2025-1-30 05:00 |

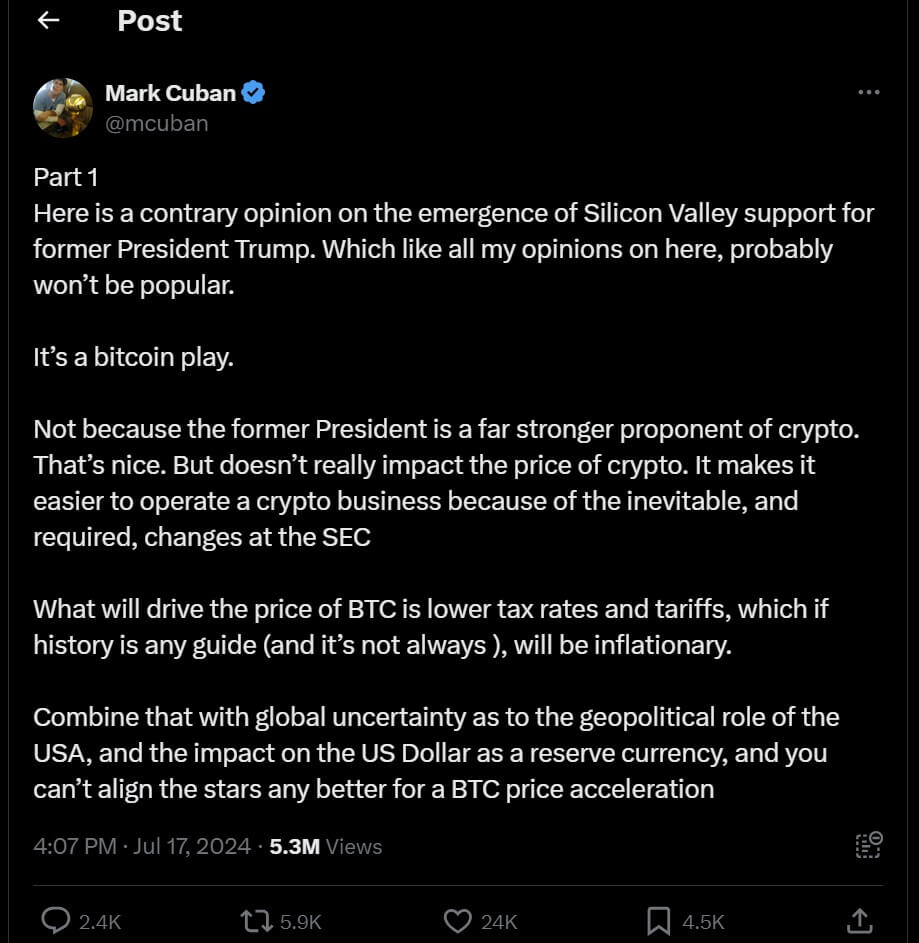

A post shared by Ito Shimotsuma on X reveals several US-based cryptocurrencies could see significant upside if Donald Trump’s proposed 0% capital gains tax becomes reality.

Included in Trump campaign proposal is a plan to boost post-COVID economic recovery by initially reducing capital gains tax to 15%, with potential further reductions and inflation indexing. The following cryptos could see the biggest benefits from the move if it gets approved:

Chainlink: Leading the Oracle RevolutionAt the forefront of Shimotsuma’s picks is Chainlink (LINK), which has established itself as the dominant force in the blockchain oracle space.

The platform’s impressive roster of partnerships with major banking institutions and Web3 projects positions it well for potential growth under a more favorable tax environment.

Sui: The Rising Layer-1 StarNext in Shimotsuma’s analysis is Sui (SUI), a rapidly expanding Layer-1 blockchain that has captured significant attention in the crypto space.

With over $2 billion in Total Value Locked (TVL) and substantial institutional backing, Sui represents a compelling opportunity in the US crypto landscape.

Ondo Finance: Bridging Traditional and Digital AssetsOndo Finance (ONDO) stands out in Shimotsuma’s selection for its leadership in Real World Assets (RWA).

The protocol has accumulated more than $800 million in TVL and secured a notable partnership with BlackRock’s BUIDL initiative, demonstrating its potential in the growing RWA sector

Hedera: Enterprise-Grade InnovationHedera (HBAR) earns its place in Shimotsuma’s analysis through its robust Layer-1 protocol and impressive list of enterprise partnerships.

The platform’s unique hashgraph technology and corporate relationships position it well for potential growth under new tax incentives.

Read Also: Crypto Expert Says ONDO is Bullish: How High Could ONDO Price Go After This Breakout?

Aptos: The Undervalued ContenderRounding out Shimotsuma’s analysis is Aptos (APT), which he identifies as an undervalued Layer-1 protocol.

With over $800 million in TVL and having secured more than $350 million in funding, Aptos presents an interesting opportunity in the US crypto ecosystem.

These selections by Shimotsuma reflect a careful consideration of US-based projects that combine strong fundamentals with significant growth potential. As discussions around Trump’s tax proposal continue to evolve, these tokens could indeed benefit from increased investor interest in US-based crypto assets.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

The post 5 US-Made Cryptos Poised for Growth Under Trump’s Tax Proposal: LINK, SUI, and Three More appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

TrumpCoin (TRUMP) íà Currencies.ru

|

|