2021-6-16 12:57 |

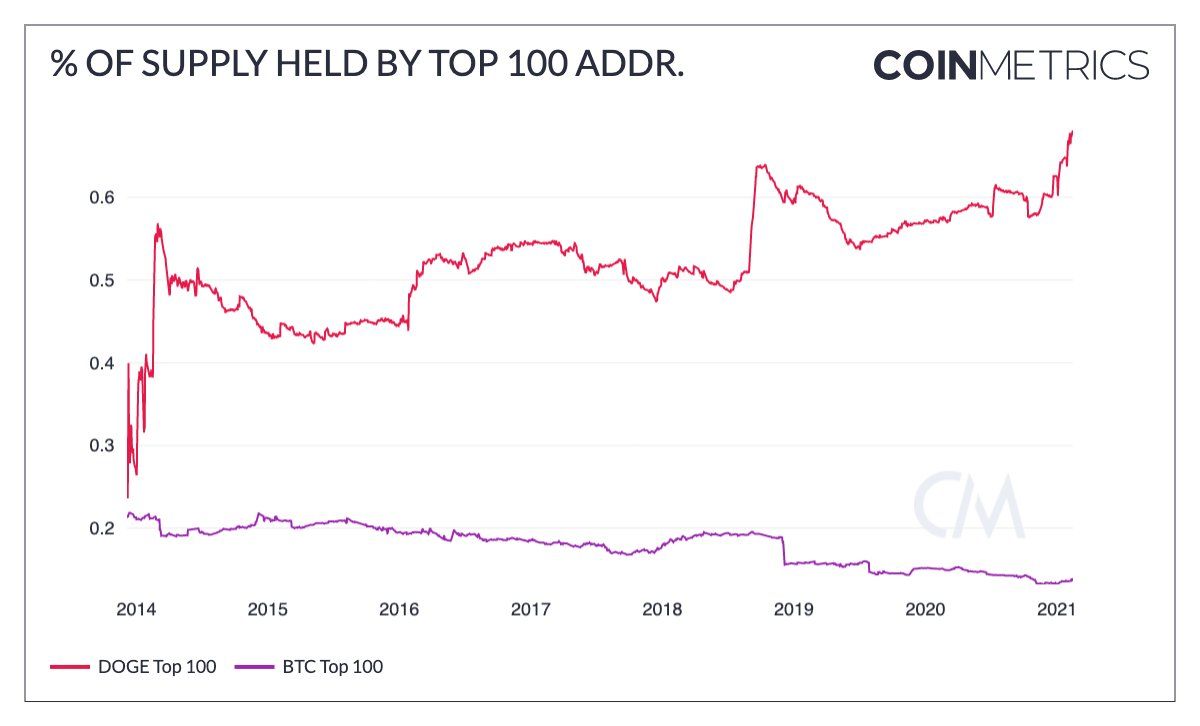

Data provided by a popular analytics company shows that crypto whales have been accumulating Bitcoin recently and now hold almost half of the total BTC supply origin »

Bitcoin price in Telegram @btc_price_every_hour

Interstellar Holdings (HOLD) на Currencies.ru

|

|