2024-5-28 18:00 |

Ethereum ETFs have a significant impact on Layer 2 networks like Polygon (MATIC), Arbitrum (ARB), and Optimism (OP). These networks are set to see an increase in adoption as people get more exposed to Ethereum.

Moreso, the growing interest in ETH ETFs could drive people to Ethereum-based tokens like Rollblock (RBLK), a new market entrant that has carved out a new niche in the crypto market as a GambleFi protocol.

Polygon (MATIC) token set to flourish despite bearish performancesSince its launch, Polygon (MATIC) has been a formidable force in the DeFi market. Polygon excels as one of the earliest layer-2 networks. While it is known for its scalability, Polygon offers solutions that focus on enhancing functionality and efficiency in the Ethereum network.

On its impressive platform, Polygon network allows users to execute multiple transactions at the same time without loss of assets and at affordable costs. Although Polygon has exhibited downward tendencies in recent times, the adoption of ETFs in the market is set to contribute to the rise of the MATIC token, making it a top cryptocurrency to buy.

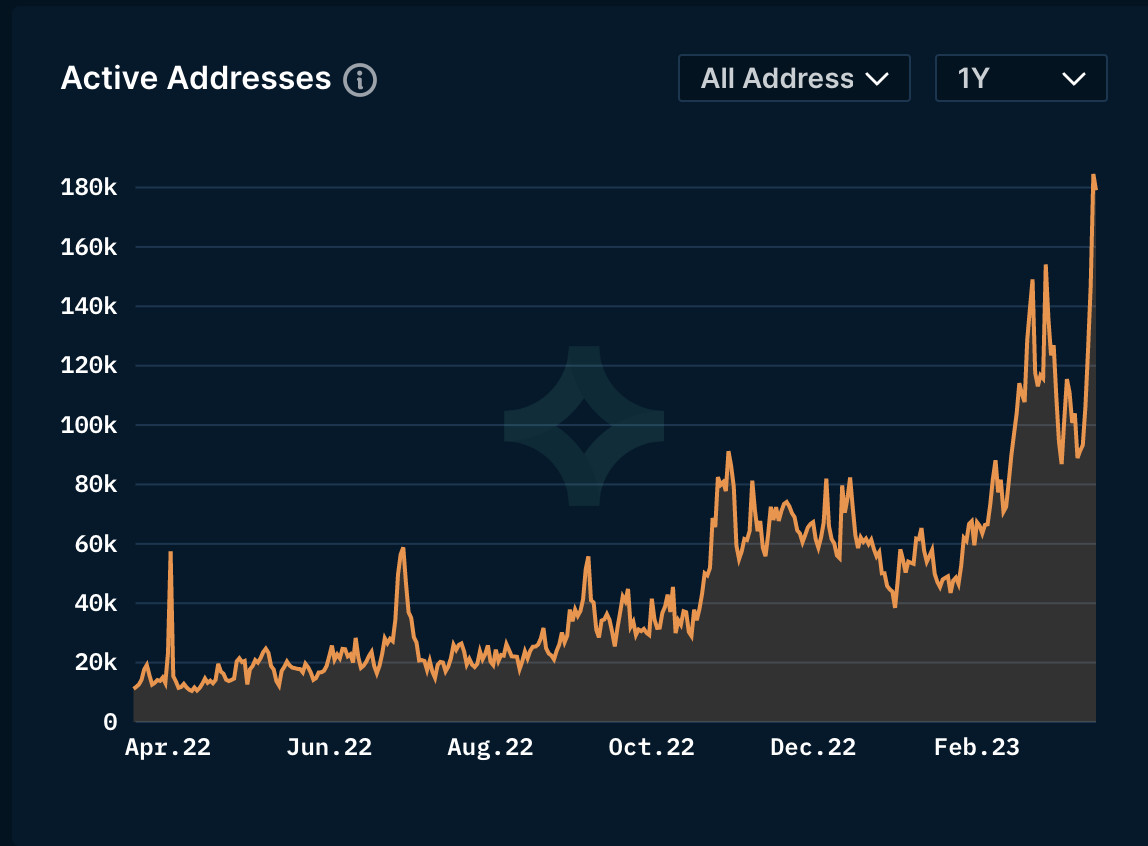

Optimism Network: OP token sees 66% Year-to-Date price surgeBuilt on the Ethereum blockchain, Optimism (OP) has risen to become one of the most recognized tokens in the cryptocurrency market. Notably, Optimism offers a broad range of impressive features including low costs, faster transactions, and a privacy-engaged network.

These features also contribute to OP token’s appeal in the DeFi market, and solidifies its position among the best crypto coins to buy. Meanwhile, Optimism token price has recorded impressive performances, one of which is a 66% surge in the last year. This has garnered widespread attention with the Optimism, OP token, witnessing mass adoption.

Arbitrum Network maintains leading status in the crypto marketRegarded as one of the fastest-growing tokens in the cryptocurrency market, the Arbitrum (ARB) network has demonstrated exceptional performance in the DeFi market. Given its advanced solution, the layer 2 network enables users to carry out transactions seamlessly and without hassle.

As such, the native ARB token has climbed up the rank to become a top DeFi token in the market, boasting a market cap of about $3B and a growing adoption in the past months.

Rollblock (RBLK) revolutionizes the casino world, experts project imminent breakoutRollblock (RBLK) emergence into the crypto market has marked a revolutionary point for the casino world. With an aim to fill in the gap between decentralized finance (DeFi) and traditional online gambling, Rollblock has established a unique platform that introduces DeFi qualities including security, privacy, and scalability as a whole.

One of Rollblock’s most commendable features is its revenue-sharing model. In a bid to repurchase RBLK tokens from the market, Rollblock allocates up to 30% of its weekly income. 50% of these tokens are channeled towards staking rewards. Meanwhile, the rest are burned via a token burn mechanism that boosts the overall value of RBLK, ultimately ranking it among the best crypto coins in the market.

With over 45 million tokens already sold, and a growing community of thousands in its second presale stage, Rollblock is rapidly gaining traction in the presale market. So far, the token has delivered to early buyers 20% ROI after increasing from $0.01 to $0.012. If it maintains this pace, Rollblock is touted to raise up to $1 million in presale revenue before the end of the month.

How will the rise of Ethereum ETFs affect Rollblock’s performance in the DeFi market?With the current frenzy surrounding Ethereum-based tokens, Rollblock (RBLK) is set to witness massive adoption and purchase of its token especially seeing that it is an Ethereum-based token.

The token is expected to ride on Ethereum’s success and increased adoption post the ether ETFs approval in the US and Hong Kong.

The post What does ETH ETFs mean for MATIC, OP and ARB? Is it better to buy Ethereum-based tokens like Rollblock (RBLK)? appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Matic Network (MATIC) на Currencies.ru

|

|