2023-3-30 10:58 |

Coinspeaker

USDC Outflows Surge Past $10B, Tether Takes Market Share to 22-Month High

The collapse of the Silicon Valley Bank (SVB) earlier this month was a major blow to USDC stablecoin issuer Circle. SVB was Circle’s key banking partner and its collapse led to huge outflows from the USDC stablecoin.

At one point, the USDC stablecoin lost its USD-peg creating further concerns but recovered it in a short while. While worries around USDC’s exposure to Silicon Valley Bank (SVB) have settled for now, the stablecoin continues to see major outflows.

Since March 10, the net outflows from the USDC stablecoin have surpassed more than $10 billion so far. Over the last month, USDC’s market cap has dropped more than 23% from over $44 billion to now at $33 billion. Over the last week, investors redeemed $1.5 billion worth of USDC in excess of the new issuance. Also, bankrupt crypto lender Voyager Digital alone redeemed $150 million on Tuesday.

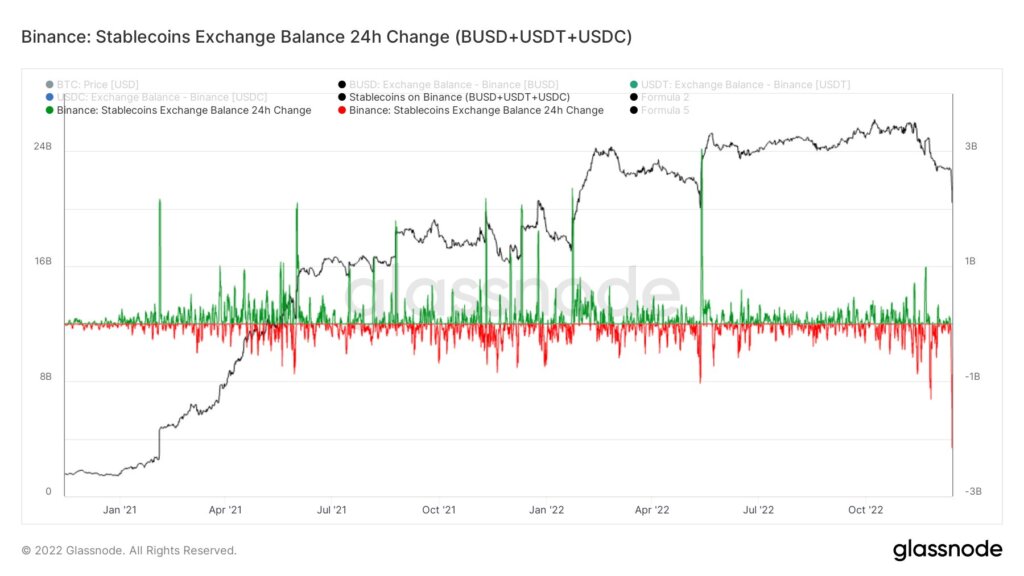

The uncertainties in the banking sector as well as the growing regulatory scrutiny have been a real test for the stablecoins sector. This month, the regulatory action on Paxos Standard also forced the exit of Binance’s BUSD stablecoin from the market.

Although at $33 billion, USDC continues to be the second-largest stablecoin in the crypto space. circle has clarified that it backs the token’s value with short-term government bonds and cash reserves at various U.S. banks.

After the collapse of its banking partner SVB, Circle has moved a large portion of its cash to BNY Mellon, the world’s largest custodian. The USDC-issuer said that they have kept limited funds with some of its other partners. It seems like USDC-issuer Circle is currently fighting a survival battle in the market.

Tether’s Dominance on the RiseAs the event unfolded this month, Tether’s native stablecoin USDT became the biggest beneficiary of it. The world’s largest stablecoin extended its dominance in the market boosting to the highest levels in 22 months since May 2021.

USDT is the key piece in the crypto infrastructure and the most widely used stablecoin to settle trades on the exchanges. However, USDT-issuer Tether too has faced scrutiny over its reserve assets as well as the lack of transparency over the years. Tether USDT’s market cap over the last month has surged by more than 12% currently reaching close to $80 billion.

With this, Tether alone grabs more than 60% share of the $132 billion stablecoin market. The outflows from USDC and the fall of the BUSD stablecoin have contributed to Tether’s rise. Taking a dig at Tether’s rising dominance, Circle Chief Executive Jeremy Allaire tweeted:

“Ironically, the players who have had the strongest position with U.S. regulation and U.S. banking system integration, are considered ‘unsafe,’ with fears that assets could be stranded .Market participants are shifting into platforms with no oversight, totally opaque bank and risk exposures, and histories of lax financial risk and integrity controls.”

However, Tether CTO Paolo Ardoino recently told CNBC that USDT has reserves in excess of $1.6 billion.

nextUSDC Outflows Surge Past $10B, Tether Takes Market Share to 22-Month High

origin »Bitcoin price in Telegram @btc_price_every_hour

USCoin (USDC) на Currencies.ru

|

|