2023-6-5 17:00 |

In a new report released by global investment manager VanEck, Ethereum (ETH) takes center stage as the cryptocurrency with immense growth potential. According to VanEck’s analysis, they predict that the price of ETH will hit $11,800 by the year 2030, positioning it as a formidable competitor to traditional US Treasury bonds.

This projection has caught the attention of cryptocurrency enthusiasts and investors worldwide, as ETH continues to solidify its position as a leading digital asset.

Valuation Methodology And CatalystsThe report, authored by Matthew Sigel, head of digital assets, and Patrick Bush, a research senior investment analyst, delves into the detailed analysis behind VanEck’s Ethereum price prediction.

According to the report, by employing a valuation methodology that accounts for transaction fees, Miner Extractable Value (MEV), and “security as a service,” VanEck calculates the present-day value of ETH to be $5,359.71, after applying a 12% discount rate.

VanEck’s analysis extends beyond valuation, exploring Ethereum’s potential in various sectors and as a store of value within the cryptocurrency market. The research predicts that by 2030, ETH network revenue will surge from an average of $2.6 billion per year to $51 billion.

This projection assumes Ethereum will capture 70% of the market share for smart contract protocols, a testament to its widespread adoption and utility.

Ethereum On The Road To $11,800The base-case scenario outlined by VanEck researchers paints a rosy picture of ETH’s future. According to their analysis, Ethereum’s projected revenue for the fiscal year ending on April 30, 2030, stands at $51 billion.

Accounting for a 1% validator fee and a 15% global tax rate, the report arrives at a net cash flow of $42.90 billion for Ethereum.

Building on these findings, VanEck establishes a base-case price target of $11,848 per ETH token by 2030. To determine its current price, the projection is discounted to $5,300, factoring in a 12% cost of capital derived from ETH’s recent beta.

These figures demonstrate VanEck’s optimism for Ethereum’s growth trajectory and solidify their prediction of ETH’s ascent to $11,800 within the next decade.

Meanwhile, ETH hasn’t shown any noteworthy spike in the past weeks aside from a 1.7% decrease over the past 7 days. The second crypto asset by market capitalization has also declined nearly 2% in the past week. And over the past 24 hours, ETH has seen a 1.8% loss in value.

At the time of writing, Ethereum currently trades at $1,870. ETH’s trading volume has also plummeted significantly from $8.2 billion earlier last week to $5.4 billion in the past 24 hours indicating less trading activity in the Ethereum Market.

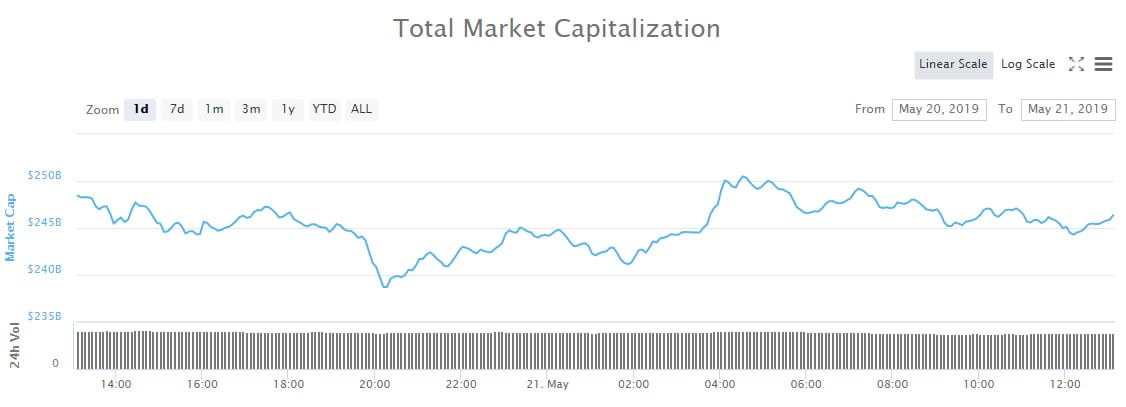

In contrast, the ETH’s market capitalization has seen a more than $4 billion loss in the past 7 days. While BTC’s market cap has plunged from $228.3 billion last Tuesday to $224 billion as of today.

Featured image from Shutterstock, Chart from TradingView

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|