2019-12-17 18:45 |

There is no way that you don’t have an opinion on this if you have been involved with cryptocurrency. The contest between Ethereum Classic and Ethereum is both an ideological and ethical one. It is important for us to know a little bit of history before we start explaining the basic difference between the two and drawing our own conclusions.

For us to arrive in this conjecture, a lot of things needed to happen. This all started as an attempt to rescue investor funds in a high-profile project. However, it has resulted in a schism that has effectively split the community on the second-largest public blockchain. Let’s check out some of the most critical points in not just Ethereum history, but cryptocurrency in general.

This article is going to discuss any question user you have regarding Ethereum Classic (ETC). It’s important to understand the events that lead to its creation – the DAO hack and the hard-fork, in order to understand why and how ETC has come into existence.

The Formation of The DAO (The Decentralized Autonomous Organization)Ethereum started out as a single token following the same consensus rules, and the entire ecosystem of Ethereum works on the basis of smart contracts. To put it in layman terms, smart contracts are automated contracts that enforce and facilitate the terms of the contract itself, and they are basically how things get done in the Ethereum eco-system.

The DAO was a complex smart contract which was going to revolutionize Ethereum forever. It received large amounts of investment, and around 12% of all ether at the time was tied in this contract. It was basically going to be a decentralized venture capital fund which was going to fund all future DAPPS made in the eco-system, and the way it worked was pretty straightforward.

You would have to purchase “DAO Tokens” for a certain amount of Ether if you wanted to have any say in the direction DAPPS that would get funded. The DAO tokens were indicators that you are now officially part of the DAO system and that you have the right to decide democratically how The DAO should disperse the funds.

But the question is, how were DAPPS going to get approved and built? Well, first they need to get whitelisted by the curators. The curators are basically known figureheads in the Ethereum world. They will get voted on by the DAO token holders after getting their stamp of approval. They will get the required funds to get started if the proposal gets a 20% approval in the vote.

The potential of the DAO and the complete transparency, control and flexibility that it offered was unprecedented. So people leaped in to get their share of the pie. It accumulated over $150 million worth of ether in a crowdsale within 28 days of its formation, and at that time, it had 14% of all ether tokens issued to date.

That’s all good, but how does one go out of the DAO? How do you opt out of the DAO if some DAPP gets approved that you are not a huge fan of? An exit door was created to enable this. The exit door was called the “Split Function,” and using this function, you would get back the ether you have invested. Also, you could even create your own “Child DAO.” In fact, you could split off with multiple DAO token holders and create your own Child DAO. After that, you could start accepting proposals.

However, there was one condition in the contract. You would have to hold on to your ether for 28 days after splitting off from the DAO. After 28 days, you could spend them. So everything looks great and spiffy for now.

However, there was one little problem and many people saw this possible loophole and pointed it out. The DAO creators assured that this was not going to be a big problem, but the only thing is, it was. Just as votes were starting to be held, The DAO was hacked, attacked or otherwise compromised. This created the entire storm that split Ethereum into Ethereum and Ethereum Classic.

The DAO AttackSomeone exploited this very loophole in the DAO on 17th June 2016, and siphoned away one-third of the DAO’s funds, which is about $50 million. The loophole that the hacker(s) discovered was pretty straightforward in hindsight, and this attack took the form of one individual withdrawing these funds and moving them to a separate account.

Ethereum developers were in a rush to remedy the situation. They proposed that the blockchain be modified in such a way that the money could be reclaimed.

This was met with some opposition. So as a compromise, the blockchain was replicated so the original Ethereum could remain intact.

However, there were a few members of the Ethereum community who didn’t agree with the change. They insisted that for a blockchain to remain secure and tamper proof, it could not be changed.

