2019-3-26 16:06 |

In an industry that defines an early-adopter as someone who discovered Bitcoin in 2014, Martin Weiss is an anomaly. He’s not a Wall Street wannabe looking for a quick buck. Or a developer with a passion for blockchain technology. He’s not on a crypto-anarchic mission, or professing a desire to bank the unbanked.

Instead, Martin Weiss runs a long-standing financial ratings business that has been around since 1971. Adding cryptocurrency to the Weiss Ratings stable of 53,000 institutions and investments is a natural progression into an emerging – and increasingly serious – market.

While the crypto sector is crowded with fascinating new ideas, applications for technology, and dreams of trillions of dollars spilling like spring water onto ‘the blockchain’, Martin Weiss is simply applying to cryptocurrency what he’s applied to many industries before: independence, objectivity, and unbiased risk/reward analysis.

And as Crypto Spring blooms, the overall sentiment is positive:

“Our ratings model gives us hard evidence that a critical segment of the cryptocurrency industry has enjoyed remarkable growth in user transaction volume, network capacity, and network security,” said Weiss. “Equally important is our finding that these improvements are often powered by an evolution in the underlying technology. Therefore, for those willing to take the risk, the best time to invest could be very near.”

Overcoming Information OverloadIn cryptocurrency, it seems everyone rates everything. Information overload is one of the problems facing the industry – how does a new participant make sense of the overwhelming amount of often-conflicting analysis?

As Weiss unveils his expanded ratings to the public today, that question is just a little closer to being answered.

Weiss Ratings – like any serious crypto ratings agency – refuses to take money from advertisers, sponsors, or the various shills who populate any financial ecosystem.

Instead of relying on token issuers to pay for a rating, the company has developed a proprietary system for evaluating the various projects in the space – and it sells a premium version of that analysis to engaged investors. Beginning today, however, part of Weiss’s trove of information is being opened up to the world.

Research begins with data collection – “thousands of data points,” as Weiss stresses in a call with Crypto Briefing. Data is then sifted through algorithms to offer insight into the key factors for potential success, which Weiss has identified as “adoption, technology, risk and reward”.

In order to remove potential bias, Weiss and his team have designed a query tree that requires simple yes-or no answers to a series of questions. The technology function of the rating, for example, delves into potential: for transaction speeds, scaling, decentralization, efficiency, monetary policy, governance, upgrade potential, and interoperability. While some of these questions require manual qualitative analysis, the quantitative data drive the grade – each ‘yes’ opens up a new branch of the query tree, delivering increasingly granular assessments.

The adoption category focuses on real-world performance, while a more traditional risk/reward assessment will be familiar to investors in common stocks.

Taken holistically, the result is a model that can be applied evenly to the diverse array of digital assets currently available on exchanges – and which holds objectivity as its watchword… by law.

Changing The Narrative Around RatingsIn 2006, Weiss Research, Inc. settled an action with the SEC in which Weiss was accused of acting as an unregistered investment adviser. Although no wrong-doing was admitted, Weiss and the company agreed to pay a disgorgement and civil penalty, and to establish an internal compliance department.

“The thing about dealing with the SEC is that it makes you focus 100% on doing things the right way,” explained Weiss. “Until you’ve had your entire business scrutinized like that, you really can’t imagine how many boxes you have to check in order to provide genuine, unbiased, objective research to the public. There’s no rigor like SEC rigor, and going through that process was difficult, but ultimately made us a better business.”

Since then, Weiss has specifically set out to ensure his company ensures “The broadest coverage, the strictest independence, complete objectivity, high ethics and a commitment to safety.”

The SEC continues to set a high bar for companies like Weiss Ratings, which have to comply with a series of mandates in order to provide their ratings to the public – for instance, they have to offer impersonal advice of a general nature; there can be no promotional material; the research company must only offer ‘disinterested’ opinions; and the timing of the publication cannot be driven by market events.

Philosophically, there’s an easy way to sum up these requirements: the SEC wants to see honest and forthright diligence. And that’s what Weiss hopes his readers will understand about the process… even if they may disagree with the result.

What Do The Weiss Ratings Say?If you publish research and issue an investment grade, you court controversy.

“When we launched, everyone was very upset because we gave Bitcoin a ‘C-plus’ grade,” says Weiss. “But that was primarily because of the risk/reward issues at that time. Cryptocurrencies are not only a high-risk asset, but we were in a high risk, very volatile, period of time then.”

“But if you look at the fundamentals without regard to risk/reward and crypto price volatility, then the space looks a lot better. And Bitcoin does get an ‘A’ grade, because it leads the space in adoption, and although its technology isn’t the best, it is good for what it’s currently being used for.”

