2025-2-8 09:09 |

It was a volatile week for Bitcoin as it struggled to stay above $100,000 amidst macroeconomic pressures.

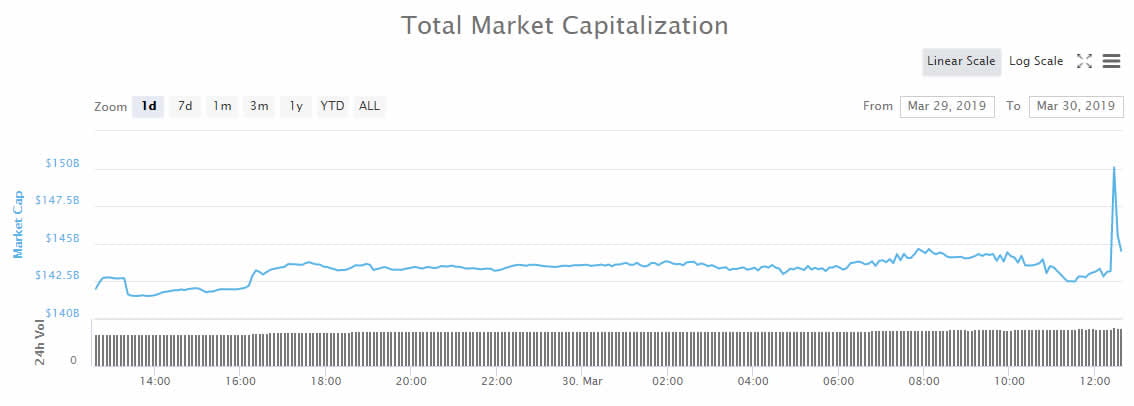

The overall crypto market capitalization fell to levels last seen in November.

This week alone, it dropped nearly 12%, reaching $3.38 trillion as of late Asian trading hours on Friday.

Trades embraced a cautious stance, which was reflected across the crypto fear and greed index, which dropped 32 points from last week’s extreme greed levels to enter fear territory at 44 when writing.

Altcoins experienced one of their worst weeks since the start of the post-election bull run, with only one of the top 99 assets managing to close the week in profit.

What happened with Bitcoin this week?Bitcoin hovered between $92,876 and $105,480 this week, with bulls repeatedly testing the $100,000 psychological resistance three times but failing to break through, keeping the price mostly below six figures.

Towards the start of the week, a global trade war triggered by US President Donald Trump spooked traders, leading to heightened volatility.

The tariff announcement sent shockwaves through the market, contributing to Bitcoin’s sharp drop to $92,460.

The turmoil culminated in the largest liquidation event in crypto history on February 3, wiping out over $2.24 billion in leveraged positions within 24 hours.

Although the price quickly recovered as Trump agreed to delay tariffs, bulls failed to hold above $100,000 as fresh US employment data added to the uncertainty.

Stronger-than-expected job numbers—with 183,000 jobs added in January, led investors to rethink the Fed’s next move, while it dampened hopes for rate cuts anytime soon.

Traders were also left disappointed after David Sacks, Trump’s crypto czar, addressed the US digital asset strategy but stopped short of confirming any plans to stockpile Bitcoin.

By the end of the week, volatility subdued as the market awaited the nonfarm payrolls report, which came in weaker than expected.

The economy added 143,000 jobs in January, falling short of the forecasted 170,000, a noticeable drop from 256,000 in December.

Following the report, Bitcoin managed to briefly reclaim $100,000, as traders speculated that the weaker-than-expected job growth might ease pressure on the Federal Reserve to keep rates elevated.

What’s next for Bitcoin?Analyst Miles Deutscher, in a February 7 X post, pointed out that the Bitcoin exchange net flow had hit an all-time low.

Typically, this signals that more BTC is moving off exchanges, as investors are likely opting to hold rather than sell.

A lower exchange balance can reduce immediate sell pressure, which historically supports price stability and potential upside.

A lot of this buying pressure was coming from whales, and Deutsher described the scenario as “Wealth transfer from the weak hands to the strong ones.”

Bitcoin could be primed for its next leg up if bulls manage to convert the $102k level as support, according to pseudonymous analyst Daan Crypto Trades.

The long-term outlook for Bitcoin remains positive for Bitcoin Bitfinex analysts said in a recent report.

However, they did not rule out the possibility of short-term volatility driven by macroeconomic pressures.

When writing, Bitcoin traded at $98,116, down 7% this week.

Slow week for altcoinsThe altcoin market dropped over 18% this week, reaching $1.3 trillion. Bitcoin remained the dominant force, with the Altcoin Season Index falling by 20 points to 34.

When writing, Mantra (OM) was the only altcoin to post notable gains, although the market was recovering.

OM rallied 17.8% over the last 7 days, leading the gains among the 100 largest crypto assets in the market.

By the end of the week, its market cap had climbed over $6.1 billion.

The RWA-focused cryptocurrency has also surged nearly 4,000% over the past year, making it one of the best-performing coins among the 100 largest crypto assets by market cap.

Source: CoinMarketCap

Most of the gains came as Mantra continued to onboard major players in the crypto space, including Republic, BlockHunters, and Cosmostation, as validators for the Mantra Chain, its dedicated blockchain for real-world asset tokenization.

Moreover, the network has also benefited from partnering with DAMAC, one of Dubai’s largest real estate companies, which plans to tokenize over $1 billion of its real estate holdings on the Mantra Chain.

Other top altcoins saw little to no gains this week.

Source: CoinMarketCap

The post Weekly crypto recap: Bitcoin drops 7%, OM leads weekly gains appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|