2020-9-27 08:08 |

Bitcoin has flatlined over recent weeks, entering a trading range between $10,000 and $11,000. On a macro basis, not all analysts are convinced that BTC is in a full-blown bull market. There are a number of resistances above Bitcoin’s current price that could mark highs of a medium-term rally. Despite this, there are crucial on-chain indicators suggesting that the cryptocurrency has room to move higher. One such indicator, which formed in 2017 prior to a 1,500% move higher, has returned. There are also fundamental trends that suggest that the ball is firmly in the court of bulls at the moment. Crucial On-Chain Bitcoin Indicator Suggests a Strong Rally Will Come

Ki Young Ju, CEO of CryptoQuant, noted that Bitcoin is likely on the verge of a full-blown bull run as the mining ecosystem flashes a number of bull signals.

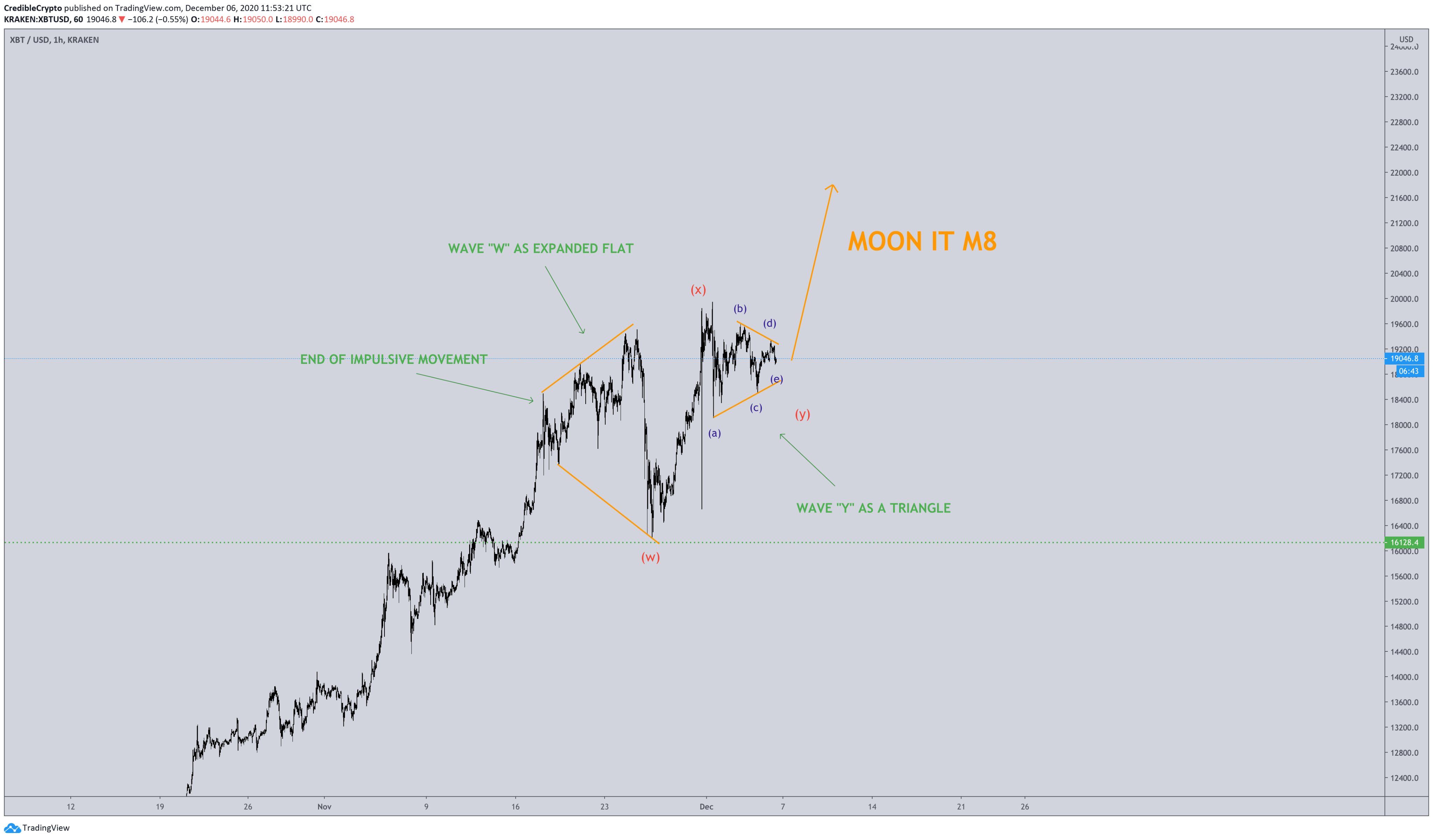

He shared the chart below on September 24th, noting that Bitcoin miners are suggesting that a bull run is around the corner. This same signal appeared in early 2017, preceding a parabolic surge.

“If $BTC miners still drive the price, the next bull-run should be starting soon. MPI(Miner Position Index) has a very high hit rate in forecasting the bull/bear market when the macro factors like the stock market are not significant.”

Should history rhyme, Bitcoin is on the verge of a parabolic rally that should bring it past the previous all-time high at $20,000.

Chart of BTC's macro price action with a miner position index analysis by crypto on-chain analyst and CryptoQuant CEO Ki Young Ju. Chart from TradingView.com Better Fundamentals Than EverAside from pure on-chain data, analysts say that the fundamentals of Bitcoin are stronger than ever. This corroborates the expectations of the cryptocurrency market to undergo a strong rally to the upside.

Speaking on the fundamentals of BTC, Raoul Pal, CEO of Real Vision, recently stated:

“Most people don’t understand the latter but is simply put, Powell has shown that there is ZERO tolerance for deflation so they will do ANYTHING to stop it, and that is good for the two hardest assets – Gold and Bitcoin. Powell WANTS inflation. I don’t think he gets true demand push inflation but he will get fiat devaluation, in conjunction with the other central banks all on the same mission.”

Others like Pal have echoed this optimistic sentiment. They say that due to the vast amount of monetary stimulus amongst other geopolitical and monetary trends, BTC is primed to move higher.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com When This SIgnal Flashed in 2017, Bitcoin Gained 1,500%. It's Back Again origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|