The community was divided on the solution due to the substantial investment in the DAO running into the multi millions, all of which stood to be lost to a hacker. Some wanted to leave the network, and if one wished to exit the DAO, they can do so by sending a request. Here are the two steps that the splitting function will follow:

Ether is given back to the users in exchange of their DAO tokens.The transaction is registered in the ledger and the internal token balance is updated.The hacker made a recursive function in the request, so this is how the splitting function went:

The DAO tokens are taken from the users and they are given the Ether requested.The recursive function made the code go back and transfer even more Ether for the same DAO tokens before the transaction could be registered.This went on and on until $50 million worth of Ether were taken out and stored in a Child DAO. The hacker stopped draining The DAO for unknown reasons. The Ethereum community and team quickly took control of the situation. After that, they presented multiple proposals to deal with the exploit. However, as you would expect, pandemonium went through the entire Ethereum community.

Note: Let’s make one distinction clear before we continue with the article. The hack did not happen because of any problems in the Ethereum itself but because of a problem in the DAO. The code written for The DAO had multiple bugs. One of them was the recursive call exploit.

Another way to look at this complex problem is to compare Ethereum to the Internet and any application based on Ethereum to a website – It doesn’t mean that the Internet is not working if a website is not working. It simply means that one website has a problem.

Aftermath of The DAO AttackEthereum is in no shape or form to blame for what happened with the DAO. However, the attack shattered the trust that people had in cryptocurrencies in general. People were openly eulogizing, and the price of ether dropped from $20 to $13.

The hacker did take away $50 million worth on Ether. However, it was still sitting in the child DAO. He couldn’t access them because the DAO smart contract explicitly stated that any of the invested ether taken out of the DAO wouldn’t be accessible for 28 days. With this in mind, the Ethereum community and team decided to take action and presented three proposals to deal with the exploit:

Nobody Does AnythingSoft ForkHard ForkNobody Does Anything

Ethereum is supposed to be immutable, so some people argued that making any changes will go against the very nature and underlying philosophy of Ethereum itself. After all, “code is law.” However, many people weren’t happy with this and the majority voted on going with a Soft Fork.

The Soft ForkThere are two ways of updating a chain – a soft fork or a hard fork. A soft fork was voted on in order to prevent the hacker from cashing in the Ether from his child DAO after the standard 28 days. This soft fork was designed to blacklist all the transactions made from The DAO, and you should think of it as an update in the software which is backward compatible. But what does this mean?

Suppose you want to open a spreadsheet built in MS Excel 2015 but you are running MS Excel 2005 on your laptop. It can still be opened because MS Excel 2015 is backward compatible.

But, there is a difference, because all the updates that you can enjoy in the newer version won’t be visible to you in the older version. Going back to our MS Excel analogy again. Suppose there is a feature which allows putting in GIFs in the spreadsheet in the 2015 version. Those GIFs won’t be seen in the 2005 version. This means that you will see the text but won’t see the GIFs.

That is basically what Ethereum planned to do with their blockchain. A soft fork wherein it’s your choice whether you want to update or not, but regardless the updated users and the non-updated users could still interact with each other.

The idea was to completely lock down the ether that the hacker stole by ignoring and segregating any blocks which contain a transaction that will help the hacker move around the stolen ether.

This seemed like a great plan and majority of the Ethereum community was on board and it was really close to being introduced. However, a problem surfaced, a problem which brought the entire community to another predicament. A few members of the community found a bug with the implementation few hours before it was supposed to be released. This opened a denial-of-service (DoS) attack vector. The fact that such a soft fork is not possible to implement means that the Ethereum blockchain is immune to transaction censorship.

What is The Soft Fork DoS?Any and all mining activities are rewarded by “Gas” in the Ethereum ecosystem, which is the primary way by which miners are protected from DoS attacks. Suppose an attacker wants to attack the network and he decides to flood it with transactions that require complex computations. The miners can then sit down and execute these computations.

They will get a Gas score even if they fail to complete the computations successfully. The score will be equivalent to a number of computations that they have done. This means that more time consuming and difficult the computation, the more Gas will be collected. At the same time, the attacker will have to spend a lot of their own money to make these attacks.

But what happens is, the attacker will find a run around this system the moment this soft fork gets implemented. Now the attacker can flood the network with transactions which interact with the DAO.

