2019-9-27 23:00 |

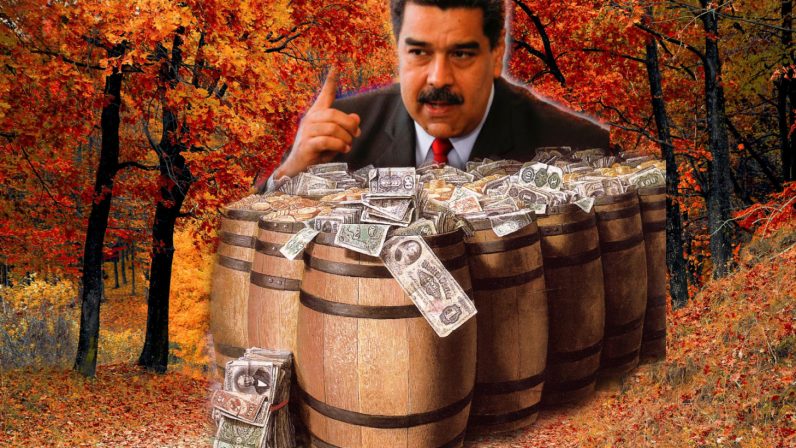

Venezuela, the country that currently suffers from hyperinflation, is reportedly taking steps to adopt cryptocurrencies. The information was highlighted through a tweet from @PattyLaya, which translated to, “Exclusive: Venezuela is conducting internal tests to determine if it can save cryptocurrencies in the central bank’s reserves, helping PDVSA download recent payments in Bitcoin and Ethereum” According […] The post Venezuela to add Bitcoin and Ethereum in central bank’s reserves appeared first on AMBCrypto. origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|