2021-1-22 21:50 |

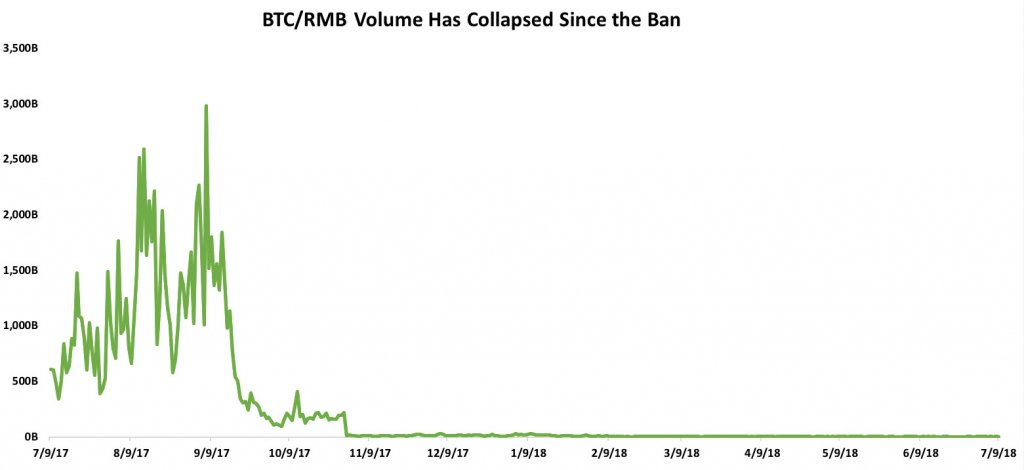

The Chinese government hasn’t been too kind to cryptocurrencies in the past years. First, initial coin offerings (ICO) were banned in China in September 2017. Then, following the crackdown on ICOs, exchange platforms that traded cryptocurrencies or provided facilitation services were also ordered to be closed. This made the task of purchasing bitcoin almost impossible for investors in China.

However, this was not merely a blanket ban. It was a preparation for things to come.

To understand the harsh attitude of the Chinese government toward cryptocurrencies, we have to look at the big picture of China’s economy and financial market.

While central banks worldwide grapple with the rise of bitcoin and their inability to control it the way they do fiat currencies, China is working toward becoming the first country to implement its own digital currency, also known as the Digital Currency Electronic Payment (DCEP) project.

By forbidding other entities in issuing their own cryptocurrencies through the ICO ban and limiting the exchange of bitcoin, the People’s Bank of China (PBOC) is securing the success of its own forthcoming digital yan. Furthermore, unlike cryptocurrencies such as bitcoin, dealing in the digital yuan won’t protect any presumption of pseudonymity, and its value will be as stable as the physical currency issued by the government.

China Racing Toward A Cashless SocietyChina wants to become the first nation to issue a digital currency in its push to internationalize the yuan and reduce its dependence on the global dollar payment system.

According to Reuters, an article published in China Finance, a magazine run by the PBOC, stated that the rights to issue and control a digital currency would become a “new battlefield” of competition between governments.

As part of the project, the PBOC defines the yuan as both physical banknotes and digital currency. The idea is to establish a new payment system network in order to break the dollar monopoly.

To this end, digital yuan tests are already underway. Several trials have taken place in four cities, namely Suzhou, Shenzhen, Chengdu and Xionggan, and at the venue for the 2022 Winter Olympic Games in Beijing.

How Is The Digital Yuan Being Tested?As of September 2020, the PBOC had issued 10 million yuan ($1.5 million) worth of digital currency and distributed it to 50,000 people in the Shenzhen area via a lottery.

The winners were rewarded with digital “red packets” worth about 200 yuan, which they could download and spend at 3,000 different stores. With nearly 2 million people signing up for the contests, the operation was deemed as successful.

At the beginning of November, PBOC’s governor indicated that four billion transactions, accounting for $299 million, had been conducted using the digital yuan.

The DCEP payment network allows selected users to convert between cash and digital money, check their account balances and make payments and remittances. Other experiments include government employees receiving transport subsidies in the form of digital currency, and McDonald’s in Xiong’an accepting payment with digital yuan.

However, there’s still been no official announcement of when the payment network will be made available to all Chinese citizens.

Will The Public Accept PBOC’s Digital Currency?It’s difficult to make a prediction. The returns from the tests have been quite positive from the public, with people signing up in droves for the lottery.

However, China is already becoming an increasingly cashless society. Even street-food vendors and market stalls in small towns prefer to use payment apps instead of cash.

Mobile wallets such as Alipay and WeChat Pay already have large userbases in China, and it is unlikely that people will switch to the government app overnight. However, it has been reported that, in contrast to these payment processors, there will be no fees involved with the digital yuan.

Digital Yuan Vs. BitcoinWhile the digital yuan has the backing of the PBOC, there are several ways in which it cannot complete, technically, with bitcoin. Chiefly, it is not decentralized (and therefore not much different than the paper version of yuan) and will not leverage a public, immutable blockchain ledger as Blockchain does.

There are two main reasons why the PBOC is not willing to run their digital currency on blockchain: First, experts have doubts that any network could handle the sheer volume of daily transactions of China’s population of 1.4 billion. Second, the decentralization and transparency inherent in blockchain technology are two concepts that go against the Chinese government’s goal to “strike a balance” between anonymity and the need to crack down on financial crimes, according to the central bank’s officials.

The digital yuan could allow the PBOC to control bank lending more closely and to direct funding where it deems appropriate, but a central-bank-controlled digital yuan will never truly compete with the value propositions of Bitcoin.

The economic impact of the forthcoming DCEP is still unclear, and only the future will tell if centralized digital currencies will help or hinder China’s economy. What is clear is that this is a new chapter in the ongoing battle between the fiat currencies controlled by central banks and bitcoin’s peer-to-peer, pseudonymous offering.

This is a guest post by Judy Smith. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The post What Does The Digital Yuan Mean For Bitcoin? appeared first on Bitcoin Magazine.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|