This make the miners do endless difficult computations for little to no Gas price and at no monetary expense to the attacker. In fact, the attacker can even set a high Gas price to trick the miners into solving a malicious computation.

The Hard ForkThe Hard fork was a more conclusive solution that was put up for vote. The primary difference between a soft fork and hard fork is that the hard fork had the sole function of returning all the Ether taken from the DAO to a refund smart contract.

The new contract would have only one function – withdraw, and once it is utilized, there is absolutely no going back whatsoever. You do not get access to any of the new updates or interact with users of the new system if you do not join the upgraded version of the blockchain.

The way the hard fork is supposed to work is that it’s a branch which separates from the main block chain at a particular point (right before the DAO attack in this case). Up until that point (block 1,920,000) the old chain and the new chain is the same. However, the two chains become completely different entities immediately after the hard fork. The name of the new chain was “Ethereum” or “ETH” for short.

The main reason why this hard fork was formed was to refund all the money which has been taken from everyone by the DAO via a refund smart contract that had the only one function – “withdraw.”

The DAO token holders can request to be sent 1 ETH for every 100 DAO, and the investors who had paid more than 1 ETH for 100 DAO could request the difference from the original address. This proposal caused a huge controversy in the community. There was a split and the people who were “Anti-Hard Fork” refused to change to the new blockchain and decided to remain in the old block chain. They named it “Ethereum Classic” or “ETC” for short.

And this is where we come to the battle between ETC and ETH. This battle is raging on in the Ethereum community as we speak, and it is fascinating because it’s an ethical and an ideological one. Gavin Wood, the co- founder of Ethereum, has called this very moment “the single most important moment in cryptocurrency history since the birth of Bitcoin.” So let’s examine both of them in detail.

Buying & Storing ETCIf you’re looking to buy ETC it is listed on nearly all the major exchanges, and most of the smaller exchanges as well.

Register at Binance or Coinbase and Buy ETC Tokens

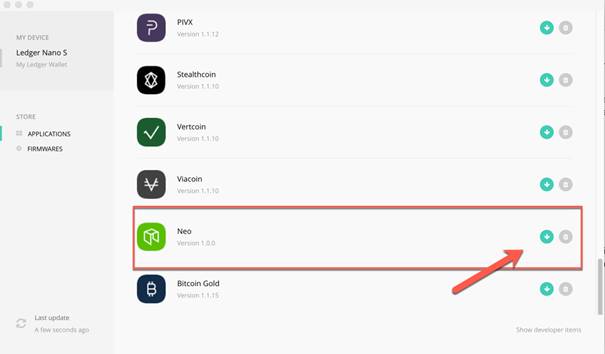

Once you have bought your ETC you are going to want to send it off the exchange and keep it in a secure crypto wallet. There are a host of wallets that support the token. We have covered a list of the best Ethereum classic wallets which will no doubt have the right wallet solution for you.

The Difference between Ethereum Classic and EthereumPeople who were opposed to the hard fork decided to stick with the original chain. They named it “Ethereum Classic” or “ETC.”

Here is a full comparison between ethereum and ethereum classic.

All the Ethereum heavy hitters, including founders Gavin Wood and Vitalik Buterin, moved onto the new chain. So, why did people stick with an old chain? Well, the answer to this question is a more philosophical one – when Ethereum, and cryptocurrency in general, was introduced, it was supposed to be a stance against financial corruption. They wanted the system to be resilient against human whims and that’s the reason why the blockchain was made immutable.

This is the reason why the hard fork is a convenient cop-out to many ETC sympathizers. If you are changing the entire chain by one hack then that completely defeats the purpose of Ethereum in the first place. You are proving that the blockchain can be affected by human whims, and this has resonated with a lot of “crypto-idealists.” Some pretty big hitters have gotten behind ETC. Barry Silbert, the CEO of Grayscale, is one of them.

Now, all that sounds well and good. However, there are some issues with Ethereum Classic that simply cannot be ignored.

