2023-4-12 18:00 |

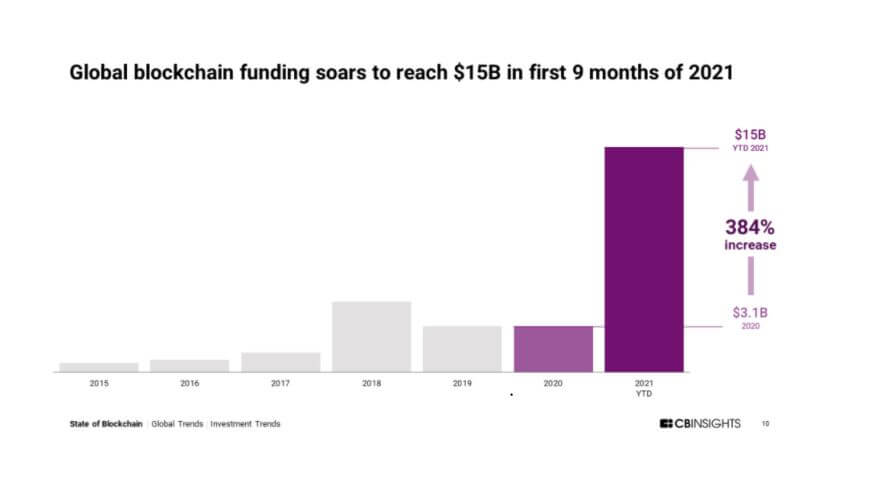

Research by Galaxy Digital suggests that Web3 venture capital investment has declined to quarterly lows not seen since 2020.

Crypto startups have faced a tougher fundraising environment as the bear market led to an $11 billion decline in venture capital investment.

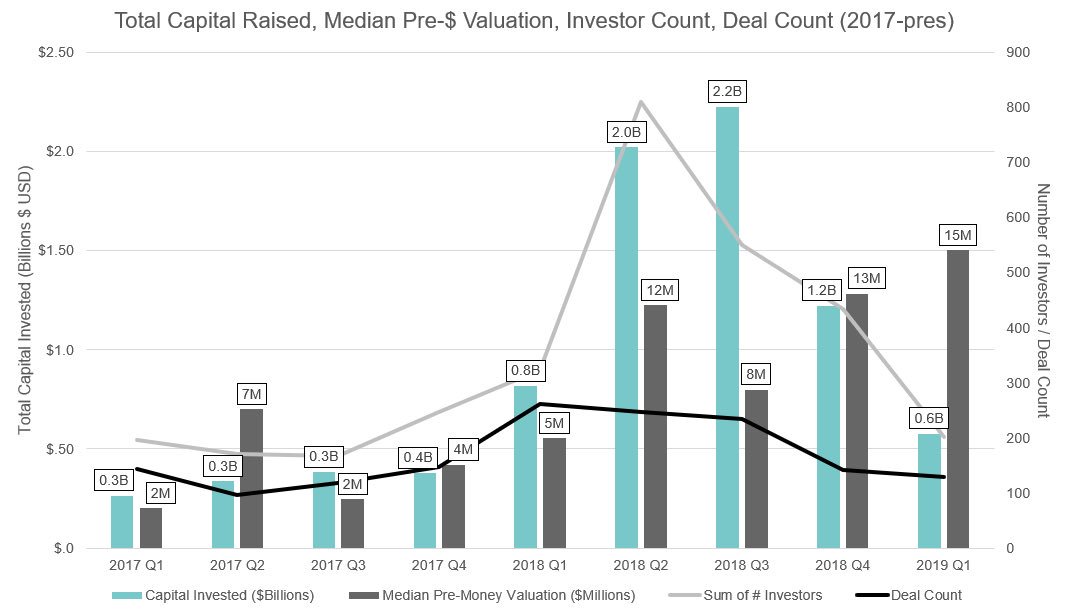

Crypto Mining Firms Account for Majority of DealsDespite the low investment, the number of funding deals closed rose to 439 in Q1 2023 compared to 366 in Q4 2022. Companies founded in 2021 and 2022 completed the most deals. Most of the capital went toward later-stage funding rounds for the firms founded in 2021.

VC Deals Closed and Capital Invested | Source: Galaxy ResearchMining firms accounted for the largest percentage of deals directed at later-stage companies. Firms offering node hosting and staking-as-a-service attracted the most deals among early-stage firms.

Regarding capital invested, the wallet and enterprise blockchain category saw the highest allocation to later-stage firms. Companies operating in the broader Web3 space, including NFTs, DAOs, and gaming, saw the least late-stage investment.

Crypto firms with U.S. headquarters secured 42.8% ($1.3 billion) of VC funding in Q1 2023. French firms accounted for roughly $500 million.

Crypo Investment in Q1 2023 by Region | Source: Galaxy ResearchA similar picture emerges when looking at the number of deals closed, with 42.3% of fundraising deals completed in the U.S.

While investment at the current rate is set to outpace 2018, Galaxy warns that founders must prioritize revenues and business models. They should also be prepared to offer investors more equity and raise funds in smaller rounds.

VC Data Reflects Broader Real-World ShiftsGalaxy’s report reflects general macro trends among crypto firms and VC investment, at least for now.

BeInCrypto recently reported that the future of the metaverse teeters on a knife edge.

Revenues for Decentraland, one of the pioneers of virtual environments, have recently declined sharply. Active traders involved in the project have also steadily dropped off, with only 20 to 30 traders trading virtual land tracts weekly.

Entertainment giant Disney announced a reduction of metaverse-related staff in late March 2023.

Once the poster child for a brave new world of virtual commerce and workplace interactions, Meta recently canned its metaverse ambitions in favor of artificial intelligence. The firm announced layoffs of thousands of employees starting in early March.

Infrastructure firms attracting the most early-stage investments make sense considering Ethereum’s imminent upgrade to enable withdrawals of staked ETH.

Developers announced they would deploy Ethereum’s Shapella fork on the blockchain’s mainnet on April 12. The upgrade would enable entities securing the network to withdraw their staked ETH and accrued rewards.

According to Dune Analytics, institutions account for three of the top five entities with the most ETH staked, making institutions an attractive investment for VC firms.

While the U.S. dominated capital investment, in Q1 2023, clearer regulation in regions could see investments shift to France and other European areas as the upcoming Markets in Crypto Assets bill nears implementation.

Stablecoin issuer Circle recently opened a Paris branch, with Chief Strategy Officer Dante Disparte arguing France is slowly emerging as a global crypto leader.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

The post Venture Capitalists Show Waning Interest in Crypto appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|