2020-2-14 11:42 |

The Ethereum price is up a staggering 120 percent year-to-date from $126 to $278. It has front-run Bitcoin and the rest of the crypto market as one of the best performing cryptocurrencies of the year.

The 3 factors behind the Ethereum rallyThe most obvious factor behind the upsurge of Ethereum is that it has been oversold in the latter half of 2019. Ethereum dropped to as low as $115 in December 2019, leaving ETH down by around 91 percent from its record high.

As the cryptocurrency market generally started to rebound in anticipation of the bitcoin block reward halving in April, the Ethereum price started to pick up momentum. The oversold nature of ETH combined with the highly anticipated release of Ethereum 2.0 and the rapid growth of the decentralized finance (DeFi) market.

DeFi is crucial for the mainstream adoption of Ethereum because it utilizes ETH as the main collateral. On DeFi platforms like BlockFi, users can issue loans, process payments, and virtually carry out all tasks a traditional financial institution can in a decentralized setting.

ETH 2.0 supplements DeFi as it increases the overall efficiency of the Ethereum blockchain network through various technologies like second-layer scaling solutions and proof-of-stake (PoS).

Over $1 billion worth of ETH is now used as collateral on DeFi platforms, which indicates actual significant real-world usage of Ethereum.

In previous bull cycles, there was criticism that Ethereum and decentralized applications (DApps) on top of it lack actual users and user activity.

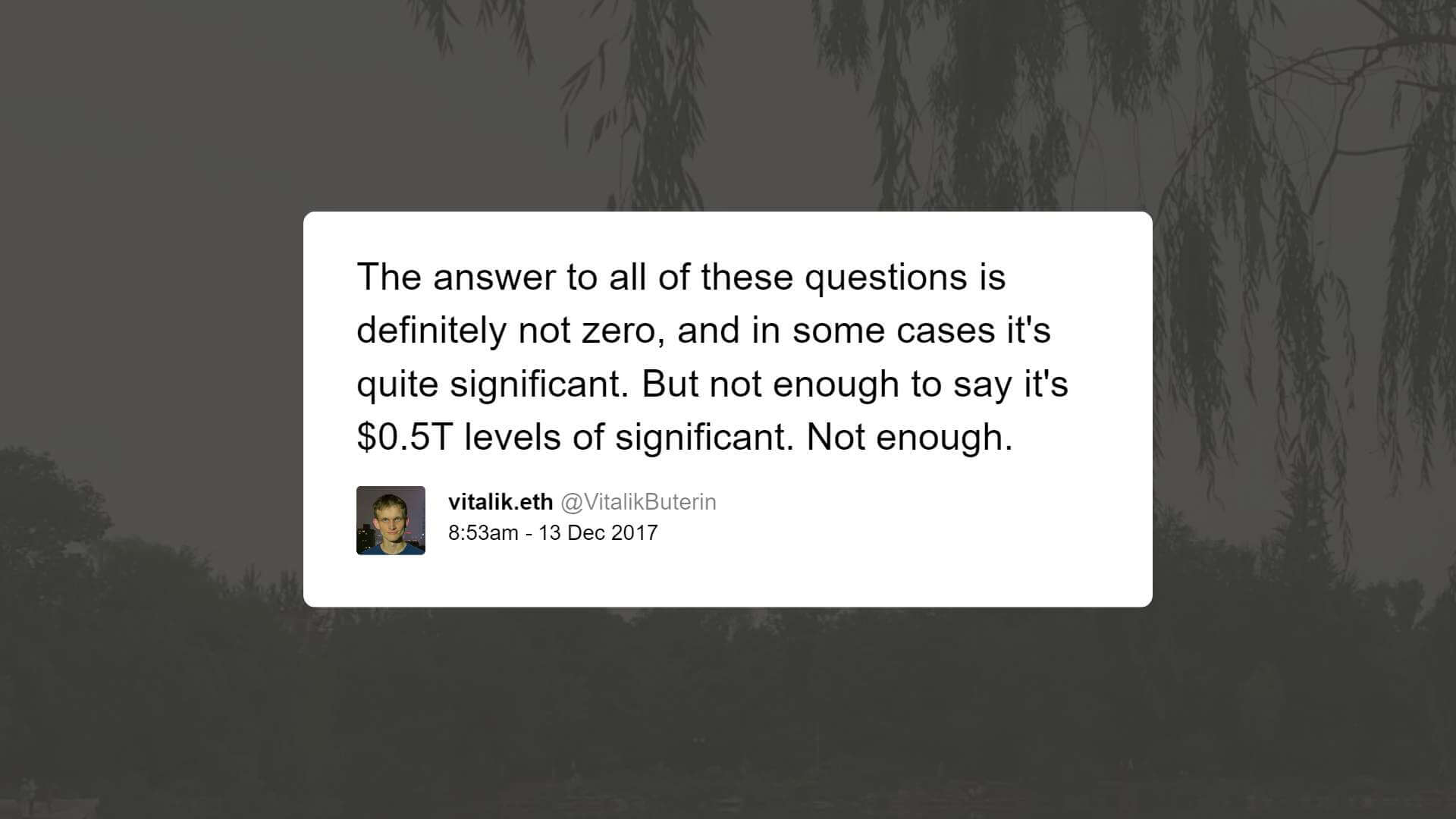

Ethereum co-founder Vitalik Buterin said in December 2017:

“So total cryptocoin market cap just hit $0.5T today. But have we earned it? How many unbanked people have we banked? How much censorship-resistant commerce for the common people have we enabled? How many dapps have we created that have substantial usage? Low added value per user for using a blockchain is fine, but then you have to make up for it in volume.”

Since then, the entire cryptocurrency market has improved in terms of infrastructure, user activity, and mainstream adoption.

The high expectations of faster growth in the DeFi market put together with the imminent release of scalability solutions are the two major fundamental factors backing the recent upsurge.

Ethereum co-founder Vitalik Buterin talks about the lack of adoption in the crypto market in 2017 Seeing venture capital interestOn Feb. 13, Bloomberg reported that crypto lending platform BlockFi raised $30 million from a group of venture capital firms including one supported by billionaire Peter Thiel. The fast expansion of the lending market is starting to garner the interest of top venture capital firms and thus the mainstream, which is a positive factor of growth for Ethereum in the medium to long-term.

The post What fundamental factors are backing the 120% Ethereum rally, and can it last? appeared first on CryptoSlate.

origin »Ethereum (ETH) на Currencies.ru

|

|