The combination of long-term fundamental indicators and shorter-term risk/reward analysis offers some fascinating insights.

Technology & Adoption

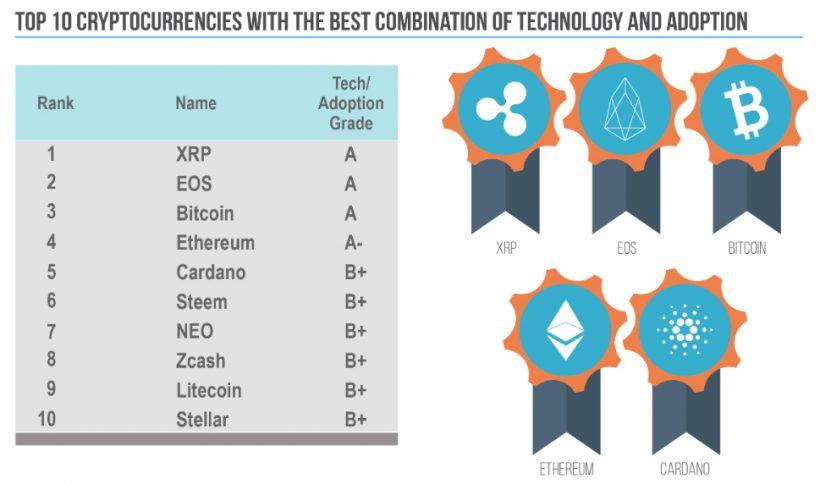

For instance, XRP also garners an ‘A’ grade for technology and adoption, and EOS and Ethereum aren’t far behind with an ‘A-minus’ grade. Cardano scores a strong ‘B-plus’. The top ten projects are rounded out by Steem, NEO, Stellar, Zcash, and BitShares.

Risk & Reward

However, the quadropoly of BTC, XRP, ETH and EOS is broken once the risk/reward factors are included, at which point Ethereum takes a back seat to Binance’s BNB token in the final analysis. While there are voluble critics of the exchange’s native currency, Weiss (along with other informed analysts) recognizes that the strong performance of the BNB token elevates it into the upper echelons of investment opportunities – although he also notes that performance may not be sustainable.

At the time of writing, Bitcoin’s tech/adoption grade was dragged down by a fairly miserly ‘D-minus’ risk/reward grade, resulting in an overall ‘B-minus’

But Binance’s BNB token – despite a weaker ‘B’ grade for tech and adoption, was elevated into the top four by a strong risk/reward, also a ‘B’ grade.

(Of the four assets in this list also rated by the Crypto Briefing research team in our independent Digital Asset Reviews and Evaluations, we agreed with Weiss on XRP and Cardano – but we graded Litecoin with a ‘C’ and Stellar with a ‘B-minus’. Interestingly (and speaking of Wild Cards), our assessments of Holochain were also congruent.)

DPoS Rules The RoostDuring the course of any research, an analyst will find interesting nuggets of information that lead to a deeper understanding of the market; Weiss noted in our discussion that the prevalence of Delegated Proof of Stake projects was a destination, but a discovery.

Juan Villaverde, the architect of the Weiss technology and adoption models noted that “We distinguish between PoW, PoS, DPoS and others in our Technology Model. In addition under, our Adoption Model, our Security Submodel also considers the consensus algorithm.”

This was one factor that resulted in the inclusion of Steem and BitShares among the Weiss Top 10. Six of the top ten on-chain performers by number of transactions were Proof of Work tokens in February 2018: but a year later, only two were left – replaced primarily by DPoS projects.

Weiss Crypto Ratings Conclusions

Martin Weiss is far too savvy to offer specific predictions about crypto markets – but he does believe that as more companies create transparency in the sector, it will continue to become more inviting.

Weiss also points to the fact that on-chain transactions have increased dramatically over the last year despite the bear market, and singles out some of the more remarkable growth stories:

As the new service opens up to the public, Weiss is keen to reiterate that crypto is not a mature asset class. But that is precisely the reason why crypto ratings companies that abide by the rules are so vital to the sector. The more immature the asset, the easier it is for bad actors to pollute the space. As Weiss puts it:

“Our mission is to help investors back away from the fray, and the fear and the hype, and cut through to the objective facts – our reports summarize the conclusions from those facts. It’s still a risky investment. You still have to ensure you only invest funds you can afford to lose. But it is very ripe for a major opportunity.”

Weiss Crypto Ratings are now available here.

The author is invested in cryptocurrencies, including Bitcoin and Ethereum, which are mentioned here.

Join the conversation on Telegram and Twitter!

The post Weiss So Serious? Crypto Ratings Founder On Why Grades Are No Joke appeared first on Crypto Briefing.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|