2020-2-14 02:08 |

Ethereum has been on an absolute tear over the last 60 days. Since bottoming at $117 in the middle of December alongside Bitcoin, the second-largest cryptocurrency has rallied by 140 percent, reaching as high as $278 on Feb. 12 as the price trend goes vertical.

Ethereum price rallyThe altcoin’s jaw-dropping 140 percent rally comes as Bitcoin has gained by a mere 60 percent in the same time frame.

This simple outperformance has led many retail cryptocurrency investors to claim that in the upcoming bull market cycle, Ethereum will strongly outperform BTC, just as it did in 2017 and early-2018 when prices rallied from sub-$10 to $1,450 in 18 months’ time.

Despite this, two prominent cryptocurrency fund managers hailing from positions on Wall Street aren’t convinced of Ethereum’s long-term viability as an investment, especially when pitted against other projects.

Is Ethereum a good investment for the next Bitcoin bull cycle?The discussion against Ethereum as an investment began with Michael Novogratz — current CEO of “crypto merchant bank” Galaxy Digital and a former partner at Goldman Sachs.

Last week, the investor released an extensive thread about altcoins vs. Bitcoin, pinning his discussion against the backdrop of Ethereum and XRP dramatically outperforming the market leader since December’s bottom.

He argued that Ethereum, “like many other cryptos,” remains in a “proving phase” whereas it acts more like a “venture bet” because it does not yet have the capability of making a lasting impact on investing and the world as a whole. He thus said Bitcoin remains the crypto space’s best bet.

Novogratz’s point has been echoed by Jeff Dorman, the CIO of research and hedge fund Arca and a former employee at Lehman Brothers and Citadel.

In Dorman’s own analysis of the viability of Ethereum as an investment, he argued the fact that the asset’s performance is so closely intertwined with that of smaller-cap altcoins makes it “not an interesting investment for anyone outside of the die-hard ETH community.”

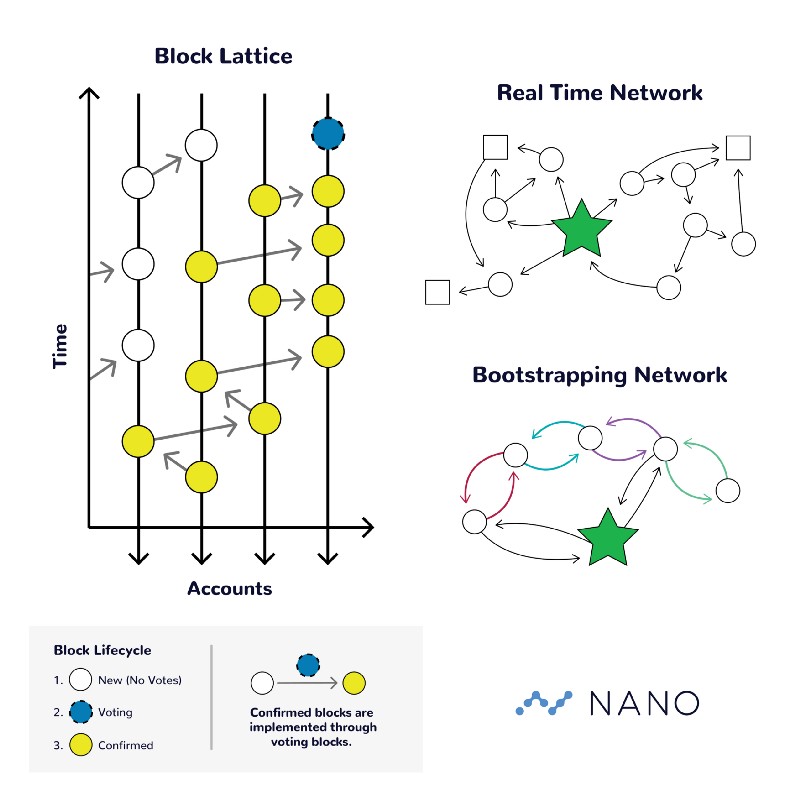

Just look to the below chart from Messari, which shows the cryptocurrencies (with over $100,000,000 in market capitalization) that have performed the best over the past month. There you can see projects like Icon, Lisk, Tezos, Siacoin, Zcash, Nano, Cardano, and Chainlink, but ETH doesn’t even show up on the list.

This underperformance against “more interesting” projects, Dorman wrote, is a good reason “why few investors care about ETH as a standalone investment (at least today).”

The Arca executive, like Novogratz, also said that “institutional investors and asset managers” simply don’t require to invest in ETH, for it isn’t a “necessary investment” like Bitcoin is, as it’s expected risk-return profile “is easily replaceable with other assets.”

Make no mistake, Ethereum has a lot going for itAdmittedly, Ethereum has a lot going for it; the project arguably has the strongest fundamentals of any cryptocurrency or blockchain venture at the moment.

Case in point, a Reuters report revealed that “Quorum,” the in-house blockchain team of JP Morgan, is in talks with Ethereum blockchain studio ConsenSys for a merger. Analysts say this would rapidly prove the blockchain’s viability.

Alongside this news, Fidelity Investments‘ digital asset chief, Tom Jessop said in a recent interview that the Wall Street giant is on the verge of adding Ethereum support to its institutional trading and custody platform. Should ETH be added to the platform, it would join Bitcoin in being two digital assets that can be accessed by trillions of dollars of institutional wealth.

Aside from the financialization of Ethereum, on the technological side of things, the blockchain is moving ever closer to scaling its blockchain to be much faster, cheaper, and functional than it was before.

Per previous reports from CryptoSlate, Gnosis Product Lead and Researcher Eric Conner said that the impending introduction of Ethereum 2.0 — the so-called “Serenity” blockchain upgrade that will implement proof-of-stake into the blockchain, and with that a lower inflation rate of ETH — will dramatically increase the viability of the project’s growth in the long-term.

The post Why crypto fund managers aren’t convinced Ethereum is a proper investment, yet appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|