2023-3-3 06:01 |

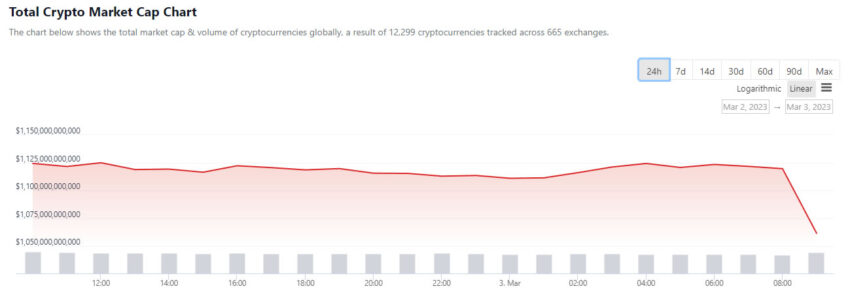

Crypto markets are currently crashing with billions of dollars leaving the sector over the past hour or so.

Total market capitalization has shrunk by more than $60 billion over the past hour. As a result, the figure has fallen to $1.06 trillion at the time of writing, according to CoinGecko.

The cause of the big Friday dump is unclear at the moment. However, there has been a lot of negative news regarding crypto bank Silvergate this week.

Bloomberg also alluded to the Silvergate fallout in its reporting on crypto markets today.

The U.S. crypto bank raised questions about whether it can stay in business on March 2. Additionally, its shares plunged to a record low as key partners severed ties to Silvergate.

Crypto markets have now returned to mid-February lows, which served as support at current levels. However, they remain within the range-bound channel that has been consolidating above $1 trillion for the past six weeks.

Total market cap 24 hours – CoinGecko Bitcoin, Ethereum TankingBitcoin has lost 5.2% in the past hour, dumping around $1,200. It has settled at $22,250 at the time of press, and there is further support at $21,500.

Crypto critic “Mr Whale” blamed a whale for selling and causing the slump.

Over $120,000,000 #Bitcoin longs have just been liquidated in the matter of seconds after 1 mega whale sold.

Maxis always talk about “decentralization” and “store or value”, yet reality is the exact opposite.

BTC prices are currently back at mid-February levels, but a 5% move is nothing new for the asset.

Bitcoin BTC Price Chart by BeInCryptoEthereum has dumped a similar percentage in a fall to $1,567 during the Friday morning Asian trading session. The latest news for the network was that the Shanghai upgrade had been delayed until mid-April.

The ETH chart has mirrored BTC, so it is also back to mid-February lows where support levels lie.

Ethereum ETH Price Chart by BeInCrypto Crypto Markets BleedingThe entire crypto market is a sea of red at the moment, with altcoins taking a bigger hit as usual. Larger losses of more than 6% have been seen on Cardano (ADA), Dogecoin (DOGE), Solana (SOL), Polkadot (DOT), and Shiba Inu (SHIB).

Others, such as Litecoin (LTC), Avalanche (AVAX), Uniswap (UNI), and Chainlink (LINK), were getting hit with losses greater than 8%.

The post Why Have Crypto Markets Dumped $60B in Less Than an Hour? appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|