2020-5-2 01:56 |

Despite the bullish momentum that pushed Bitcoin above $9,000, sentiment analysis shows that investors are getting skeptical, indicating an impending pullback.

Shifting Bitcoin SentimentBitcoin surged more than 27% over the past week, peaking at a high of $9,440. The bullish impulse enabled the flagship cryptocurrency to recover losses incurred during “Bloody Thursday” in March, sending it back to pre-drop levels, said Arcane Research.

During the latest rally, it seems like investors rushed to exchanges to get a piece of Bitcoin’s recent price action.

IntoTheBlock reported that Bitcoin perpetual swap volumes across multiple crypto-derivatives exchanges soared over 200%. On Thursday alone, the volume for perpetual swaps reached a 30-day high of $30.8 billion in notional value.

Bitcoin Perpetual Swaps Volume by IntoTheBlockBulls shouldn’t get lulled into comfort, however. Over the last day, there has been a significant shift in market sentiment.

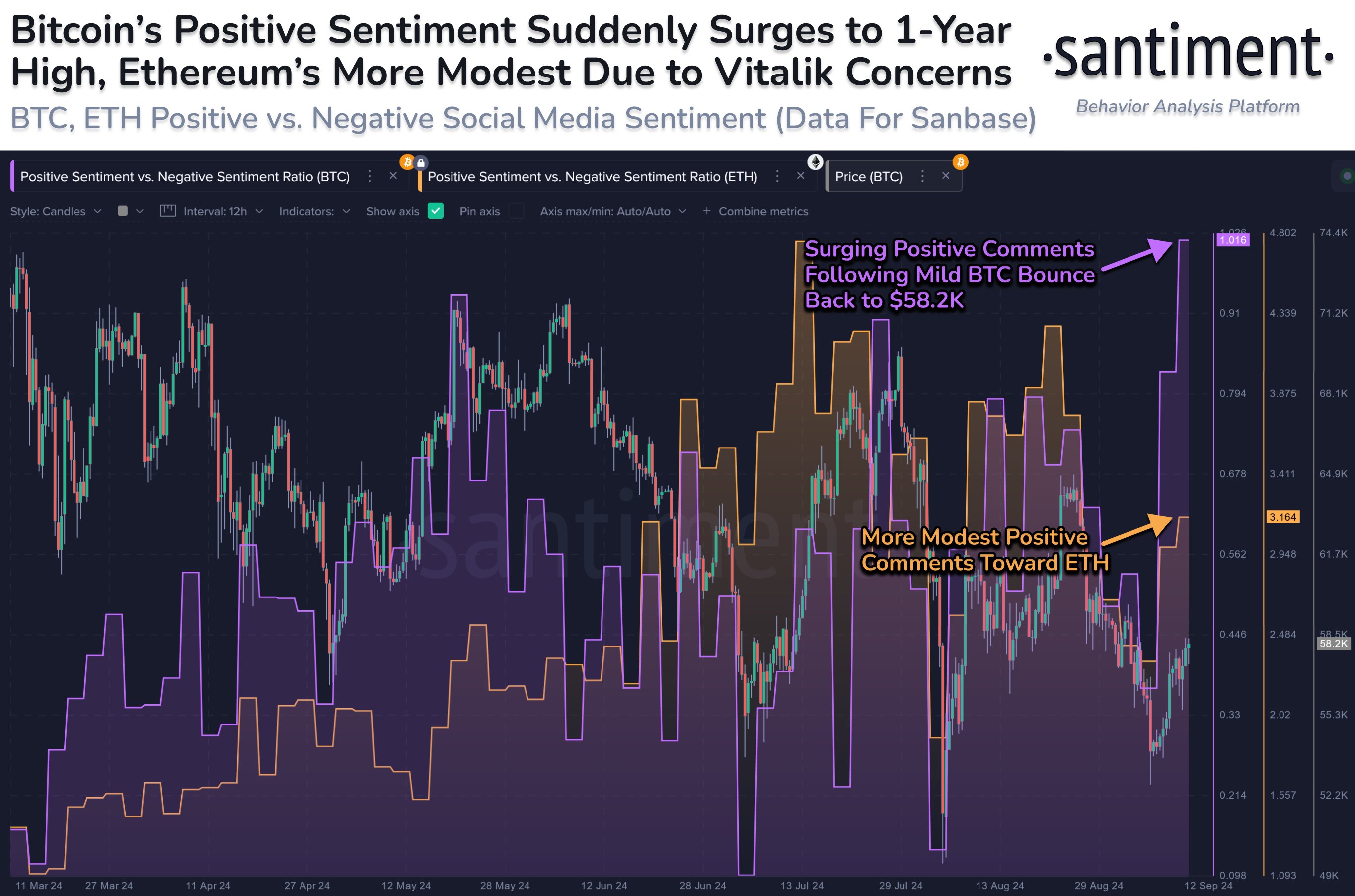

Social media data from Santiment reveals that the number of keywords related to selling has outpaced the number of keywords related to buying. “It is fairly typical to see this kind of rapid sentiment shift in a quick price surge,” said Santiment.

Market Sentiment by SantimentSeveral crypto analysts share the bullish outlook for Bitcoin, with many anticipating a steep price decline for BTC.

Bitcoin Retracement Forthcoming?Thomas Thornton, the founder of Hedge Fund Telemetry, said that Bitcoin is getting excessively “overbought.” He went on to explain that the flagship cryptocurrency is currently showing “sell” signals.

After analyzing the relative strength index (RSI), the TD sequential indicator, and a proprietary metric, the chartist is confident that Bitcoin is bound for a bearish impulse.

BTC/USD chart. Souce: TwitterAs such, the trading veteran has exited his long Bitcoin positions and has continued to warn other investors about a potential retracement.

Meanwhile, TraderXO maintains that Bitcoin has been contained within a descending parallel channel since late June 2019.

Since then, each time BTC rises to the upper boundary of the channel it drops down to hit the lower boundary, and from this point, it bounces back up again.

The bellwether cryptocurrency surged 136% since March, pushing BTC back up against the upper boundary of the channel. The barrier looks to have rejected Bitcoin from advancing further, which could result in a drop towards the middle of the channel, according to TraderXO.

Right now, this lower support barrier is hovering around $6,000.

BTC/USD chart. Souce: TwitterThis pessimistic outlook coincides with crypto-analyst Tone Vays’ predictions. As with other bearish analysts, the Wall Street trader argued that the cryptocurrency market is getting overheated.

As a result, Vays expects prices to revisit the 50-day moving average, which sits at $7,000.

Trader @ToneVays is still a confident $BTC bull, but markets can overheat temporarily, so he is expecting a pullback for #bitcoin.

Check out the full video, where Tone looks at $BTC, #stocks & #commodities:https://t.co/gAulL6g8PI pic.twitter.com/TJtq10YaOH

— Bloxlive.TV (@BloxliveTV) April 30, 2020

The different views must be taken with caution, however, since the cryptocurrency market is hard to pin down. While the signals seem bearish in the short term, long term the fundamental reasons to stay in Bitcoin look sound.

Regardless of whether a trader is bearish or bullish, sound risk management is critical during these times of volatility. For most, trading without leverage, or staying out of the market entirely right now, is a sound recommendation.

The post What the Future Holds for Bitcoin, Analysts Weigh-In appeared first on Crypto Briefing.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|