2025-1-29 22:24 |

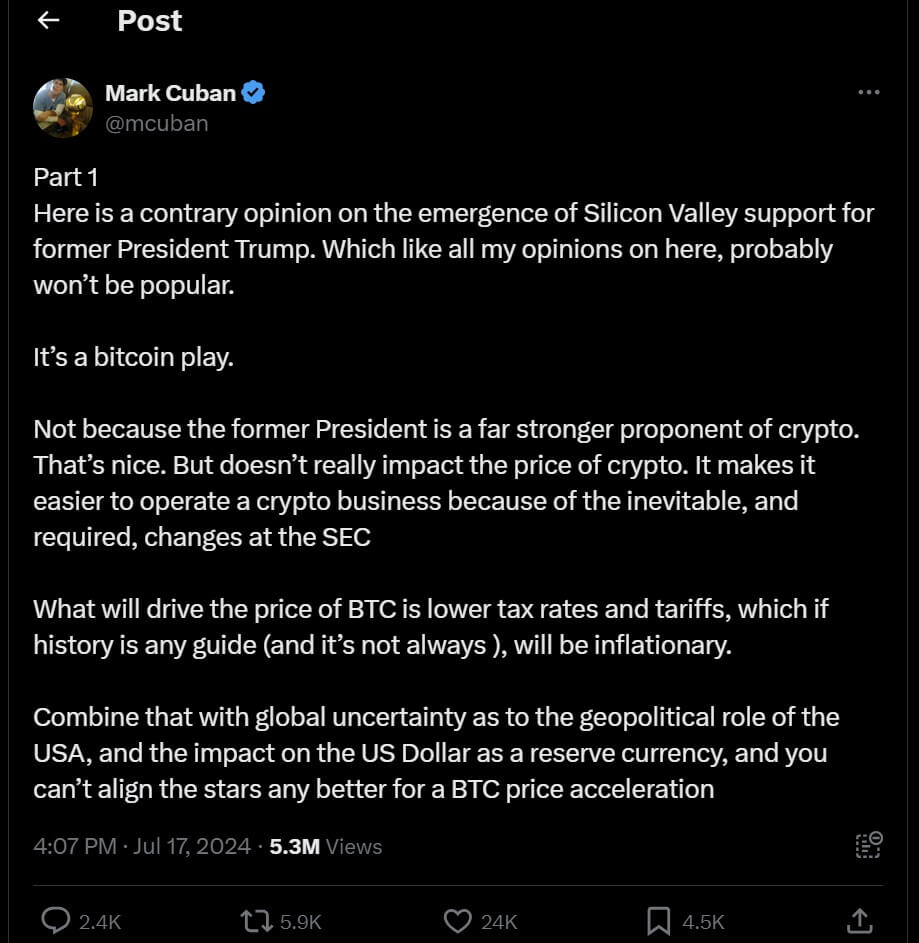

Things have changed now, and I don’t think people have truly grasped the scope of that change. For all his flaws, and complete lack of personal care on the subject, a sitting President has made promises to act favorably towards this space from a regulatory point of view. Obviously, many of the things he will do will wind up being detrimental to this space, and much of it will be favorable to other projects besides Bitcoin.

Yet still we argue and bicker like children. It boggles my mind how many people seemed to think it was just taken for granted that any government stockpile of digital assets would include only Bitcoin. The Trump campaign received money from numerous camps in this space, not just Bitcoiners, has a history of multiple NFT projects on Ethereum, and has no deep understanding of this space or any of the technology developed in it.

Why would he see Bitcoin as any different than everything else in this space except being the oldest and biggest?

That’s better than most average Americans. Most people in the US don’t even appreciate any difference between Bitcoin and other cryptocurrencies. They see the entire ecosystem as just a bunch of degenerate gamblers and crooked insiders profiting from the gamblers. Arguing over Bitcoin versus other cryptocurrencies in a reserve fund to most people is like arguing over which fast food restaurant you are going to. You’re eating shit food no matter what.

Everyone is focusing on these irrelevant internal arguments over Garlinghouse and Ripple, why a reserve should only be Bitcoin, etc. You are all ignoring the much more important issue looming over everything: your average person doesn’t see the difference between Bitcoin and everything else.

They are going to see any reserve holding any asset by and large as a complete waste of public money. A reserve will create a large amount of resentment, it will be seen as early adopters weaseling up to the President to have him pump their bags. That’s the wider reality everyone is ignoring, and one of the many reasons I am against any type of reserve that actively accumulates bitcoin.

Arguing with shitcoiners, or even former Congressmen, over what should go into a reserve fund is putting the cart before the horse. Politics is driven by two things, money and popular sentiment. The shitcoiner money isn’t going away, so that leaves getting across to normal people the difference between Bitcoin and other cryptocurrencies.

Without that public support, such arguments are going to likely fall on deaf ears.

This article is a Take. Opinions expressed are entirely the author's and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

origin »Bitcoin price in Telegram @btc_price_every_hour

Global Currency Reserve (GCR) на Currencies.ru

|

|