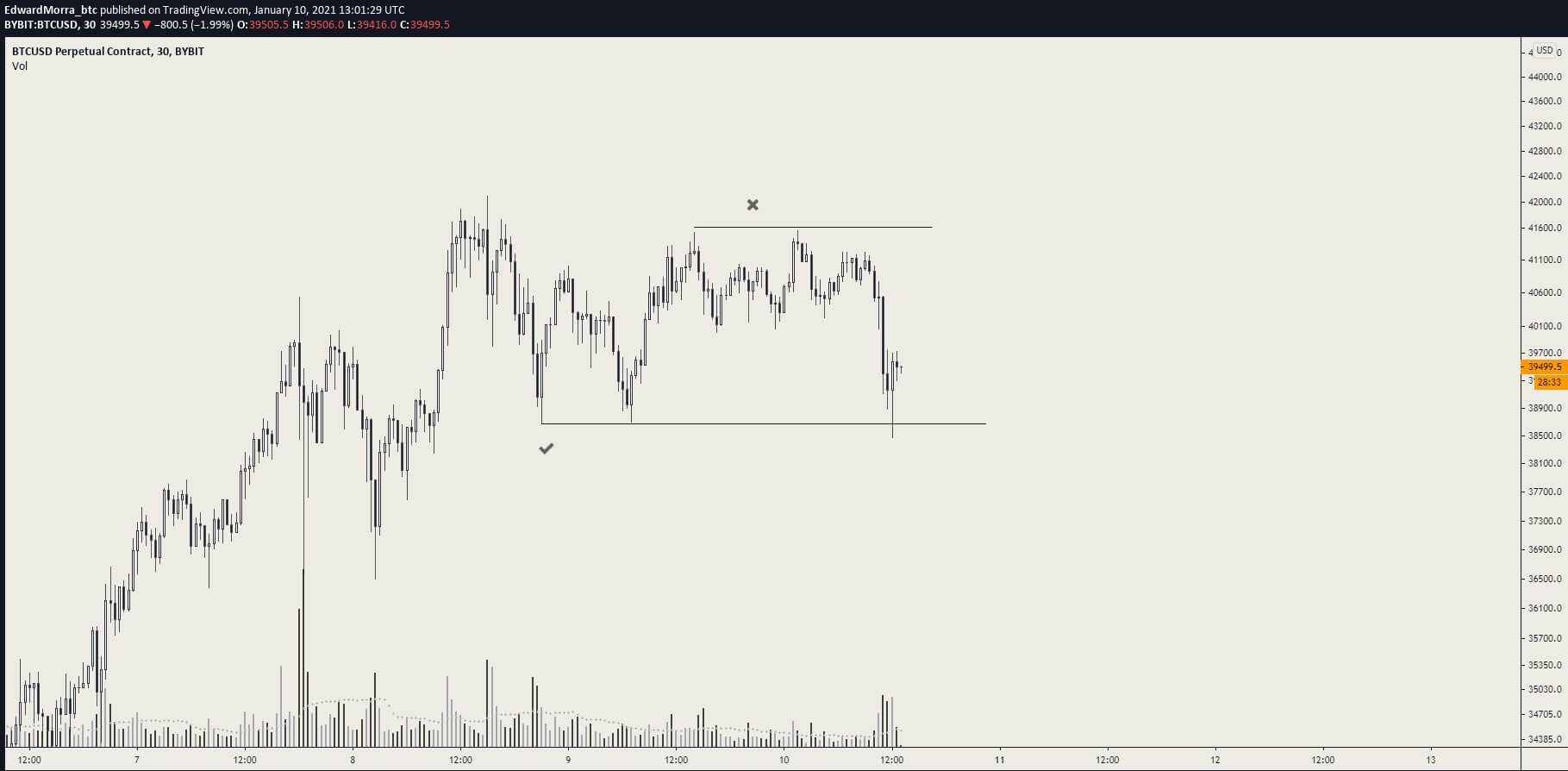

Why some technical analysts expected this moveSome traders and technical analysts anticipated Bitcoin to pullback, due to the range it has seen in recent days.

Bitcoin has been consolidating between $38,800 and $41,000 throughout the last 72 hours. Considering that it is the weekend and there is a low volume all around, the probability of BTC declining and testing the low point of the range was high.

Scott Melker, a cryptocurrency trader, anticipated Bitcoin to “sweep the lows” of the range, which it did. BTC dropped slightly lower than $38,800, which caught many traders off guard.

$BTC Hourly

Here is the sweep of the lows that I mentioned in the previous tweet. pic.twitter.com/GNMxDLdcjX

— The Wolf Of All Streets (@scottmelker) January 10, 2021

Some traders placed a bid at the $39,300 support area with a stop slightly below $38,800. But, BTC pulled back stronger than most expected, causing many stops to get triggered.

In the near term, traders remain generally cautious and uncertain about the price trend of BTC.

On January 11, Bitcoin would see a new weekly candle, which is typically met with a spike in volatility.

Edward Morra, for example, a cryptocurrency trader, said that many stops have been cleared and there is liquidity on the “range high.” This means that BTC is likely to rally towards the high point of the range at $41,000. He said:

“Stops cleared, now we have some liquidity at the range high, however there is 1 bearish possibility i spotted.”

The price of Bitcoin with a range. Source: BTCUSD on TradingView What happens next?There are two scenarios in the short term. First, Bitcoin could retest the $41,100 range high and pull back once again.

Second, Bitcoin could surge to $41,100 again and break out of it this time, as BTC historically tends to break out on the third retest.

But, some traders have pinpointed the emergence of celebrity tweets around crypto, which previously marked the top of BTC in past bull cycles.

A pseudonymous trader known as “Loma” said it does not necessarily show that Bitcoin is bearish or bullish. But, it can be used as a way to gauge the market sentiment. He said:

“It’s not necessarily bullish or bearish in terms of technicals. I don’t expect price to crash tmrw because Katy Perry has crypto nails or KSI tweets about $ETH. I just like using them as a gauge for where we are in the cycle. I’m sure it brings in a lot of new buyers and attention but I always find myself asking: Alright well if we get a fuck ton of exposure through celebrities, institutions are buying/have bought, traders are most likely in. That sounds like a lot of buyers that’ve already bought.”

The post Why the Bitcoin price suddenly fell 5% in three hours—and where it goes next appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|