The Issues with Ethereum ClassicThe lack of backward compatibility with the Ethereum Hard Fork is the main issue with the ETC. All the heavyweights of the Ethereum community have moved on to the new chain. This means that anyone who is part of the Ethereum Classic won’t be able to access any of the updates done by the Ethereum, and the perfect example is Ethereum’s move from Proof of Work (PoW) to Proof of Stake (PoS). Ethereum Classic won’t be able to implement that. The main reason for that is that their software simply doesn’t allow the use of updates.

However, that’s not the end of it. There are far more nefarious issues with Ethereum Classic, some of which borders on conspiracy. Many people consider Ethereum Classic to be an attack against Ethereum itself. But what does this mean? Post hard fork, when the community was split and vulnerable, many people claim that the anti-Ethereum camp openly supported Ethereum Classic. They did it just to cause disruption in the community.

Is ETC a Good Investment?Truthfully, it is difficult to answer this question. ETC has been benefiting from the buzz created by its prior. However, no one knows whether that buzz will die out.

It could still go up right now, but there is no promise of a future.

It is important to note that a similar thing happened to Bitcoin in 2016, with the development of Bitcoin Classic. Bitcoin Classic never beat out Bitcoin. However, the concept of it is alive and well, tended to by a cult following on a Bitcoin subreddit.

The Ethereum Classic team currently has four developers, according to its lead organizer, named Arvicco. However, theoretically, anyone can join. ETC is supported by an open-source community, just like ethereum itself. ETC does have a strong mining base. Many miners are devoting computing power with hopes of a payday.

It is also worth noting that the blockchain is not merely being supported for ideological reasons and that there is a growing number of Ethereum miners who have devoted computational power toward the classic blockchain, because they see a value in securing its transactions and winning the associated mining rewards.

Also, many notable developers, including original Ethereum CEO Charles Hoskinson, have also offered to help with Ethereum Classic.

All these factors speak to the currencies potential, but progress will be stalled when it is competing against a larger, more well-known version of itself.

But If You Want To Invest in ETC

Ethereum is currently more profitable, because its beloved blockchain technology and massive corporate backing allowed it to leap ahead of its clone.

However, the interesting fact is that Ethereum Classic has already made a handful of investors a boatload of money.

Any current Ethereum fund holder had their money replicated when the fork happened, which means if you had $20 dollars on ETH, you will have $20 dollars on ETC without paying more. Those investors have gone on to make money simultaneously, on both Ethereum and Ethereum Classic.

Unfortunately, this opportunity is lost to new investors. They will have to invest in the coins separately. However, many investors still choose to invest in both currencies.

Coinbase does not allow investors to invest in ETC. However, you can invest through Poloniex and Kraken.

Ethereum Hard Fork or ETHETH is the result of the hard fork. It is now considered the “new Ethereum.” According to CoinMarketCap, ETH stands at $260.94. Let’s take a look at what the graph looks like:

The market cap for ETH currently stands at a staggering $24 billion. ETH is currently the second most expensive cryptocurrency in the world (bitcoin is the first).

No matter what the detractors say, ETH is the new form of Ethereum. ETH happens to be the one going through the most revolutionary changes (like the aforementioned switch from POW to POS). Also, the original heavy hitters are all part of the system. ETH was formed for one reason and one reason only. The reason is to return the funds stolen by “the DAO attacker” back to the rightful owners.

ETH represents a victory for the Ethereum community. They came together after facing the worst hack in cryptocurrency history. They stuck together and made something that is stronger than its predecessor.

But having said that, as we have already mentioned, there is an issue with ETH. This issue is an ideological one, according to Pro-ETC fans.

The Issues with ETH

The formation of ETH goes against the idea of the immutability of the blockchain and the philosophy of “code being law.” We have already mentioned that. The hardfork was a cop out from Ethereum in the eyes of anti-ETH people, and they should have accepted the main blockchain for what it was.

