2026-1-10 18:00 |

XRP reclaiming the $2.27 level has sparked renewed confidence across its investor base. After years of regulatory overhang and subdued performance, price action is finally reflecting sustained demand. For many long-term holders, the rally feels like vindication—proof that XRP has weathered its storm and remains one of crypto’s most resilient assets.

But while the broader market celebrates the move, a quieter shift is unfolding behind the scenes. On-chain activity suggests that large holders are no longer adding exposure at these levels. Instead, wallets that rode XRP’s recovery are beginning to reallocate capital elsewhere.

At the center of this rotation is Digitap ($TAP), a private banking infrastructure platform currently in its crypto presale. Digitap is increasingly discussed as one of the best cryptos to buy now because capital efficiency is becoming more important than legacy positioning.

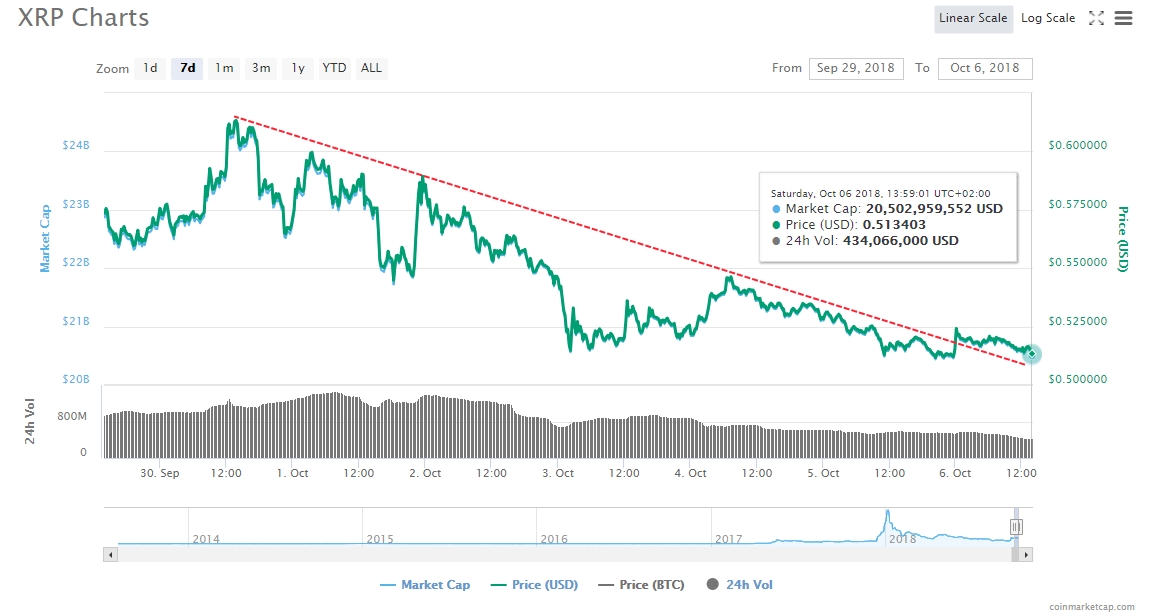

XRP Price Action: Why $2.27 Signals Diminishing Upside, Not Maximum OpportunityXRP’s climb to $2.27 marks a meaningful milestone, but for large holders, it also represents a familiar inflection point. At scale, upside compresses. Each additional percentage gain requires exponentially more capital, while downside risk remains ever-present if sentiment shifts.

For retail investors, a continuation from $2.27 to higher resistance may still feel compelling. For whales managing seven- and eight-figure positions, the math looks different. When an asset reaches maturity, opportunity cost becomes the dominant consideration.

The question is no longer whether XRP can move higher, but whether capital is being deployed where returns are most asymmetric, particularly as investors reassess altcoins to buy with earlier-stage upside.

History shows that this is typically when large holders trim, not because conviction is lost, but because efficiency matters. That pattern appears to be playing out again. XRP remains respected, liquid, and relevant, but its most explosive growth phase is increasingly viewed as already realized.

Beyond Payments: Why Capital Is Prioritising Financial PrivacyXRP continues to play a central role in cross-border payments, but the broader crypto narrative in 2026 is evolving. Speed and settlement alone are no longer enough. Investors are now focused on how capital is stored, accessed, and protected in a world where transparency has become the default, reshaping views on the best crypto to invest in now.

As crypto adoption accelerates, visibility follows. Exchange reporting, wallet analytics, and regulatory oversight are now inseparable from mainstream usage. For everyday users, this shift may feel abstract. For high-net-worth investors, it fundamentally reshapes risk exposure.

This is why whales are increasingly positioning around platforms that combine crypto functionality with private, real-world financial infrastructure. The next phase of value creation is not just about moving money faster but about controlling how visible that money is, where it sits, and how it flows. This is where Digitap begins to stand out.

Everyday Liquidity: Turning Crypto into Usable MoneyOne of crypto’s most persistent challenges has always been liquidity at the point of use. Moving funds between wallets, exchanges, and banks often introduces friction, delays, and unnecessary exposure to intermediaries.

Digitap addresses this problem directly. The platform, already live on iOS and Android, integrates crypto wallets, fiat accounts, international transfers, and card-based spending into a single banking interface. Funds can route through traditional rails such as SEPA or SWIFT or settle via crypto when efficient, with intelligent routing handling the process automatically.

For users, this abstraction changes everything. Crypto stops behaving like an asset that must be exited and starts functioning like money that can be stored, moved, and spent discreetly.

Digitap also creates intrinsic demand through daily financial activity. This places it firmly among crypto presales focused on real-world utility.

The Early Positioning Play: Why the $TAP Presale Is Gaining AttentionCurrently priced at $0.0427, $TAP is progressing through a structured presale with clearly defined pricing stages. The next increase is already set, creating a narrowing window for early positioning. More than $3.9 million has been raised so far, signaling steady accumulation rather than hype-driven inflows.

Digitap’s token economics reinforce this long-term thesis. Platform revenue funds ongoing buybacks, with a portion of tokens permanently removed from circulation. Combined with a fixed maximum supply, this structure minimizes dilution and directly ties ecosystem usage to token value.

As 2026 unfolds, capital is increasingly flowing toward projects that combine execution, usability, and early valuation, reshaping perceptions around the best crypto to buy now. For whales reallocating gains from assets like XRP, Digitap represents a move toward infrastructure that prioritizes privacy, control, and capital efficiency.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Whales Move $2.27 XRP Gains into the Best Crypto Presale 2026 for Offshore Privacy appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) íà Currencies.ru

|

|