2021-6-2 18:24 |

The transparency blockchain provides lets fundamental analysts see when whales are loading up on Bitcoin, but it can’t tell when technicals take a turn. However, whale behavior might still be the key to understanding price action.

Right now, whales on the long-standing crypto exchange Bitfinex have amassed one of the largest collective long positions ever. Past data shows these signals are rarely incorrect and that watching for what positions whales take can help to understand when the tide is about to change.

Bitfinex Bitcoin Whales Go Heavily Long, But Are They Usually Right?In finance, a whale is a market participant that trades with enough size and capital to make a big splash in price action. It is these whales that sold the top of the recent Bitcoin price rally while the rest of the market was still bullish. And it is also these whales that are now going long on the top cryptocurrency.

Related Reading | The Most Profitable Signal In Bitcoin Is Back And About To Trigger

Certain crypto trading platforms offer advanced products such as derivatives, leverage, or long and short positions. Rather than buying and selling, traders can go short to hedge spot holdings, or try to add to long positions with each dip – the strategy is near endless.

Traders on the pioneer trading platform Bitfinex are overwhelmingly long – nearing all-time high levels of long positions on the platform known for whales.

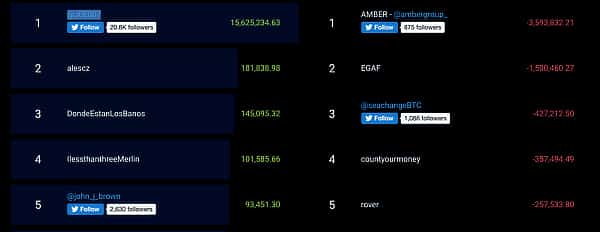

Bitfinex whales have only been wrong once in years | Source: BTCUSDLONGS on TradingView.comBitfinex is home to many whales, most famously Joe007 who gained notoriety for longing BTC at $6,500 in 2019, but shorting the coin in late 2020.

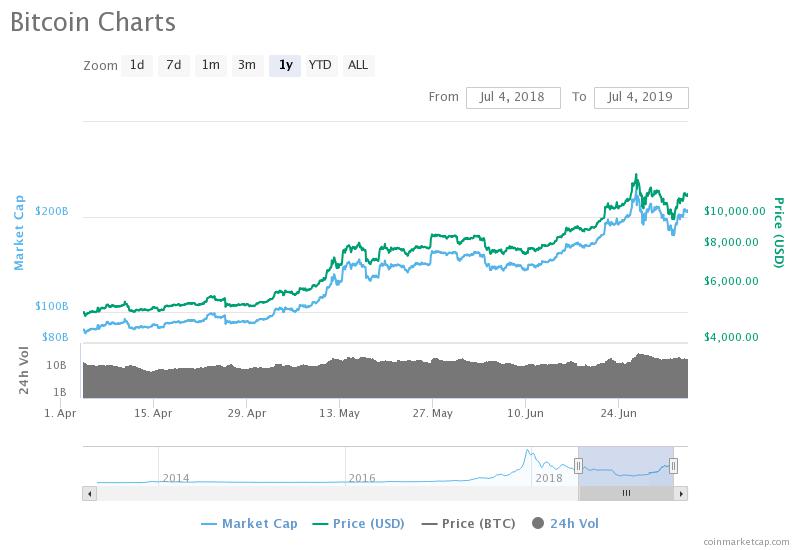

The positions these whales take can have such significance, TradingView has developed charts to watch both long and shorts on the exchange. With the metric back near all-time highs, it is clear that whales expect Bitcoin price to increase. But will they be right?

Looking back, each time long positions hit the green box above, Bitcoin saw a major bounce dating all the way back to the bear market. Each “bottom” was marked by an influx of longs.

Related Reading | SEC Warns Investors Of “Highly Speculative” Bitcoin Risk

Bitfinex traders once again bet big at the December 2018 and December 2019 bottoms correctly. It was only Black Thursday that these whales were wrong, but the black swan event shocked the world and no one saw it coming.

The last time longs were this heavy, Bitcoin price rallied from $12,000 to $64,000 in less than one year. With these whales back taking such a sizable long position, is in indicative of a bounce and new highs? Only time will tell, but we’ll keep watching whale behavior closely.

Source: Blockchain WhispersIt’s worth noting that the rest of the market isn’t as convinced as Bitfinex. However, the platform itself is where some of the biggest trades are made due to the low leverage the platform provides. While gamblers prefer 100x and high leverage derivatives, whales stick to modest amplification in exchange for capital protection.

At just 3x leverage, these long positions can typically withstand a deep drawdown without having to cover, so chances of another push down are still high despite whales getting ready.

Featured image from iStockPhoto, Charts from TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

Blue Whale Token (BWX) на Currencies.ru

|

|