Another problem raised and the community has tons of questions. How was anyone going to know for sure that no more hard forks were going to take place in the future subject to human whims and what if there are multiple hard forks creating different versions of Ethereum? What if there are hundreds or thousands of different versions of Ethereum running at the same time, wouldn’t that considerably devalue it and cryptocurrency in general?

The Pros and Cons of Both Ethereum and Ethereum ClassicEthereum Classic

PROS:Ethereum Classic has been offered help by many notable developersETC stays true with the philosophy of the immutability of the blockchainCONS:Ethereum Classic is known to be full of scammersIt is considered an attack and an insult on the Ethereum communityMost of the builders and heavyweights of the Ethereum have moved on to ETHETC doesn’t have access to all the new updates made in the ETH chain (for example the move from Proof of Work (PoW) to Proof of Stake (PoS))

Ethereum

PROS:ETH is great and powerful example of what the Ethereum community is capable of when it comes together to solve an issueETH has a higher hash-rate than ETCIt is being constantly updated with the latest changesETH has reversed the DAO hack and given back the stolen money to the DAO token holders (its rightful owners)ETH has the majority of original developers who have created Ethereum in its cornerIt is growing at an exponential paceETH is backed by a powerful group of over 200 corporations called the Enterprise Ethereum Alliance (EEA). This group aims to use the blockchain technology to run smart contracts at Fortune 500 companies. Members include ING, Toyota, JP Morgan, Microsoft, etc.CONS:ETH stands against the policy of immutability

The Reasons Why You Should Support ETH

We have examined the differences between ETC and ETC in detail and glanced over the history of Ethereum itself. After reading this article, which camp do you lean towards? It goes without saying that you should be in camp ETH if you want to be part of history and want to support the Ethereum community. There are enormous holes in the arguments of the anti-ETH people. Let’s examine them.

Argument #1: This could be the beginning of numerous hard forks

There is one major reason why this argument is unfounded – The Ethereum community is democratic and decentralized, and you cannot make major decisions like that unless the majority of the people agree to it.

Argument #2: ETH goes against blockchain immutability

It is true that the hard fork went against the immutability. However, the circumstances around the change have to be considered. The DAO attack stole one-third of the DAO’s ether supply. This in turn had 14% of the world’s ether. Something needed to be done after such an attack to make sure that justice was carried out. That is exactly what the DAO fork achieved. It greatly devalued the amount of ether held by the attacker, and it also reimbursed every DAO token holder as well.

ConclusionEthereum has made a strong and spectacular comeback from a total disaster. It looks like it’s going fulfill all the expectations that people had had in it when it began. The true power of Ethereum lies in its full scope. It is not just a currency. Ethereum is a platform on which people can build projects that will dictate the future, and if decentralization is indeed the future, then Ethereum is going to be in the front and center of it.

Now, the big question: What does this mean for Ethereum (ETH) and Ethereum Classic (ETC)? ETH has all the lead developers on its side, and it is only going to get better with the backing of the EEA. The value of any currency comes from the trust that people have on it, and the trust in ETH is only going to grow because of all these factors. ETH is going to grow from strength to strength and many experts predict that ETH will be the first cryptocurrency since Bitcoin to break the $1000 barrier.

Sadly, the same can’t be said for ETC. ETC is always going to be black sheep of the Ethereum family in the eyes of the people. As of right now, ETH is about 15 times more valuable than ETC. The situation isn’t going to get any better soon. Also, the fact that ETC is known to be full of scammers only reduces the trust that people have in it. This in turn decreases its value. Is this mean that ETC is going to completely disappear from the market? Of course not. Does ETC have much growth potential? Maybe yes, maybe no. ETC has chosen to keep their chain and move forward. That’s the beauty of free capitalism and blockchain mechanics.

The future is bright for ETH, and it is a living proof of what the Ethereum community is capable of. They faced a serious crisis. However, they stuck together and came up with a truly elegant solution. ETH is the future and it will keep on growing. If you are an Ethereum supporter and you believe in what it stands for, then you should definitely be in camp ETH.

Good luck and happy investing!

The post What is Ethereum Classic (ETC)? Complete Guide for Beginners appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|