2020-10-10 17:00 |

The DeFi ecosystem started to recover this week thanks to Bitcoin's positive momentum that drove the crypto market upwards.

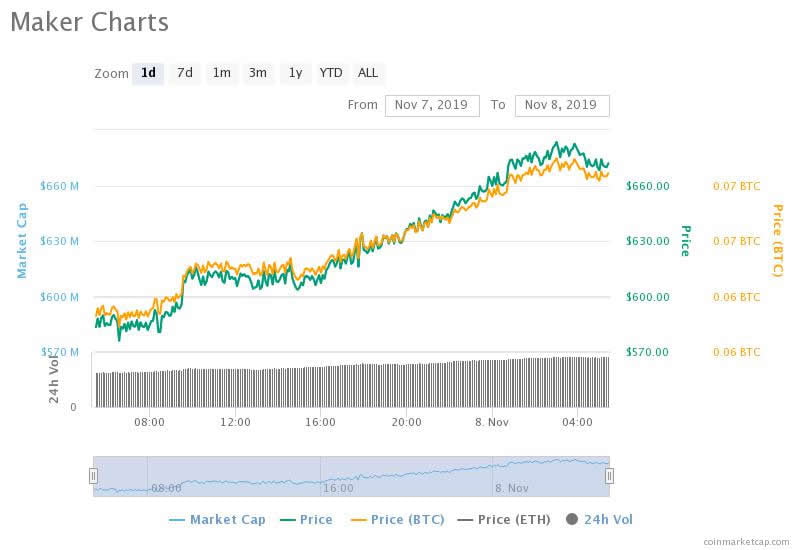

While the likes of YFI, SUSHI, UNI, CRV, RUNE, BAL, and KNC are experiencing mild losses today, less than -5%, considerable gains are recorded by UMA (+32%), AST (-28%), MFT (+27%), and AKRO (+24%) with less than 10% gains seen by YFII, LRC, KAVA, LEND, MKR, COMP, SNX, ZRX, and others.

As a result, the total value locked (TVL) in the sector also saw an uptick, approaching $11 billion yet again.

With this, the DeFi tokens look to be finding the bottom, after all, following the deep correction that went on for a few weeks, that came after a wild rally, resulting in many popular tokens to lose 80% to 90% of their value.

Still, some are glad the pullback happened because “as painful as it was, it accomplished a few things: 1. Washed out the weak hands 2. Gave us a sense of where value for DeFi assets are in a big drawdown 3. Hopefully killed off random food coins offering 10000% APY farming,” noted a former partner at Goldman Sachs who is now part of the crypto fund, The Spartan Group.

According to him, even some of the family offices and high net worth individuals (HNWI) are now “starting to get curious, and they will get into the action via funds as it is too hard for them to do it themselves.”

The Macro TrendThe overall crypto market is currently experiencing the greens, with Bitcoin and altcoins seemingly belonging to the same asset class and being correlated to each other.

However, according to the quant trader and entrepreneur Qiao Wang, “Reality is BTC is increasingly behaving like a macro asset whereas alts are still very much venture bets.”

In the macro world, the markets are eagerly waiting for the US presidential election, coming in November, to end the uncertainty prevalent in the market currently. Moreover, the stimulus package isn’t expected to be approved until then, either.

According to Bloomberg’s latest crypto newsletter, while Joe Biden’s win as the president would be good for Bitcoin, in contrast with Donald Trump’s “hands-off policy,” it would hamper DeFi’s growth.

“The world has morphed into one big macro trade. Asset prices are increasingly driven by global policy expectations rather than underlying fundamentals. Deflation + insolvency risk is rising,” noted Kevin Kelly, co-founder Delphi Digital.

The current environment outlines the bull case for Bitcoin and crypto, “the backdrop has never been more conducive for this industry to thrive,” with historical Q4 performance suggesting we could push to new highs.

But the “risk of deflation, insolvencies, and upside dollar risk are of paramount concern for markets,” including bitcoin and crypto alike, added Kelly.

The post What the Painful DeFi Correction Did, Actually Good For the Market? first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|