2026-1-21 19:15 |

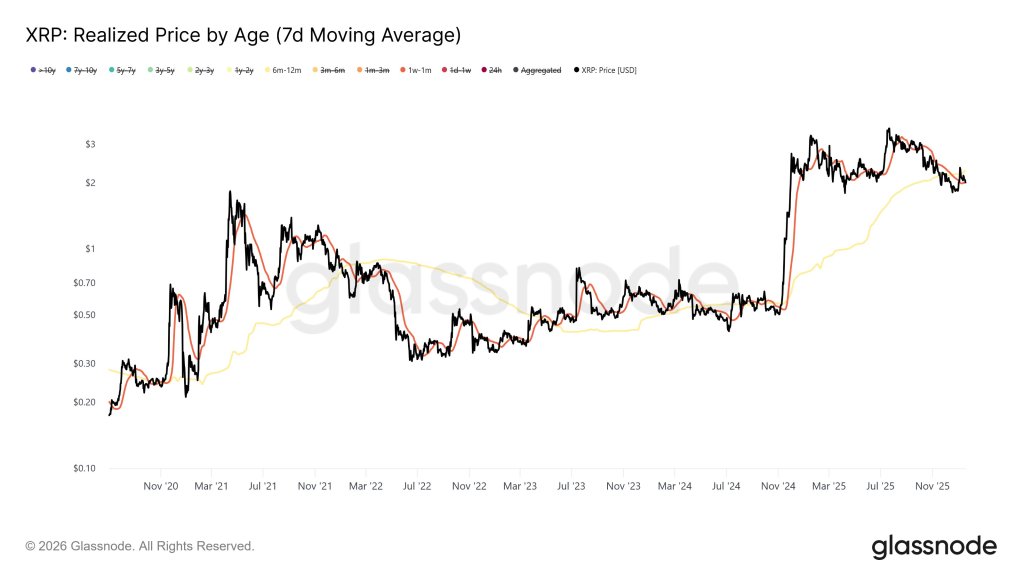

XRP's on-chain structure now mirrors a precarious moment from early 2022, when short-term accumulation beneath longer-term cost bases set the stage for prolonged sideways chop.

Glassnode flagged the pattern on Jan. 19: investors active over the 1-week to 1-month window are buying below the realized price of the 6- to 12-month cohort.

That age-band inversion means newer buyers hold a better average entry than prior “top buyers,” and as the configuration persists, psychological pressure on underwater holders intensifies.

XRP's 6-12 month cohort (yellow line) holds cost bases above current spot price, creating overhead resistance as newer buyers accumulate lower.Each rally toward their breakeven becomes a potential exit ramp, turning relief into resistance.

The question isn't whether pressure exists, it does. The question is whether that pressure is translating into actual distribution, and whether leverage is positioned to amplify the next move.

Related Reading XRP on exchanges hits 8 year low, but historical data exposes a brutal flaw in the popular “moon” narrative Jan 1, 2026 · Gino Matos Supply in profit sits near healthy levels, but cohort stress persistsSantiment data shows that 71.5% of the XRP supply is in profit as of Jan. 19, with the token priced at $2.01. That places the market within the range typically associated with healthier bull structures, where the majority of holders sit comfortably above water.

But the aggregate figure masks the structural tension Glassnode identifies: the six-to-12-month cohort holds cost bases materially above where recent participants are accumulating.

XRP realized profit/loss spiked sharply in early January while the percentage of supply in profit declined from prior highs.Markets don't move through aggregate averages. Instead, they move through clustered layers of supply at distinct cost bases. When short-term buyers accumulate stressed longer-term holders, rallies encounter fresh selling pressure from cohorts seeking to reduce risk or exit positions that have tested conviction for months.

The cohort inversion matters more when the broader market is already skewed toward profits. With over 70% of supply in the green, rallies face higher odds of profit-taking layered on top of breakeven selling from top buyers.

That dual pressure can cap momentum before it builds.

Realized profit and loss patterns reveal distribution into ralliesIf top buyers are cracking, it shows up as realized losses on downswings and realized profits in relief rallies. Santiment data tracks the pattern: XRP realized profit and loss jumped from 5.15 million on Jan. 12 to 104.2 million on Jan. 14, before cooling to 1.42 million by Jan. 16.

XRP's realized profit/loss ratio spiked sharply in early January, indicating heightened on-chain spending activity during price volatility.That mid-week spike coincided with price volatility around the $2 zone, capturing on-chain spending behavior as stressed cohorts moved coins in response to short-term price action.

When realized profits spike during rallies while the cohort inversion persists, it reads as relief-rally selling and top buyers getting out. When realized losses spike without price making materially lower lows, it can signal capitulation, the final wave of discouraged sellers exiting before sentiment shifts.

The distinction determines whether current price action represents a floor or simply a pause before deeper selling.

Exchange flows confirm accumulation bias despite cohort stressCryptoQuant data shows XRP exchange reserves on Binance at 5.55 billion tokens as of Jan. 17, with daily outflows of 1.1 million XRP outpacing inflows of 629,500 XRP.

XRP exchange inflows (top) and outflows (bottom) spiked in mid-December, with outflows consistently exceeding inflows through mid-January, indicating net self-custody movement.That net-outflow dynamic persists even as the age-band inversion creates overhead supply, suggesting newer participants are absorbing coins and moving them to self-custody rather than leaving them on exchanges for near-term sale.

If overhead supply were cleared by selling, exchange inflows would rise around the same periods when realized profits jump.

The current flow pattern of net outflows, while realized profit and loss remain elevated, supports an accumulation read. Pressure exists, but it hasn't yet been translated into sustained market sell flow.

That can change quickly if stressed holders decide relief rallies are their last chance to exit.

Derivatives reset removes forced-selling fuel but limits breakout powerCoinGlass data shows XRP open interest at $3.58 billion as of Jan. 19, with funding rates at 0.0041% and $42.44 million in liquidations over the prior 24 hours.

That configuration reflects a market where leverage has been significantly reduced from prior highs, stripping out the speculative positioning that fueled October's rally.

Lower open interest reduces the risk of cascading liquidations, as underwater longs have already been flushed. Still, it also removes the reflexive leverage bid that typically powers clean breakouts through overhead resistance.

Cohort pressure becomes reflexive when leverage builds on top of it. Rising open interest and one-sided funding can turn normal sell pressure into cascades.

The current setup of muted funding and moderate open interest suggests the structure is more likely to play out as spot-led chop and slower grind, where pressure builds but forced flow remains limited.

Related Reading XRP is quietly forming a “spring-loaded” supply setup that frustrated retail traders are completely ignoring Dec 29, 2025 · Oluwapelumi Adejumo Three paths forward, each data-dependentThe next two to six weeks will clarify which scenario takes hold.

Continued net outflows, stabilizing realized profit and loss, and muted funding would confirm absorption and constructive positioning.

Rising exchange inflows, realized profits spiking into rallies, and funding re-accelerating would validate the “sell-the-rips” thesis, confirming that the age-band inversion is actively translating into distribution.

Rising inflows, paired with realized-loss spikes and liquidation bursts, would flag capitulation risk, even with open interest below prior cycles. February 2022 took months to resolve.

XRP's current structure is healthy on the surface but strained beneath the surface. It suggests the same patience will define the next phase.

The post While 71% are in profit XRP just triggered a rare signal last seen in 2022 that could paralyze rallies for months appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|