2019-7-8 11:42 |

In September 2018 Bitcoin’s price had fallen from a 2017 high of over $19,500 to around $6,000. That was until news of Facebook’s cryptocurrency plans in June of this year which pushed the price back up to over $14,000. While the market has rebalanced itself back below this figure, it highlights the potential highs and lows that speculation and news events can have on Bitcoin. It’s a market, not unlike gold, which still doesn’t really have a clear idea of whether it is a currency or an investment. Yet.

Source: Pixabay

Bitcoin’s bubble proves it isn’t really a currencyThe 2017 jump in value, followed by market corrections, represented big chunks of its value (it lost 25% in just one day in 2017), and mark out Bitcoin right now as something other than a currency. Gold shares that uneasy currency/investment relationship. Gold is a major alternative investment utilised more when faith in the USD weakens, while Bitcoin isn’t actually considered either a major or a minor currency, due to its huge degree of volatility.

Gold is much more stable than cryptocurrencies and it isn’t subject to shifts in price due to market news events (it has been traded for over 7000 years). When it does shift, it tends to move more slowly. It wasn’t part of the huge precious metals crashes of 1980 and 2011, but gold still experiences big shifts in value and both it and Bitcoin share some other similarities, too. The major one is the limited amount of each: there is only so much gold to trade and only so many Bitcoins that can be mined, meaning the market isn’t going to be flooded. The other is their relative value to other commodities and currencies, both of which are easily converted.

Source: Pixabay

Market crashes occur throughout finance and tradeWhen Bitcoin crashes, it doesn’t signal an end. There have been other major financial crashes, too. DailyFX highlights how bubble and mania have been around for a long time, not just with cryptocurrency. In 2008 crude oil dropped over 77% of its value in six months and the NASDAQ dropped 30% in 2000 after the internet boom. Housing and mineral prices can also feel the effect of economic environments and financial policy-making.

One of the most relatable market crashes to Bitcoin was the dot com bubble burst of the late 1990s. While there were different factors at play, the dot com boom centred on the widespread integration of new technology. There was a heady sense that the future had been realised in the shape of the internet. It turns out that was exactly the case. The same can be said for Bitcoin and cryptocurrency. The feeling is we are at the beginning of a major monetary revolution. It just hasn’t kicked in yet and this fuels an awful lot of speculation and price shifts.

Source: Pixabay

Libra launches increased cryptocurrency expectationsFacebook’s decision to launch Libra, its own cryptocurrency does much to legitimise the idea of Bitcoin-style payments. Facebook has a huge global network, and if even just a fraction of that audience start adopting payments through Libra it will increase the legitimacy of Bitcoin payments. This might well help stabilise Bitcoin prices or encourage the market and cryptocurrency traders to buy positions for the longer term, creating an upward, less volatile market where there are fewer bubbles and bursts.

The future can’t predict where and when the bubble will endThere are still huge price corrections that quickly follow when Bitcoin’s price rises rapidly, like the huge gains in 2017 that were quickly followed by similar losses the following year. Just as the dot com crash signalled the start of the internet age at the beginning of the century, this move by Facebook and the recent gains made by Bitcoin, alongside developments made by Ripple and Ethereum (the three main cryptocurrencies by market cap), might also herald similar market stability in cryptocurrency.

Bitcoin’s bubble and burst trajectory doesn’t mark the end life of the currency. When compared to other financial markets this might well be just the beginning of a much bigger, stronger bubble for Bitcoin and a prelude to more practical money payments with widescale adoption.

The post Was the Bitcoin Bubble and Burst of 2018 Just a Teething Problem for This Cryptocurrency? appeared first on CaptainAltcoin.

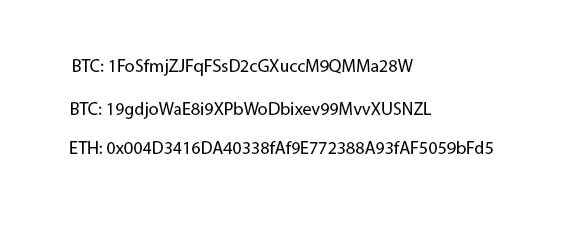

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|